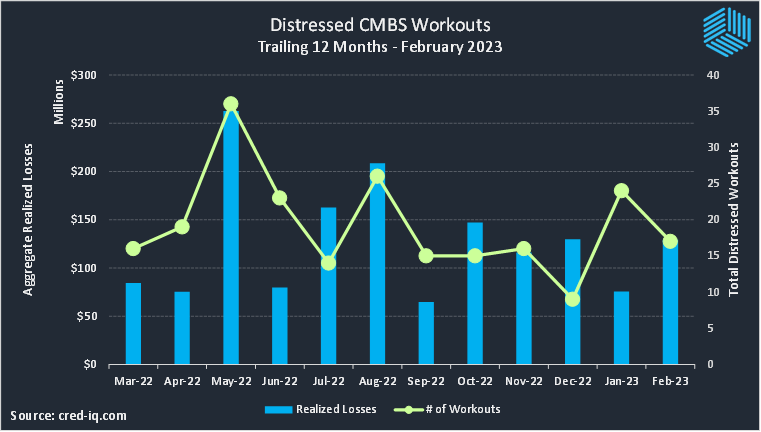

CMBS transactions incurred approximately $129 million in realized losses during February 2023 via the workout of distressed assets. CRED iQ identified 17 workouts classified as dispositions, liquidations, or discounted payoffs in February 2023. Of the 17 workouts, six were resolved without a loss. Of the 11 workouts resulting in losses, severities for the month of February ranged from 1% to 95%, based on outstanding balances at disposition. Aggregate realized losses in February 2023 were approximately 70% higher than January 2023 despite fewer distressed workouts. On a monthly basis, realized losses for CMBS transactions averaged approximately $128 million during the trailing 12 months, which was in line with this month’s aggregate total.

By property type, workouts were concentrated in lodging, accounting for six of the 17 distressed resolutions. Distressed workouts for lodging properties had the second-highest total of aggregate realized losses ($17.5 million), which accounted for 13.5% of the total for the month. The largest distressed workout featuring a lodging property was a $17.5 million loan secured by Embassy Suites Lubbock, a 156-key full-service hotel located in Lubbock, TX. The loan transferred to special servicing in June 2020 due to pandemic-related performance issues. The loan was originally set to mature in January 2023 but was ultimately resolved in February 2023 with a $16.4 million loss, equal to a 93.5% severity.

The largest workout by both outstanding debt balance and individual loss amount was the Town Center at Cobb, a 559,940-SF portion of a regional mall located in Cobb County, GA, which is approximately 25 miles northwest of Atlanta. The property became REO in February 2021 and had outstanding debt of $166.7 million at the time of liquidation. Realized losses from the REO regional mall totaled $96.5 million, equal to a 58% loss severity based on the outstanding balance prior to liquidation. The Town Center at Cobb liquidation alone accounted for 75% of the aggregate realized losses observed by CRED iQ this month.

Also notable among February’s list of distressed workouts were three multifamily properties, including two that incurred losses. Distressed workouts involving multifamily properties have been few in number over the past several months and have generally been able to be resolved without a principal loss. However, this month’s results show that even the multifamily sector is not immune from distress. Other rare property type appearances in February’s tally of distressed workouts included a co-operative housing property and a self-storage facility.

Excluding defeased loans, there was approximately $3.5 billion in securitized debt among CMBS conduit, Single-Borrower Large-Loan, and Freddie Mac securitizations that was paid off or liquidated in February 2023, which was approximately a 38% decrease compared to $5.7 billion in January 2023. In February, 8% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 7% in the prior month. Approximately 6% of the loans were paid off with prepayment penalties, which was significantly less than 28% as of the prior month.

Excluding Freddie Mac securitizations, multifamily had the highest total of outstanding debt payoff in February with approximately 37% of the total by balance. Lodging and office were the property types with the next highest outstanding debt payoff with 23% and 19% of the total, respectively. Aside from Town Center at Cobb, the largest individual payoffs included a $345 million senior mortgage secured by the Rio All-Suite Hotel and Casino in Las Vegas, NV and a $195 million mortgage secured by the Aruba Marriott Resort in the Caribbean.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.