Freddie Mac loans secured by distressed properties are sources for opportunities within the multifamily sector that include traditional garden-style and high-rise as well as multiple property sub-types, including student housing and senior housing properties that were among those highlighted this week. Mortgage originators, distressed investors, and commercial brokers are able to search CRED iQ’s database of approximately 26,000 Freddie Mac loans totaling $336 billion in outstanding debt for their next opportunity. The properties featured in this week’s WAR Report secure a subset of distressed Freddie Mac loans across multiple primary markets, including Philadelphia, San Diego, San Antonio, and Los Angeles. This week, CRED iQ calculated real-time valuations for 5 distressed multifamily properties that secure Freddie Mac loans. Click the link below for a list of all multifamily properties.

CRED iQ valuations factor in base-case (Most Likely), downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

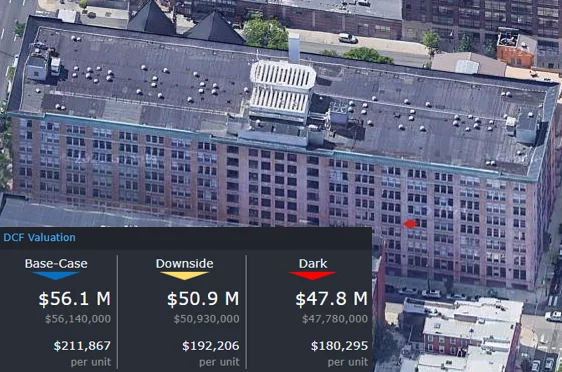

Lofts 640

265 units, Multifamily, Philadelphia, PA [View Details]

This $40.1 million loan transferred to special servicing on October 28, 2020 and has been over 90 days delinquent since. CWCapital, as special servicer, has filed for receivership multiple times but the motions were denied. A short-term forbearance agreement was initially agreed upon in April 2021 at the onset of the pandemic but the property’s poor performance can be traced back to pre-pandemic operational struggles. For this reason, the borrower’s request for an extension of forbearance after the initial 3-month period was denied. Workout of the loan is ongoing and the special servicer appears to be continuing with its strategy of foreclosure.

The mortgage is secured by a 9-story, 265-unit loft-style multifamily property in the Fairmount submarket of Philadelphia. Occupancy at the property started to show declines in 2016 when it dropped to 91 from 96%. Occupancy then continued to decline below 90% in the following years and was as low as 75% during the pandemic before recovering to 97% as of September 2021. Additionally, the property benefitted from a 10-year real estate tax abatement from the City of Philadelphia that expired at year-end 2016. In 2017, unabated real estate taxes increased nearly 5x to approximately $769,000. By the end of 2019, net cash flow from the property was not sufficient to cover the loan’s debt service.

The property appraised for $53.9 million ($203,396/unit) in February 2021, which represented a 14% decline in value compared to the property’s 2011 appraisal. For the full valuation report and loan-level details, click here.

| Property Name | Lofts 640 |

| Address | 640 North Broad Street Philadelphia, PA 19130 |

| Outstanding Balance | $40,107,327 |

| Interest Rate | 4.24% |

| Maturity Date | 11/1/2021 |

| Most Recent Appraisal | $53,900,000 ($203,396/unit) |

| Most Recent Appraisal Date | 2/15/2021 |

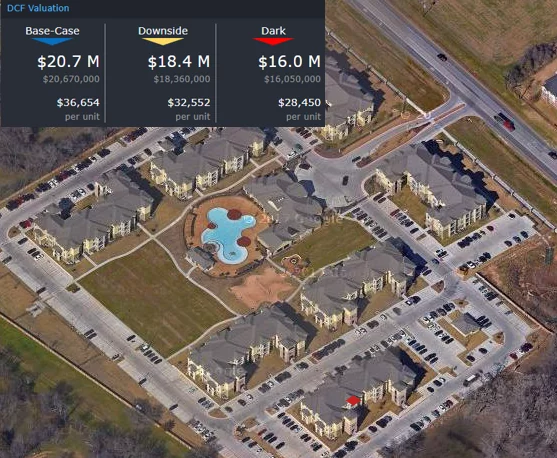

Domain at Waco Apartments

564 beds, Student Housing, Waco, TX [View Details]

This $24.6 million loan transferred to special servicing on February 3, 2021 after failing to stay current following the end of a forbearance period. An initial forbearance agreement was granted in September 2020 to provide COVID relief and the payback period was scheduled to begin in December 2020; however, the tenants-in-common borrowing entity did not make any repayments. The loan became severely delinquent for several months after it transferred to special servicing. CWCapital, as special servicer, reached an agreement with the borrower to cure the loan and a second forbearance agreement was signed in September 2021. The loan has been current in payment in accordance with the terms of the forbearance since the second agreement was executed. The window for clearing up credit issues for this loan is getting shorter with loan maturity scheduled for January 2023.

