2024 Loan Modifications, Led by CRE CLO are on Track to Surpass a Record Setting 2023.The CRED iQ Research team has been fielding requests for deeper analysis on loan modifications during this period of elevated interest rates and levels of delinquency. Loan modifications have surged as borrowers worked with lenders to achieve loan extensions and other alterations to their loan covenants.

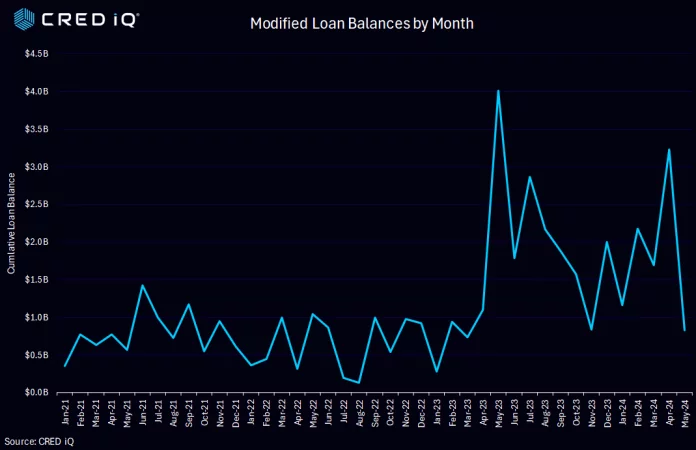

Approximately $22 billion in loans have been modified in the past 12 months ending May 31, 2024. Over $9 billion in loans have already been modified this year through May, placing 2024 squarely on a path to a record setting year of loan modifications. This compares to a total of $16.8 billion that was modified in 2023.

The notion of “pretend and extend” is totally understandable as loans reach maturity in this challenging rate environment. As of May 31, 2024, the average volume of loan modifications averaged $1.8 billion. April was the busiest month which saw over $3 billion in CRE loan modifications.

Nearly half of the modification types (46.2%) compiled from CRED iQ loan data fell into the Maturity Date Extension category. CRE CLO loans continued to dominate the loan modifications by deal type with YTD cumulative balances of $4 billion, representing 44% of all modifications in 2024. The SBLL deal type notched a second-place finish at $3.3 billion (36.4%) YTD through May, followed by conduit loans with YTD totals of $1.6 billion (17.4%).

The number of modifications in 2023 more than doubled compared to 2022. So far in 2024 the CRE CLO category is on track to easily outpace its 2023 print while all other categories run rates are tracking closer to the 2023 benchmarks.

According to CRED iQ’s 2024 CRE Maturity Outlook, 2024 will see $210 billion in securitized maturities—likely fueling the demand for loan modifications in the second half of 2024.

Some of the largest loan modifications thus far in 2024 include:

Phoenix Corporate Tower, a 457,878 SF office, is backed by a $33.7 million loan (originally $38.0M). Due to its upcoming maturity in April 2024, the loan was added to the servicer’s watchlist in January 2024. The loan was modified in April 2024, extending the maturity to July 2025. The office tower is in the Central Corridor submarket of Phoenix and was appraised for $42.5 million ($93/sf) at underwriting in February 2019. A 0.83 DSCR and 78.0% occupancy was reported as of March 2024.

The $63.9 million loan backed by the 412-unit Retreat at Riverside multifamily property in the Atlanta market was modified in May 2024. The loan was originally scheduled to mature in May 2024 but was extended by two months to July 2024. Life safety issues and upcoming maturity lead to the loan being on the servicer’s watchlist since June 2023. At underwriting in February 2021, the asset was appraised at $81.3 million ($197,330/unit). The property was 93.4% occupied with a 0.78 DSCR as of March 2024.

About CRED iQ

CRED iQ is an official market data provider for the Commercial Real Estate and financial industries. Powered by over $2.3 trillion in loan and transaction data that includes all property types and geographies.

CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.