Overall delinquency continued to decline this reporting period following its rapid ascent from April to June this year. We maintain our position that delinquencies will remain elevated over the near term despite the improving trend based on the continued impact of the COVID 19 pandemic on the commercial real estate market.

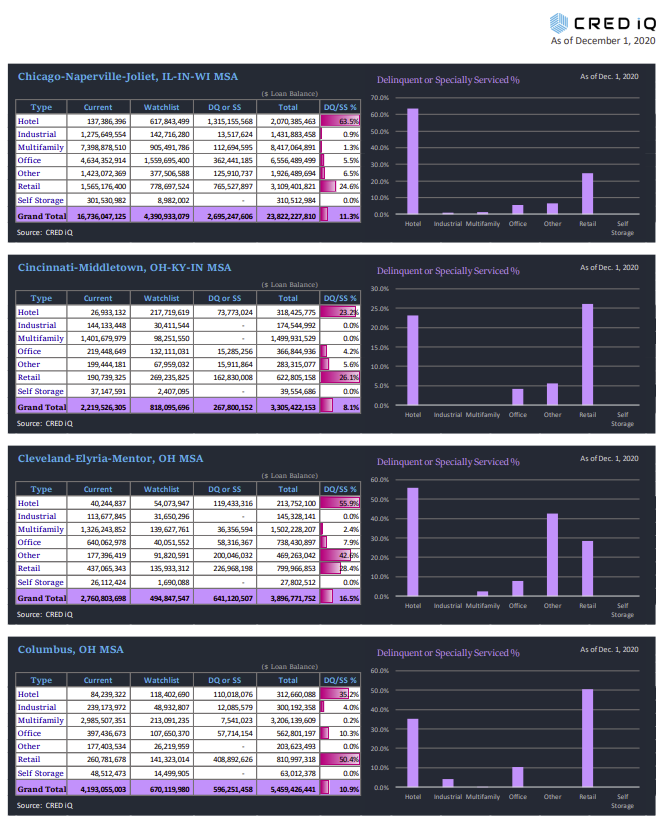

CRED iQ monitors market performance for nearly 400 MSAs across the United States. Below is a summary of the default rates for the 50 largest metros segmented by property type. Consistent with the months following the start of the pandemic, the hotel and retail sectors remain the largest contributors to the delinquency percentages for the majority of these statistical areas. Loans backed by self-storage, multifamily, and industrial facilities posted the lowest delinquency rates for most of these markets.

Featured Markets Below:

CRED iQ will continue to track developments by market across the nearly 400 MSAs under coverage. Please visit cred-iq.com for periodic updates and to identify lending, leasing, distressed debt or acquisition opportunities within these markets.

Download the full December 2020 Delinquency Report here:

About CRED iQ

CRED iQ is a commercial real estate data, analytics and valuation platform designed to help industry professionals unlock investment opportunities and evaluate portfolio risks. Driven by a combined 30+ years of experience, CRED iQ provides actionable intelligence for $765 billion of commercial mortgage data. The user-friendly interface effectively identifies near- and long-term credit risks through interactive proprietary valuation and monitoring systems. For a free account, sign up here.