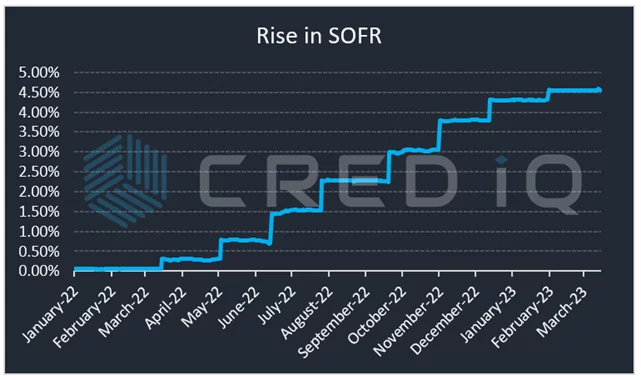

CRED iQ sourced and analyzed interest rate cap agreements for nearly 700 floating-rate loans that have been securitized in CRE CLOs (Commercial Real Estate Collateralized Loan Obligations). Interest rate cap agreements included in the analysis covered more than $30 billion in aggregate notional balance. The analysis was completed in response to an environment conditioned by rising interest rates, and corresponding benchmark indexes for floating-rate commercial real estate debt that have risen dramatically over the past year. In some ways, March 2023 marks an allegorical anniversary of this era of rising rates. One of the primary benchmarking indexes for floating-rate commercial real estate debt — SOFR (Secured Overnight Financing Rate) — has risen from ~0.5% in March 2022 to ~4.5% as of mid-March 2023. The velocity of interest rate increases has made interest rate cap agreements a timely focus point for the commercial real estate industry that heavily relies of floating-rate debt.

Key Takeaways:

- CRED iQ identified and compiled key parameters for interest rate cap agreements for nearly 700 floating-rate commercial real estate loans totaling more than $30 billion in notional.

- Interest rate cap agreements in the sample dataset have termination dates ranging from 2023 to 2026. Of those rate cap agreements with expiration dates in the next four years, 40% have expiration dates that occur prior to respective loans’ maturity dates.

- Current note rates, absent a rate cap agreement, are approximately 200 bps higher on average than effective note rates that have been capped via agreements’ strike prices.

- From a credit risk perspective, rate cap agreement expirations are a source of potential pressure on debt service coverage ratios and also present refinancing risk at loan maturity.

- Rate cap expirations can also be a source of opportunities, if identified in a timely manner, to monetize in-the-money agreements as well as facilitate transaction volume.

CRED iQ’s observations included approximately 680 securitized floating-rate mortgages with an aggregate outstanding balance totaling over $25 billion. The observations do not represent an exhaustive list of the CRE CLO universe, but rather a significant subset of the CRE CLO loan population — in many cases, granular information related to interest rate cap agreements was not widely available for the entire universe of CRE CLO loans. Due to the structure of the mortgages observed, the notional balances of the interest rate cap agreements were often higher than outstanding loan balances to account for non-securitized portions of the whole loans and future funding amounts that may be available to borrowers to carry out business plans for stabilization and repositioning of loan collateral.

In the analysis, multifamily properties accounted for most of the loan collateral composition by property type. Loans secured by multifamily properties accounted for 76% of the total quantity of floating-rate mortgages in the dataset. Generally, multifamily properties serving as collateral were slated for transition to higher quality/class assets. Loans secured by office properties accounted for 9% of the total and industrial loans accounted for 6%. Often, these office and industrial properties needed stabilization in the form of lease-up or repositioning at the time of origination.

SMBC is the most prevalent provider of interest rate cap agreements. The firm provided nearly 90% of the agreements for the loans in CRED iQ’s analysis. As many as eight additional firms provided interest rate cap agreements, including US Bank (5% of total) and Goldman Sachs (4% of total). Of note, many interest rate cap providers will only provide agreements if a prior lending relationship exists, which can contribute to the counterparty concentration observed with SMBC.

The termination date of an interest rate cap agreement compared to a loan’s maturity date can be a source of credit risk. The proverbial wall of maturities — detailed in CRED iQ’s 2023 CRE Maturity Outlook — may also have arêtes of rate cap expirations on the windward side. In the chart below, interest rate cap agreements in the analysis were grouped together by expiration date. There are three quarters — Q3 2023, Q1 2024, and Q2 2024 — in which nearly $5 billion in notional rate cap agreements are set to expire. Furthermore, the dataset includes approximately 100 expiring agreements spanning five consecutive quarters, starting in Q3 2023. This visualization of expiring interest rate cap agreements shares similarities to widely circulated maturity wall data over the near to intermediate term; although timing of rate cap expirations and maturities is not commonly coterminous.

If the interest rate cap agreement expires before the loan is scheduled to mature, debt service on the mortgage could surge substantially, absent a new or extended interest rate cap agreement. To put this in perspective, current note rates, absent a rate cap agreement, are approximately 200 bps higher on average than effective notes rates that have been capped via strike prices from respective interest rate cap agreements. Of the 682 loans observed by CRED iQ, approximately 40% were structured with interest rate cap agreements that were scheduled to terminate prior to loans’ maturity dates. This is especially relevant considering all loans in the analysis benefitted from the in-place interest rate cap agreement as of February 2023. In other words, every single rate cap agreement in the analysis was activated and capping respective borrowers’ debt service.

Opportunistically, real estate professionals can view interest rate cap agreements with remaining term as a method of monetization. Keeping in mind the bridge financing attributes of loans securitized in CRE CLOs, borrowers have historically looked to lock in fixed-rate financing after the completion of a business plan or the stabilization of the collateral property. Locking in fixed-rate financing in 2023 may no longer be a palatable option given the run up in interest rates; however, the particular dynamics and attributes of individual properties’ cash flows and credit risk can still facilitate refinancing or sales transactions. Some deals are stilling closing. In these cases, if a loan prepays and the interest rate cap agreement still has term remaining, the rate cap agreement likely has value and can be monetized to the benefit of the borrower to close a transaction. Timeliness is an important factor in the monetization of interest rate cap agreements; all else equal the values of rate caps decline as the agreements approach termination dates.

We conclude the analysis with a few notable examples of interest rate cap agreements, including a time-series view of the exponential rise in the cost of capping floating-rate debt. Using rate cap pricing information from Derivative Logic, an independent hedge advisory firm, we leveraged CRED iQ’s property and loan-level data to evaluate the year-over-year change in cost for interest rate cap protection for five of the largest floating-rate mortgages in the dataset. One of the most extreme examples was a $337.5 million agreement expiring in February 2024 with a strike price of 4.00%. A year ago, the rate cap for such a deal would have cost approximately $780,000 but the cost had risen to $3.5 million as of mid-March 2023 — equal to a 348% year-over-year increase. In fact, all five sample rate caps shown in the chart and table below exhibited more than 2x growth in total costs over the course of trailing 12 months.

No matter the perspective, knowing the parameters and monetary values of interest rate cap agreements will play an integral part in facilitating commercial real estate transactions over the next year and beyond, with or without stable interest rates.

For the complete dataset featuring detailed loan information and specific attributes of individual interest rate cap agreements, please reach out to team@cred-iq.com. The dataset includes rate cap expiration dates, notional amounts, and strike prices among other data points.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.