This week, CRED iQ calculated real-time valuations for five specially serviced loans that have recently transferred to special servicing. The CRED iQ valuations factor in a base-case (Most Likely), a downside (loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and contact information, sign up for a free trial here.

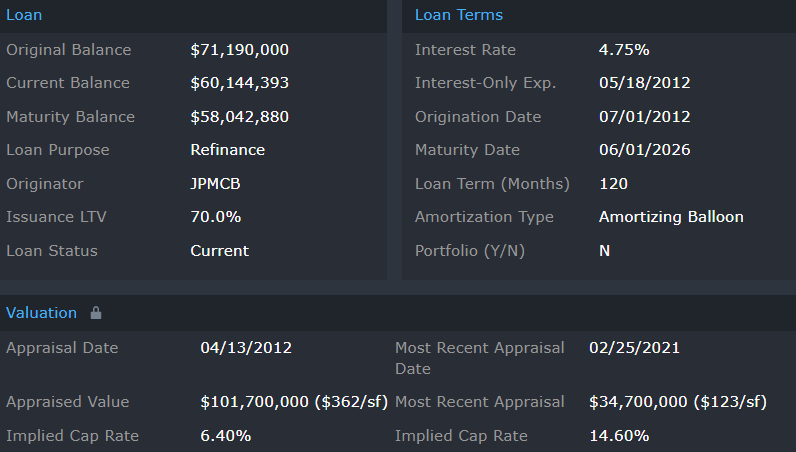

Jefferson Mall

281,020-sf, Regional Mall, Louisville, KY

The Loan transferred to special servicing on 1/28/21 for imminent non-monetary default related to the bankruptcy proceedings of the Loan sponsor. The Loan is secured by a portion of a regional mall located in Louisville, KY. Notable CRED iQ Comps are Oxmoor Center and Mall St. Matthews, both within 10 miles of Jefferson Mall.

The Loan was modified on 8/11/20 to extend maturity two years to 6/1/26. The Borrower is seeking a subsequent modification and Argentic is completing the necessary due diligence to address the request. An updated appraisal for 2/25/21 was recently reported, implying a cap rate of 15%; although, the CRED iQ Base-Case valuation comes in even lower. For the full valuation report and loan-level details, click here.

