Office collateral has been one of the more heavily scrutinized property types in CMBS over the past year given the ever-evolving dynamics of remote work and businesses’ evaluations of the need for physical space. The adverse impacts from the pandemic on lodging and retail were severe and immediate but both sectors recovered substantially over the past 18 months. Conversely, the office sector has been relatively less impacted, and distress has been concentrated to specific sets of factors such as location, class, vintage, or some combination thereof.

CRED iQ’s Distressed Rate for Office CMBS collateral stood at 3.67% as of January 2022 and has increased for 3 consecutive months. The Distressed Rates for Retail and Lodging properties have exhibited a clear downward trend in 2021. That variance in distress among property types can, in part, be attributed to the length of leases for each property type sector. Lodging properties have nightly or weekly rentals and in-line tenants for retail properties generally have lease terms ranging from 2 to 5 years. Lease terms for office properties are typically longer than retail properties and can be 10 years or more in length. Of course, with the uncertainty that a pandemic brings, there has been evidence of pressure for shorter lease terms across retail and office.

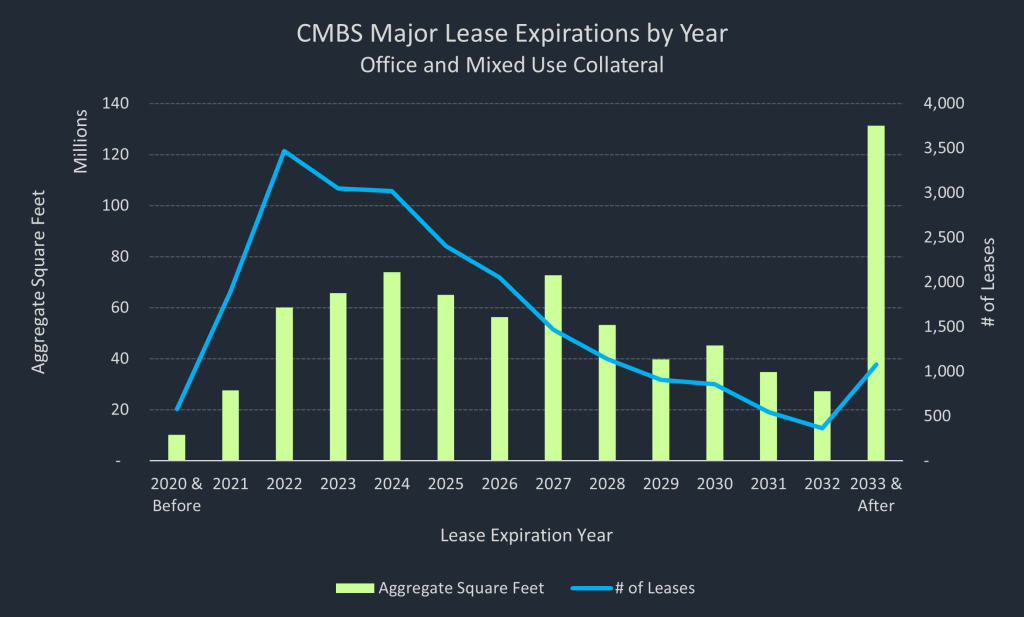

There is generally a longer amount of time required for an office property’s tenant roster to rollover compared to other property types. Examining lease rollover trends is one of many tools we have to identify when and where the next pocket of office distress may materialize. CRED iQ examined over 23,000 major leases in CMBS office and mixed-use collateral properties. For this exercise, all leases that were among the 5 largest by percentage of net rentable area (NRA) for a particular building qualified as a major lease.

Initial high-level observations included nearly 60 million square feet of office space in CMBS that were set to expire in 2022. The amount of square feet expiring per year ramps up to over 65 million in 2024 and to a peak of almost 74 million square feet in 2024. Lease expirations subsequently taper off in 2025 and 2026 before spiking up in 2027 to approximately 73 million square feet. There are some caveats to these figures — underlying data by its nature is historical, imperfect, and may not reflect the most recent extensions that tenants may have executed. A pertinent example is one of the biggest leases within the subset that is scheduled to expire in 2022 — JP Morgan’s 780,000 square foot lease at 245 Park Avenue in Manhattan, NY. The lease is scheduled to expire in October 2022 but most of the space will not be hitting the market anytime soon because JP Morgan had been subletting to Société Générale. At lease expiration, a direct lease with take effect with the subtenant for a 10-year term with 2, 5-year extension options.

Lease expirations can have several possible outcomes for office landlords. From a positive perspective, a renewal or new direct lease may allow rents to rest higher if market conditions are favorable. However, high vacancies and downward pressures on rental rates may lead to reductions in cash flow and subsequent distressed scenarios.

Taking a closer look at lease rollover in 2022, CRED iQ also examined major lease expirations based on geographic concentration. The New York-Northern New-Long Island MSA had the highest number of expiring leases and the most amount of square footage expiring in 2022 with over 300 expiring leases totaling more than 10 million square feet. The Philadelphia MSA had the second highest amount of rollover in 2022 with approximately 4.5 million square feet set to expire in 2022. Minneapolis followed close behind with approximately 3.5 million square feet scheduled to expire in 2022. Other regions that were included in the Top 10 MSAs with Major Lease Expirations included Houston, Dallas, Los Angeles, Chicago, San Francisco, Detroit, and Seattle.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.