Overall distressed levels remain relatively unchanged, while industrial segment’s distressed rates almost double this month.

Following 10 consecutive increases CRED iQ’s overall distress rate for CMBS fell modestly in November by 5 basis points to 7.52%. There are important variables impacting these results—including some previously reported anomalies in the October print.

The core delinquency rate increased by 13 basis points to 5.27% – after recording a minor reduction in October. Similarly, our special servicing rate, which represents the percentage of CMBS loans that are with the special servicer (includes both delinquent and non-delinquent), increased by 6 basis points to 6.84%.

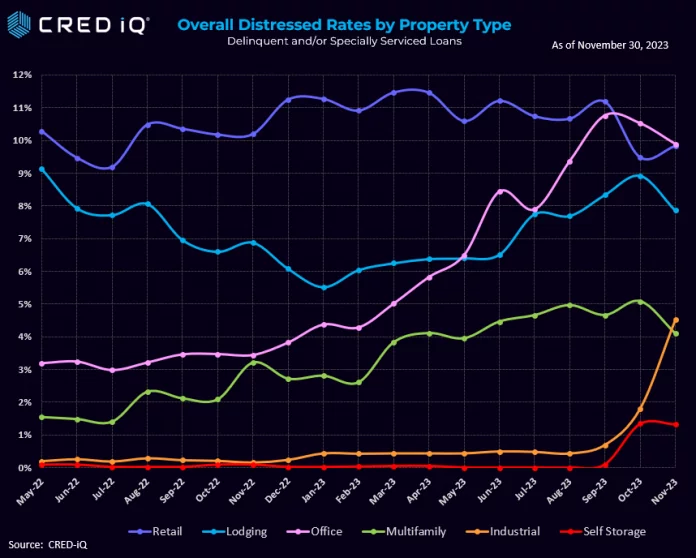

Looking across the CRED iQ Distressed Rate Heat Map, the retail segment enjoyed its second consecutive month turning in an overall distress rate under 10%. On a month-over-month basis, however, retail overall distress increased by 35 basis points to 9.82% – putting a three month/sub 10% trend on thin margins.

Industrial saw the greatest month-over-month distress increase from 1.81% to 4.53%. The industrial segment has spent most of 2023 below 1.0% until October. One significant factor was the $2.2 billion industrial portfolio (BX Trust 2021-ACNT) that failed to pay off on its initial November 9, 2023 maturity date. The failure to pay off at maturity caused the payment status to change from current to performing matured. There are three 12-month extension options, allowing for an extended maturity through November 2026. The floating rate loan, which was originated in October 2021, is structured with an interest rate that equates to one-month LIBOR plus a 2.37% spread rate, which has now spiked to 7.82%. The sponsor of the loan, Blackstone, had their interest rate cap agreement expire on November 15, 2023, which had an original strike rate of 3.50%.

Lodging, multifamily and the well-watched office segments all trimmed their Distressed Rate month-over-month modestly.

Self storage continued to dominate the overall delinquency rate performance at 1.33%, 2 basis points off the 2023 high of 1.35%. Self storage logged three months with 0% delinquency, and most months in 2023 were in the single digits.

Nearly half of the delinquencies were categorized as Non-Performing Matured Balloon. Approximately 25% were 90+ Days Delinquent and just below 20% were Performing Matured Balloon.

CRED iQ’soverall distress rate aggregates the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate. This includes any loan with a payment status of 30+ days or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

As with the October report, we caution that November’s results are inconclusive from a trending perspective. With that said, it is noteworthy that all but 2 defined segments logged reduced delinquency month over month (the Other category saw an increase).

About CRED iQ

CRED iQ is a data & analytics platform used by commercial real estate brokers, lenders, investors, and appraisers. It provides an easy-to-use interface, comprehensive and official loan data, true borrower and owner contact information, and a built-in valuation tool. As an official data provider, CRED iQ’s precise and audited data includes across all property types and geographies, all of which help CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition and lending opportunities, market analysis, underwriting, & risk management