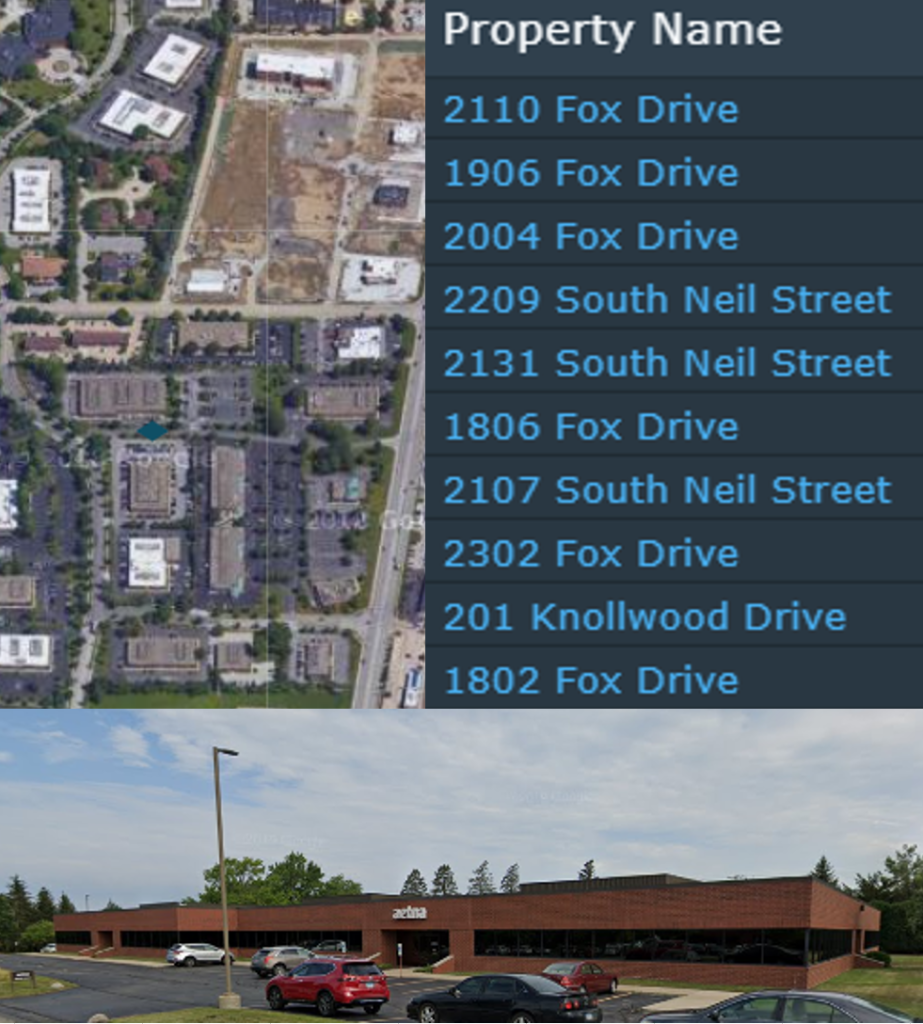

Newport Centre

1,148,835-sf, Regional Mall, Jersey City, NJ

The Loan transferred to special servicing on 5/3/21 for maturity default. Prior to maturity, a forbearance agreement allowed the Borrower to defer principal payments from May through July 2020. Deferred principal payments were required to be paid back by the 5/1/21 maturity date. The Loan is secured by 972,484 sf of retail space that includes 3 anchor parcels occupied by Macy’s, Sears, and Kohl’s. JCPenney owns and operates a fourth anchor parcel totaling 180,891 sf, located on the south end of the property. The Borrower has requested for a maturity extension. For the full valuation report and loan-level details, click here.

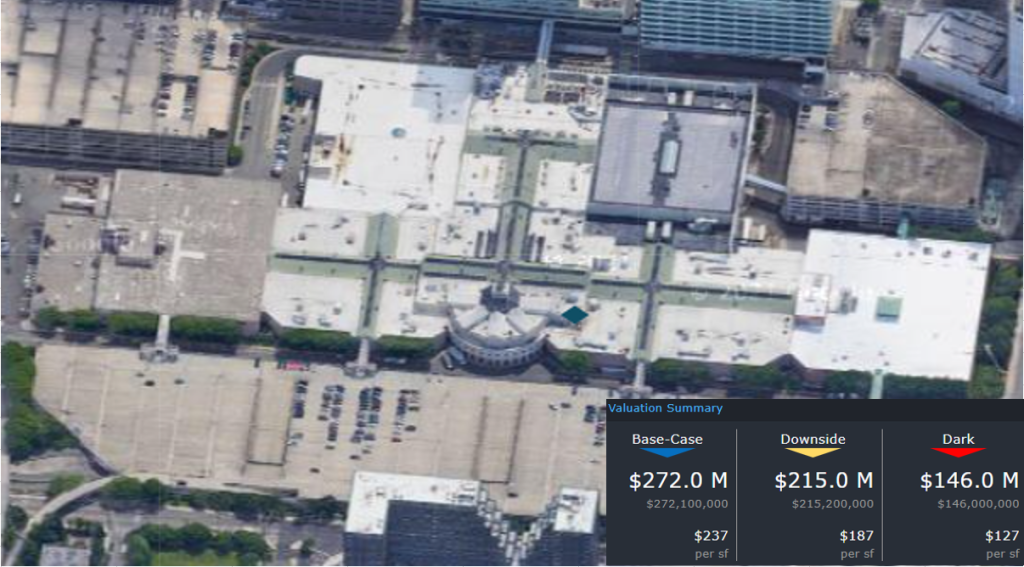

Crowne Plaza Portland Convention Center Hotel

241 keys, Full-Service Hotel, Portland, OR

The Loan transferred to special servicing on 5/7/21 for maturity default. Loan is secured by a full-service hotel that operates as a Crowne Plaza and is heavily dependent on primary demand generators such as the Moda Center and the Oregon Convention Center. NOI for the hotel in 2020 was negative due to demand disruption from COVID-19. Rialto is reaching out to the Borrower to assess the next steps for workout. For the full valuation report and loan-level details, click here.

