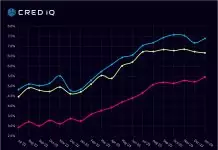

The CRED iQ team made the most out of 2021 by providing market constituents with commercial real estate analytics, loan and property data, as well as fresh takes on commercial real estate trends and new cycles. CRED iQ’s WAR Report (Weekly Asset Review) is among its most popular reads, providing in-depth analysis on a variety of topics including distressed asset valuations and credit risk analysis. CRED iQ’s commentary on commercial mortgage origination trends has gained popularity this year as well, examining lender terms and loan structures for new originations. Lastly, our CRED DQ report — featuring CMBS delinquency and special servicing rates as well as market delinquency tracking — has been featured in several widely recognized media outlets.

The team here at CRED iQ looks forward to providing more great content in 2022!

Here are this year’s most-read posts:

| Rank | Post Type | Post Title | Publication Date | Description | Link |

| 1 | WAR Report | Washington Prime Group Properties | Sep-21 | CRED iQ’s take on Washington Prime Group (WPG) following the shopping center REIT’s emergence from bankruptcy. | View Post |

| 2 | Lending Landscape | Recent Commercial Mortgage Originations | Sep-21 | CRED iQ’s WAR Report examined newly originated loans to evaluate the CMBS lending environment. | View Post |

| 3 | WAR Report | REO Retail Properties | Jul-21 | CRED iQ’s updated valuations for REO retail assets, including the highly-publicized Montgomery Mall in North Wales, PA. | View Post |

| 4 | Top Stories | CRED iQ and Waterstone Defeasance Announce Integration Partnership | Jun-21 | CRED iQ announced an integration partnership with Waterstone Defeasance to allow clients to calculate defeasance costs. | View Post |

| 5 | CRED DQ Report | August 2021 Delinquency Report | Aug-21 | CRED iQ debuted an enhanced delinquency report, providing a new standard of CMBS data analytics. | View Post |

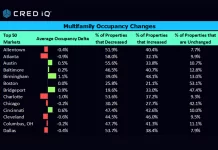

| 6 | WAR Report | Distressed GNMA Properties | Sep-21 | Following the addition of Ginnie Mae data to the CRED iQ platform, we took a look at distressed multifamily properties. | View Post |

| 7 | WAR Report | Specially Serviced Loans | Sep-21 | One of our most popular WAR Report posts that featured a regional mall located in Lancaster, PA and 2 mixed-used properties located in Lower Manhattan. | View Post |

| 8 | WAR Report | REO Regional Malls | Aug-21 | CRED iQ’s follow up to a feature in MarketWatch that examines values of REO regional malls. | View Post |

| 9 | WAR Report | Top Markets for Distressed Hotel Opportunities | Aug-21 | CRED iQ examined markets with the highest rates of distress for lodging properties. | View Post |

| 10 | WAR Report | Hotel Auctions | Nov-21 | CRED iQ prepared analysis for upcoming auctions of distressed hotel properties. | View Post |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.