The loan is secured by a 186-unit student housing facility located in Waco, TX. The property contains 564 beds and provides housing to students enrolled at Baylor University, which is located about 1.5 miles away. Despite receiving COVID-related forbearance, the property has had occupancy issues prior to the pandemic and was 70% occupied in 2019. Newer housing options and locations closer to campus were reasons cited for low occupancy. Occupancy appears to have recovered for the 2021 academic year and was most recently reported as 97% as of October 2021. The property was appraised for $23.2 million ($41,135/bed) in February 2021, which represented a 34% decline in value compared to the property’s August 2015 appraisal at origination. For the full valuation report and loan-level details, click here.

| Property Name | The Domain At Waco Apartments |

| Address | 2825 South University Parks Drive Waco, TX 76706 |

| Outstanding Balance | $24,574,541 |

| Interest Rate | LIBOR + 2.94% |

| Maturity Date | 1/1/2023 |

| Most Recent Appraisal | $23,200,000 ($41,135/bed) |

| Most Recent Appraisal Date | 2/26/2021 |

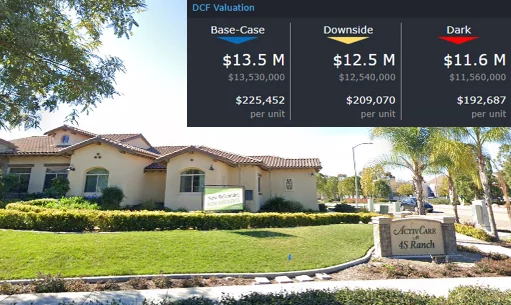

ActivCare At 4S Ranch

60 units, Assisted Living Facility, San Diego, CA [View Details]

This $9.8 million loan has had delinquency issues since July 2021 and was most recently over 90 days delinquent in November. The loan is secured by a 60-unit senior living facility in San Diego, CA that provides memory care and specialized assisted living accommodations. The loan first became delinquent after a 3-month forbearance period ended in May 2021. A second forbearance period was agreed upon by the servicer and the relief period appears to have been extended. Occupancy at the property was 37% as of July 2021, which is a reflection of the severe impact from the pandemic. However, the borrower has stated plans to partner with local non-profits to provide residential housing to those in need of assisted living care. Contract revenue from such a partnership may aid in the property’s stabilization as forbearance is repaid over the next 24 months. For the full valuation report and loan-level details, click here.

| Property Name | ActivCare at 4S Ranch |

| Address | 10603 Rancho Bernardo San Diego, CA 92127 |

| Outstanding Balance | $9,579,065 |

| Interest Rate | 5.01% |

| Maturity Date | 6/1/2028 |

| Most Recent Appraisal | $16,760,000 ($279,333/unit) |

| Most Recent Appraisal Date | 3/23/2018 |

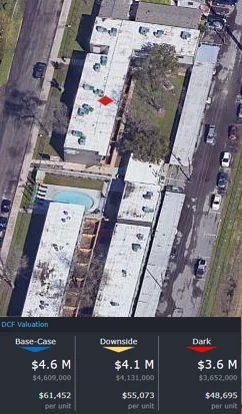

Nexus Urban Living

75 units, Multifamily, San Antonio, TX [View Details]

This 75-unit multifamily property in northeast San Antonio, TX is facing foreclosure due to payment default on a $4.9 million mortgage. The loan transferred to special servicing in August 2021 and the foreclosure sale is scheduled for December 2021. A 3-month forbearance agreement for the loan had been signed in March 2021 but the borrower was unable to keep up with repayments starting in June 2021. Occupancy at the property was impacted by the pandemic and declined to as low as 72% during 2020 before recovering to 91% as of June 2021. For the full valuation report and loan-level details, click here.

| Property Name | Nexus Urban Living |

| Address | 6810 Glendora Avenue San Antonio, TX 78218 |

| Outstanding Balance | $4,940,000 |

| Interest Rate | 5.10% |

| Maturity Date | 4/1/2029 |

| Most Recent Appraisal | $6,370,000 ($84,933/unit) |

| Most Recent Appraisal Date | 1/18/2019 |

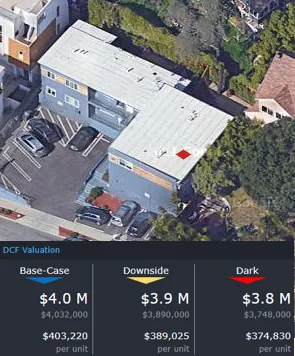

The Niagara Apartments

10 units, Multifamily, Los Angeles, CA [View Details]

This $2.6 million loan transferred to special servicing on November 4, 2021 due to delinquency. The loan is secured by a 10-unit multifamily building in the Echo Park neighborhood of central Los Angeles. The 2-story property is built into a hillside and is located just off Sunset Boulevard, in close proximity to Dodgers Stadium. The mortgage, which was 60 days delinquent as of November, is still in the early stages of workout. The property was 100% occupied as of year-end 2020; however, updated occupancy and performance figures were not yet reported for 2021. For the full valuation report and loan-level details, click here.

| Property Name | The Niagara Apartments |

| Address | 1315 Montana Street Los Angeles, CA 90026 |

| Outstanding Balance | $2,622,391 |

| Interest Rate | 4.50% |

| Maturity Date | 9/1/2039 |

| Most Recent Appraisal | $3,800,000 ($380,000/unit) |

| Most Recent Appraisal Date | 6/7/2019 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.