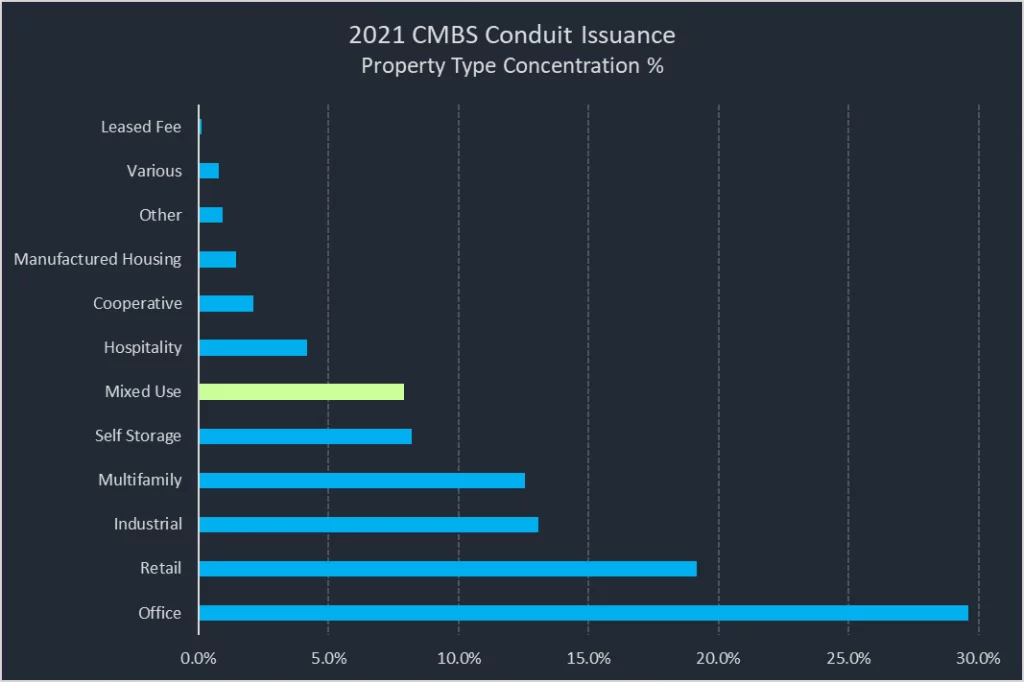

Loans secured by mixed-use properties accounted for approximately 8% of total conduit issuance in 2021 after nearly reaching 10% in 2020. The mixed-use property type, along with office, helped to offset the decline in securitization volume of hotel and retail properties in 2020 and 2021 vintage CMBS. Although retail collateral accounted for approximately 19% of conduit issuance in 2021, lodging collateral only accounted for about 4%, which was comparatively lower compared to vintage trends from prior years.

The inclusion of mixed-use collateral in CMBS transactions has exhibited a steady, although somewhat erratic, increase in frequency of loans and amount of outstanding debt since 2010. CMBS conduit transactions with a vintage year of 2017 have the highest amount of outstanding debt secured by mixed-use properties with over $4 billion. After a peak in volume in 2017, mixed-use collateral in CMBS conduits declined over 50% in 2018 before rebounding to over $3.7 billion in 2019. There was reduced volume in conduit transactions in 2020 and 2021, compared to 2019, but the concentration of mixed-use properties within collateral pools remained in line with elevated levels over the past 10 years, totaling approximately 9% in 2020 and 8% in 2021.

A property can be classified as mixed-use when revenue from an alternative-use component of the property accounts for a specified percentage of total revenue. The most common type of mixed-use collateral is an office building with a ground floor retail component. With more than 1,700 mixed-use properties in CMBS conduit transactions that CRED iQ monitors, approximately 42% of the properties (47% by outstanding debt) have a retail/office combination of usage. Combinations of multifamily properties with retail components are the next most common property mix type, accounting for 15% of total mixed-use properties (7% by outstanding debt). Office and retail were the most frequent components present in mixed-use CMBS conduit properties.

On a more granular level, many properties are classified as mixed-use within the CMBS reporting package, even though the use type is singular. This is often the case for properties that are part of portfolios that secure a single mortgage. Although these loans are secured by mixed-use portfolios, the individual properties have a singular use. Inclusive of mixed-use portfolios, CRED iQ accounted for over 40 combinations of property uses for mixed-use mortgage collateral. Other types of single use properties that may be categorized as mixed-use include event-driven facilities such as design centers, showrooms, galleries, or other types of event spaces. Even a variety of social clubs have appeared as mixed-use collateral for CMBS loans, although those types of properties have characteristics most in common with retail.

Often times, the physical layout of a building or property with a mixed-use designation belies the true nature of underlying operations. For example, the $2.3 billion GM Building loan is secured by a 2 million-sf 50-story office tower with an iconic retail component at its base — the flagship Apple Store, designer brands DIOR and Balenciaga, and a flagship store for Under Amour (or FAO Schwarz for the nostalgic) are highlights of the GM Building’s retail offerings. Although the retail component of the GM Building is only about 9% of the building’s total NRA, retail tenants accounted for approximately 26% of base rents at loan origination.

The largest mixed-use property by property size and number of uses is McClellan Business Park in Sacramento, CA, which secures a $358 million mortgage. With nearly 7 million square feet, the business park primarily comprises industrial (82% of NRA) and office (15% of NRA), but also features residential and retail buildings as well as airfield hangars.

As different property types fall out of favor or gain popularity from a lending perspective, mixed-use collateral may have an advantage of providing diversification of cash flow from multiple property sectors. Additionally, the physical structure of a mixed-use property may be more amenable to repositioning if one particular use case becomes impaired. Relatively newer mixed-use combinations include life science components, which have distinctive buildouts with attributes of office, lab, and manufacturing characteristics. Nearly all mixed-use properties with a life science component were in a 2019 or later vintage conduit deal. Considering the value-add nature of commercial real estate, properties can evolve to their highest and best use over time, which may require generating cash flow from multiple types of mixed-use combinations. When evaluating mixed-use property types, it is important to ask ‘What’s in your collateral?’

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.