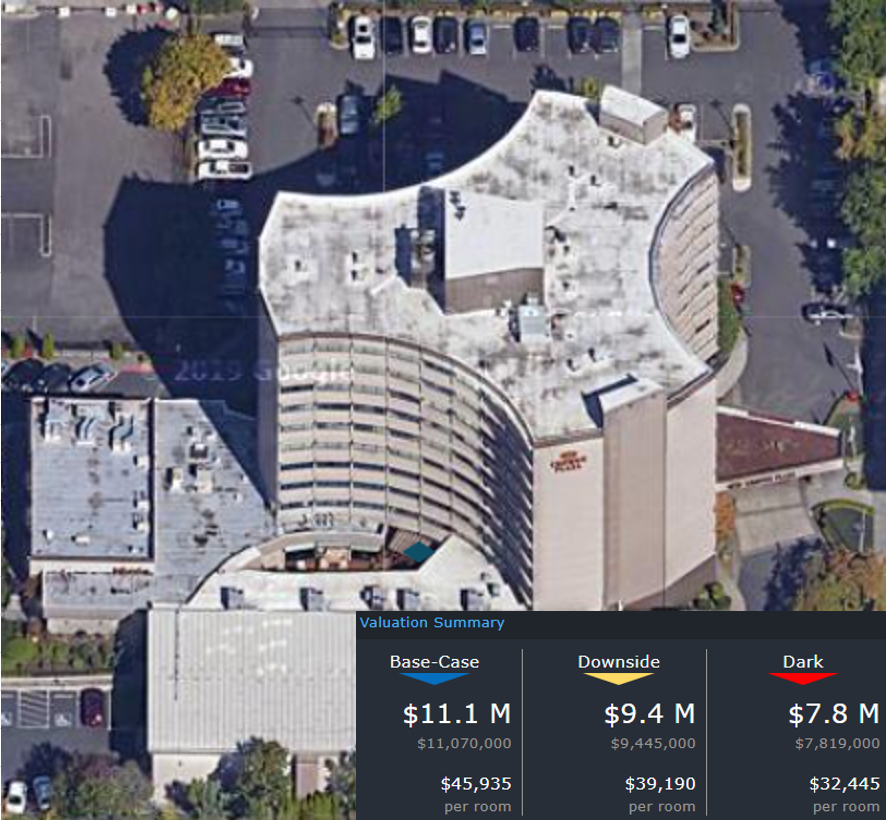

Champaign Portfolio

200,191-sf, Mixed-Use Office Portfolio, Champaign, IL

The Loan transferred to special servicing on 4/23/21 for imminent monetary default. The Loan is secured by a portfolio of 10 single-story buildings, that primarily function as office use with some light industrial capability. The Borrower has not yet signed a pre-negotiation agreement and loan workout has yet to be determined.

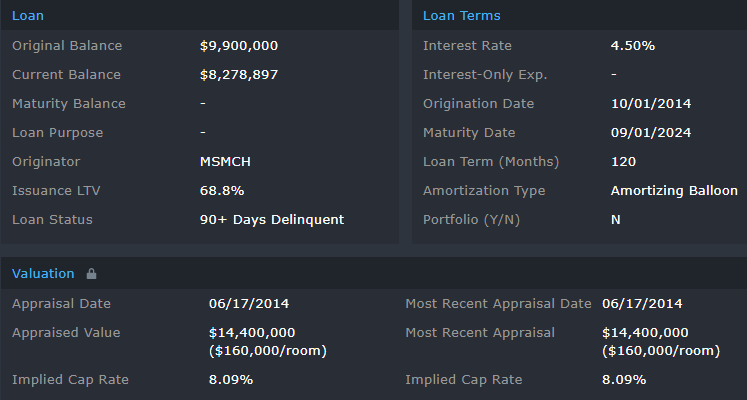

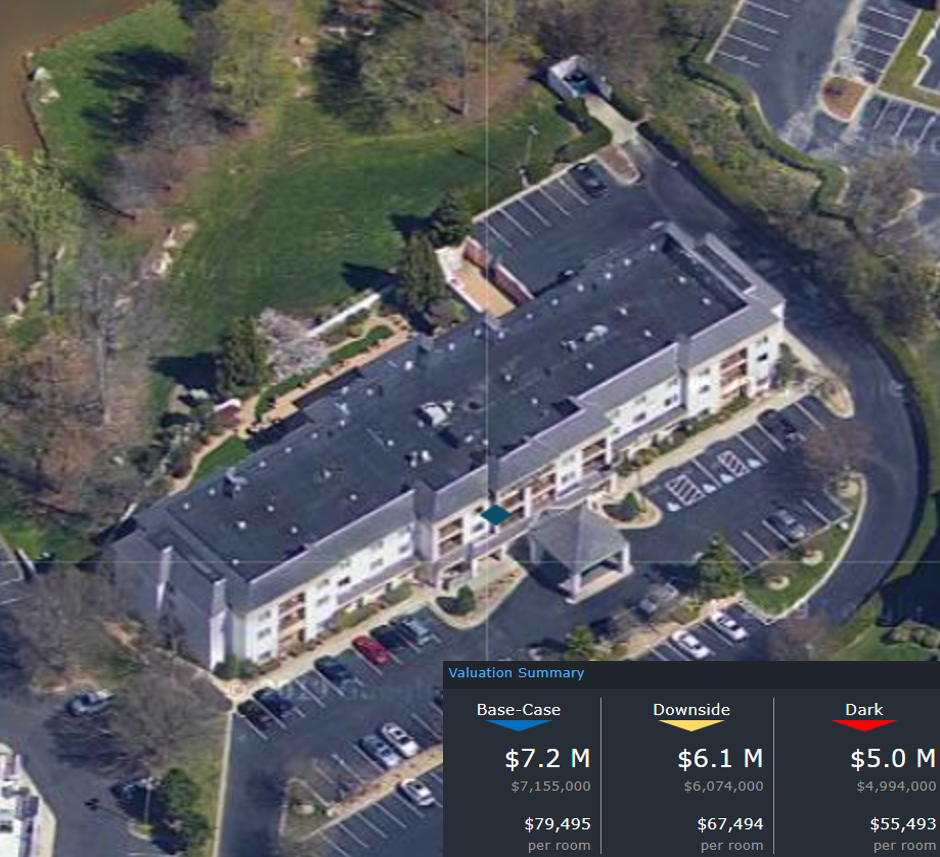

Courtyard By Marriott – Lake Norman

90 keys, Limited-Service Hotel, Huntersville, NC

The Loan transferred to special servicing on 5/4/21 for payment default. The Loan is secured by a limited-service hotel that operates as a Courtyard by Marriott catering to leisure guests with the benefit of lake access within 5 miles. COVID-19 was cited by the Borrower as the primary reason for distress and Rialto has reached out to the Borrower to assess the next steps of workout. For the full valuation report and loan-level details, click here.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: