This week, CRED iQ calculated real-time valuations for 3 multifamily properties that secure delinquent GNMA loans. Although GNMA loans have mortgage insurance from the FHA as well as a timely payment guarantee, delinquent Ginnie Mae loans can still lead to foreclosure that can provide opportunities for distressed investors looking to step in and inject additional capital or create value-add plans by improving operations. Mortgage originators, distressed investors, and commercial brokers search CRED iQ’s database of approximately 15,000 Ginnie Mae loans totaling more than $138 billion in outstanding debt for their next deal. The properties featured in this week’s WAR Report secure a subset of select Ginnie Mae loans that are at least 30 days delinquent, including 2 properties in the Washington, DC MSA.

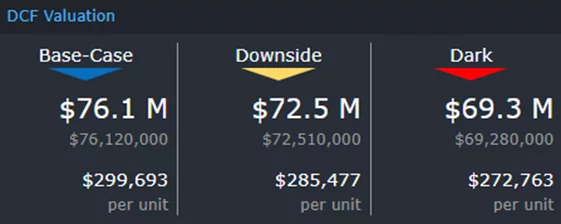

CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS and GNMA loan reporting, including detailed financials and borrower contact information, sign up for a free trial here.

Glenmont Metrocenter Apartments

254 units, Multifamily, Silver Spring, MD [View Details]

GNMA 2019-G617GYZT6

This $56.1 million loan, which is over 30 days delinquent, is secured by a 4-story, 254-unit multifamily property in Silver Spring, MD, located within walking distance to the Glenmont Station for the Washington Metropolitan Area Transit Authority (WMATA). The mortgage backs Ginnie Mae construction loan certifications (CLCs) and was originated by AGM Financial Services in February 2019. There were 28 funding draws with the latest one occurring in November 2021. The FHA-insured mortgage was issued through the Department of Housing and Urban Development’s (HUD) 221(d)(4) program to facilitate the construction of multifamily properties for moderate-income families. The loan has an interest rate of 4.62%, a 40-year term, and a prepayment premium for the first 10 years of the loan term. The collateral property was renamed as the Atelier Apartments and is part of a 30-acre redevelopment project that also features newly constructed residential townhomes. The property, which opened in 2021, was developed by Buchanan Partners and Elion Partners. Despite the reported delinquency, the property compares favorably to rental stock in the immediate vicinity of Glenmont Station and has superior amenities that should allow the apartments to command rents in line or relatively higher than the market. For the full valuation report and loan-level details, click here.

| Property Name | Atelier Apartments |

| Address | 2511 Glenallan Ave Silver Spring, MD 20906 |

| Outstanding Balance | $56,053,067 |

| Interest Rate | 4.62% |

| Origination Date | 2/14/2019 |

| Maturity Date | 6/1/2061 |

Eden By The Rouge

180 units, Assisted Living, Canton, MI [View Details]

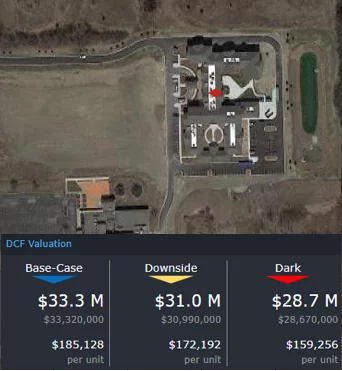

GNMA 2019-3617J4UY3

This $16.3 million loan, which is over 6 months delinquent, is secured by a 180-unit senior housing facility in Canton, MI, located approximately 25 miles west of Detroit, MI. Similar to the Glenmont Metrocenter Apartments, this mortgage represents construction financing that back CLCs. However, this loan was issued through HUD’s 232 program, which facilitates the construction of assisted living facilities. Love Funding originated the loan in April 2019 with an original balance of just under $1 million. Since origination, there have been 19 funding draws with the latest occurring in June 2021. The loan has an interest rate of 4.53% and a maturity date in December 2060. The property was renamed Kingsley Senior Living after completion and provides memory care services as well as assisted living facilities. The facility opened in mid-2021, although the status and velocity of resident enrollment was not disclosed. For the full valuation report and loan-level details, click here.

| Property Name | Kingsley Senior Living |

| Address | 44100 Connection Way Canton, MI 48188 |

| Outstanding Balance | $16,304,017 |

| Interest Rate | 4.53% |

| Origination Date | 4/1/2019 |

| Maturity Date | 12/1/2060 |

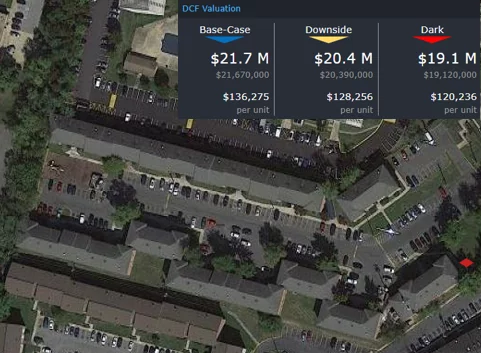

Parkway Apartments

159 units, Affordable Housing, Temple Hills, MD [View Details]

GNMA 2013-36181GW54

This $8.1 million loan is over 6 months delinquent and is secured by a 3-story, 159-unit affordable housing multifamily property in Temple Hills, MD, located approximately 9 miles outside of Washington, DC. The mortgage backs Ginnie Mae permanent loan certificates (PLCs) and was originated by Wells Fargo Multifamily Capital in September 2013. The loan falls under both Section 221 (d)(4) and Section 223 (a)(7) of FHA’s mortgage insurance program for the rehabilitation and refinancing, respectively, of affordable housing properties. The loan carries an interest rate of 3.85% and has a maturity date in October 2050. A prepayment penalty of 10% is required during the first 5 years of the loan term and then is reduced to 5% before it declines annually by 1%. The loan is eligible for prepayment without penalty on November 1, 2023. The property operates with a Low-Income Housing Tax Credit (LIHTC) and approximately 90% of the units are set aside with rent ceilings lower than 60% of Area Median Income (AMI). The LIHTC was issued in 2003, which is more than 15 years ago, so the property may be out of its initial compliance period. For the full valuation report and loan-level details, click here.

| Property Name | Parkway Apartments |

| Address | 4425 23rd Parkway Temple Hills, MD 20748 |

| Outstanding Balance | $8,092,547 |

| Interest Rate | 3.85% |

| Origination Date | 9/1/2013 |

| Maturity Date | 10/1/2050 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.