CRED iQ examined loans that were added to the Watchlist in 2023. Our research team wanted to understand the underlying factors so far year.

As of the July 2023 remittance reports, CRED iQ has conducted its CRE watchlist analysis for loan and property data. In 2023, the Year-to-Date count of loans on the servicer watchlist has reached approximately 12,000 loans. In the reporting month of July 2023, CRED iQ identified just over 4,600 loans that have been recently added to the watchlist.

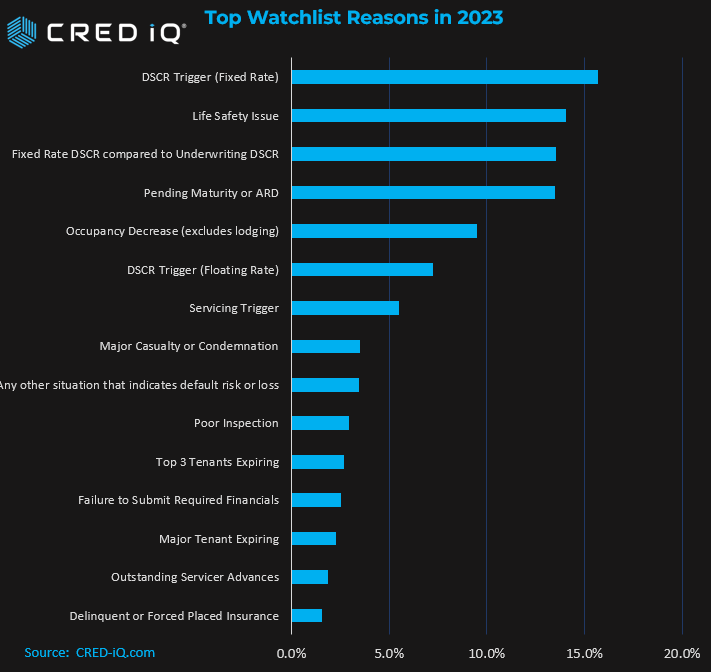

- 36.5% of all Watchlist loans were attributable to DSCR triggers –both fixed rate and floating rate.

- Pending Maturity or ARD represented 13.5% of the names on the list—a increase of 4.5% vs all Watchlist accounts in our database

- Occupancy Decrease (excluding logging) accounted for 9.5%. of loans added to the watchlist in 2023—surprisingly a slight decrease against the overall Watchlist factor of 11.7%.

- Major tenant expirations were attributable to 2.3% of Watchlist loans so far this year –a fractional increase of .3% against all Watchlist filings

One recent example, is 1166 Avenue of the Americas, a 195,375-SF office tower in Manhattan that is encumbered by $130M in debt. The loan was recently added to the watchlist according to CRED iQ data due to its largest tenants vacating. The largest tenant, D.E. Shaw, (44% of the GLA) will be moving out as well as Arcesium, 20% of GLA) is actively looking for new office space as its lease expires in June 2024. The loss of those two tenants could reduce the building’s total revenue by $8-$9M, which will negatively impact its DSCR.

What is a Commercial Real Estate Watchlist and Why is it Important?

The Watchlist is a specialized designation that tracks and monitors properties and loans that are experiencing delinquency or non-payment of their financial obligations. This watchlist is particularly relevant for lenders, investors, and real estate professionals who want to keep a close eye on the performance of commercial real estate loans and identify potential risks in their portfolios.

Key features and benefits of a commercial real estate delinquency watchlist include:

- Identifying Troubled Assets: The watchlist helps lenders and investors identify properties and loans that are experiencing payment issues, providing early warnings of potential financial distress.

- Risk Management: Monitoring delinquencies helps in assessing the overall risk exposure of a commercial real estate portfolio and allows for timely risk mitigation measures.

- Decision Making: The watchlist enables lenders to make informed decisions about asset management, loan restructuring, or potential loan sales based on delinquency trends.

- Portfolio Diversification: By analyzing delinquencies across different property types, geographic locations, and asset classes, investors can make more informed decisions about portfolio diversification.

- Market Insights: Delinquency watchlists offer valuable insights into market trends and economic conditions, as high delinquency rates can signal broader economic challenges.

- Mitigating Losses: Early identification of delinquencies allows lenders and investors to take appropriate actions to mitigate potential losses, such as initiating foreclosure or loan workouts.

- Loan Servicing: For loan servicers, a delinquency watchlist helps in managing collections and guiding borrowers back to compliance.

- Compliance and Reporting: It assists financial institutions in adhering to regulatory requirements and reporting delinquency rates accurately.

- Real Estate Market Monitoring: By tracking delinquencies across different property types and regions, real estate professionals can gain insights into emerging market trends and potential investment opportunities.

- Asset Valuation: Delinquency information can impact the valuation of commercial mortgage-backed securities (CMBS) and other real estate investment products.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.