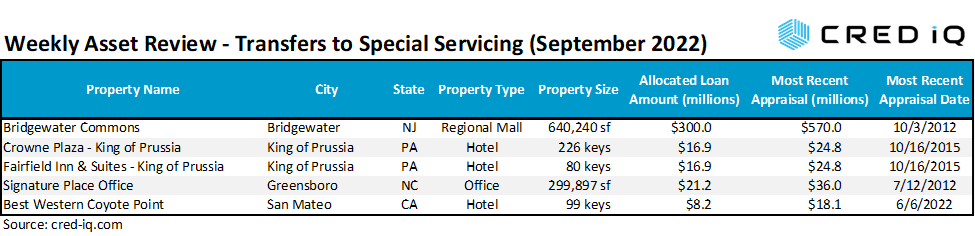

In this Weekly Asset Review (WAR Report), CRED iQ highlights five distressed properties that have transferred to special servicing in August and September 2022. CRED iQ’s special servicing rate for CMBS conduit and SASB transactions has shown a recent uptick. In August 2022, the special servicing rate was 4.91%, representing a 10% increase compared to the prior month. Featured properties in this week’s review include a regional mall in Northern NJ with loan maturity issues, a pair of hotels in King of Prussia, PA, and a suburban office property in Greensboro, NC.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

Bridgewater Commons

640,210 sf, Regional Mall/Lifestyle Center, Bridgewater, NJ [View Details]

This $300 million loan transferred to the special servicer on August 10, 2022 due to an impending maturity default. The loan is scheduled to mature in November 2022 and a timely payoff is unlikely given the current refinancing environment for regional malls coupled with a decline in the collateral property’s value since loan origination. One of the special servicer’s first steps of workout is ordering an appraisal to determine the valuation of the collateral in relation to outstanding debt.

The loan is secured by two adjacent properties: a 546,411-sf portion of a regional mall known as Bridgewater Commons and a 93,799-sf lifestyle center known as The Village at Bridgewater Commons. The retail development is located approximately 40 miles west of Manhattan, NY. The mall has three traditional anchor boxes, although two of the spaces do not serve as collateral for the $300 million mortgage. Macy’s owns and operates a 223,222-sf store and there is a 129,129-sf vacant box that was formerly operated and owned by Lord & Taylor. The largest collateral tenant is Bloomingdales with a 150,525-sf lease, accounting for 23.5% of NRA, that expires in January 2029. Of note, The Village at Bridgewater Commons lost its second-largest tenant, Crate & Barrel, when it vacated at the end of 2021. For a valuation report and loan-level details, click here.

| Property Name | Bridgewater Commons |

| Address | 400 Commons Way Bridgewater, NJ 08807 |

| Outstanding Balance | $300,000,000 |

| Interest Rate | 3.34% |

| Maturity Date | 11/1/2022 |

| Most Recent Appraisal | $570,000,000 ($890/sf) |

| Most Recent Appraisal Date | 10/3/2012 |

| CRED iQ Base-Case Value | Requires Log In |

King of Prussia Hotel Portfolio

306 keys, Lodging, King of Prussia, PA [View Details]

This $33.8 million loan transferred to the special servicer on August 30, 2022 due to imminent default. The loan, which has an interest rate of 5.02%, is secured by two hotels in King of Prussia, PA, located approximately 20 miles northwest of Philadelphia, PA. The loan has an upcoming maturity date in December 2022, but a timely payoff may be in doubt given the recent transfer to special servicing. Forbearance for the loan was previously granted in October 2020 to provide pandemic-related relief. However, average occupancy across the hotels, 43% for the trailing 12 months ended June 2022, has not recovered to pre-pandemic levels and aggregate net cash flow across the two hotels was barely positive for the same time period.

| Property Name | Size (keys) | Address | Allocated Loan Amount | Most Recent Appraisal | Most Recent Appraisal Date | CRED iQ Base-Case Value |

| Crowne Plaza | 226 | 260 Mall Boulevard King of Prussia, PA 19406 | $16,881,024 | $24,800,000 ($109,735/key) | 10/16/2015 | Requires Log In |

| Fairfield Inn & Suites | 80 | 258 Mall Boulevard King of Prussia, PA 19406 | $16,881,024 | $24,800,000 ($310,000/key) | 10/16/2015 | Requires Log In |

| Total | 306 | $33,762,048 | $49,600,000 ($162,092/key) |

- Crowne Plaza

- The larger of the two hotels serving as collateral for the newly transferred loan has 226 keys and operates as a Crowne Plaza pursuant to a franchise agreement that expires in November 2025. The property was constructed in 1969 and is the older of the two adjacent hotels. Additionally, the Crowne Plaza has 24,088 sf of meeting space. Occupancy at the hotel for the trailing 12 months ended June 2022 averaged 37%. For the valuation report and loan-level details, click here.

- Fairfield Inn & Suites

- The smaller of the two properties is an 80-key limited-service hotel that operates as a Fairfield Inn & Suites under a franchise agreement that expires in June 2030. The hotel was built in 1995 to provide overflow lodging for the adjacent Crowne Plaza. As such, many of the Crowne Plaza’s amenities are shared with guests at the Fairfield Inn & Suites. Average occupancy at the hotel was approximately 57% for the trailing 12 months ended June 2022. For the valuation report and loan-level details, click here.

Signature Place Office

299,897-sf, Suburban Office, Greensboro, NC [View Details]

This $21.2 million loan transferred to the special servicer on September 2, 2022, which was one month ahead of its scheduled October 2022 maturity date. The borrower had planned to market the property for sale ahead of the loan’s maturity date; however, the transfer to special servicing indicates imminent maturity default. The loan is secured by a four-story office building located three miles outside of downtown Greensboro, SC.

The office building has been approximately 75% occupied for the past several years. Occupancy at the property initially declined from 95% to 75% in 2016 when the property’s former largest tenant, Novartis, vacated. There has been limited leasing activity since the Novartis departure and the property has, at times, had difficulty maintaining an occupancy level at 75%. For a valuation report and loan-level details, click here.

| Property Name | Signature Place Office |

| Address | 3200 Northline Avenue Greensboro, NC 27408 |

| Outstanding Balance | $21,242,556 |

| Interest Rate | 6.00% |

| Maturity Date | 10/6/2022 |

| Most Recent Appraisal | $36,000,000 ($120/sf) |

| Most Recent Appraisal Date | 7/12/2012 |

| CRED iQ Base-Case Value | Requires Log In |

Best Western Coyote Point

99 keys, Limited-Service Hotel, San Mateo, CA [View Details]

This $8.2 million loan transferred to the special servicer on August 12, 2022 due to delinquency. The loan first became 30 days delinquent in May 2022 and was over 60 days delinquent as of September 2022. The loan is secured by a 99-key limited-service hotel located in San Mateo, CA. The hotel, which is flagged as a Best Western, averaged 74% occupancy during 2021. Occupancy during 2021 represented a significant recovery from a pandemic-induced low occupancy mark of 47% during 2020. Updated occupancy and performance figures for 2022 were not available. For the valuation report and loan-level details, click here.

| Property Name | Best Western Plus Coyote Point |

| Address | 480 N Bayshore Blvd San Mateo, CA 94401 |

| Outstanding Balance | $8,206,981 |

| Interest Rate | 5.72% |

| Maturity Date | 7/6/2023 |

| Most Recent Appraisal | $18,100,000 ($182,828/key) |

| Most Recent Appraisal Date | 6/11/2013 |

| CRED iQ Base-Case Value | Requires Log In |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.