This week, CRED iQ calculated real-time valuations for 5 properties with exposure to major tenants with lease expirations in 2021. Featured leases include large blocks of office space that were vacated by Bank of America, in the Chicago market, and Wells Fargo, in the Charlotte market. The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

301 South College Street

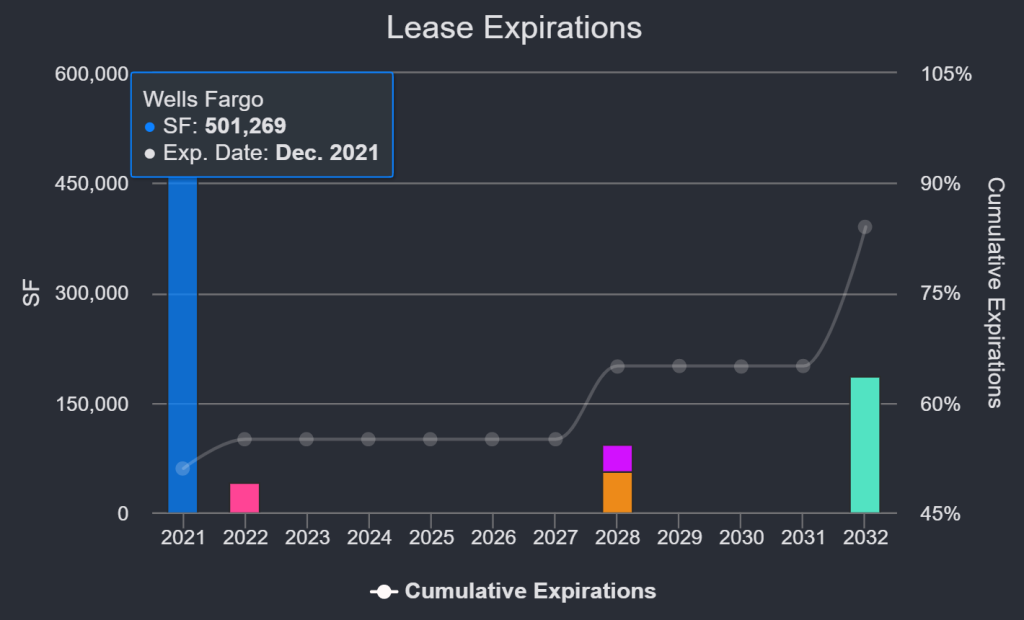

One Wells Fargo Center

988,646 sf, CBD Office, Charlotte, NC 28202

We first brought attention to the largest tenant’s lease expiration at this property in our April 12th LinkedIn post. As a refresher, Wells Fargo is vacating 501,269 sf of space on December 31st at One Wells Fargo Center, a Class-A office tower located in the CBD of Charlotte. The tenant is reducing its footprint at the property but will retain 185,565 sf of space with a lease that expires in 2032. Among the spaces that will be available are the entire floor plates for stories 7 through 20. Fee and leasehold interests in the office tower secure a $165.3 million loan that has been on the servicer’s watchlist since January 2021. CRED iQ’s estimated occupancy for the property is 48%; although, the loan has a healthy reserve balance of $16.6 million and a cash trap is in place, equal to $30 per square foot of vacated space, that should help leasing efforts. For the full valuation report and loan-level details, click here.

135 South Lasalle

1.3 million sf, CBD Office, Chicago, IL 60603

Bank of America is vacating 788,499 sf of space on July 31st at 135 South LaSalle, a Class-A office tower located in the Central Loop submarket of Chicago. The property secures a $100.0 million mortgage loan that has been on the servicer’s watchlist since August 2020. July servicer commentary finally confirmed Bank of America’s departure, which was widely speculated over the prior 12 months. CRED iQ’s estimated occupancy for the property is 24%. The loan remains current in payment and has an anticipated repayment date on May 1, 2025 with a final maturity date on May 1, 2030. For the full valuation report and loan-level details, click here.

Cool Springs Commons

301,697 sf, Suburban Office, Brentwood, TN 37027

Community Health Systems (CHS), a healthcare operator and provider based in Tennessee, is the largest tenant at Cool Springs Commons, accounting for 66% of the GLA with a 199,915-sf lease that expired in January 2021. Cool Springs Commons is a Class-B office property located in suburban Nashville. Commentary from the servicer stated that CHS has already relocated many of its employees, which indicates downsizing by the tenant at best. A second tenant, Comprehensive Health Management, has a 17,789-sf lease that expires on November 30, 2011. CRED iQ’s estimated occupancy for the property is 31%, assuming that CHS completely vacates instead of downsizing. For the full valuation report and loan-level details, click here.

Owasso Market

351,370 sf, Power Center, Owasso, OK 74055

The Owasso Market power center in Owasso, OK, which is shadow-anchored by a Walmart Supercenter, continues to work through lease rollover issues. The property’s largest tenant, Lowe’s Home Improvement, has a 191,940-sf ground lease, accounting for 55% of the GLA, that is set to expire on September 30, 2021, but has six, five-year extension options remaining. The second-largest tenant, Kohl’s, had an 86,584-sf lease, accounting for 25% of the GLA, that expired in January 2021 but the retailer signed a five-year renewal through January 2026. The third-largest tenant, Office Depot, has a 20,000-sf lease, accounting for 6% of the GLA, that is scheduled to expire on December 31, 2021 and has a fairly generous list of termination options. The loan secures an $18.8 million loan that is scheduled to mature in August 2028. CRED iQ’s estimated occupancy is 93%, assuming Lowe’s Home Improvement renews and Office Depot vacates. For the full valuation report and loan-level details, click here.

10310 Harwin Drive

311,486 sf, Industrial, Houston, TX 77036

Both tenants at this gated warehouse facility, located in southwest Houston, have lease expirations in 2021. GRM, a document management company, has a 173,095-sf lease, accounting for 56% of the GLA, that is scheduled to expire on October 31, 2021. The remaining 44% of GLA is occupied by Iron Mountain through a 138,391-sf lease that expired on June 30, 2021. The warehouse is part of a two-property portfolio that secures a $15.9 million loan, which is scheduled to mature on February 6, 2022. There have been no leasing updates from the borrower based on July’s servicer commentary; however, GRM is affiliated with the borrower sponsor. Based on CRED iQ’s Base-Case valuation, leverage for the property is not a significant concern; although the lease rollover issues may require some type of bridge financing. For the full valuation report and loan-level details, click here.

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: