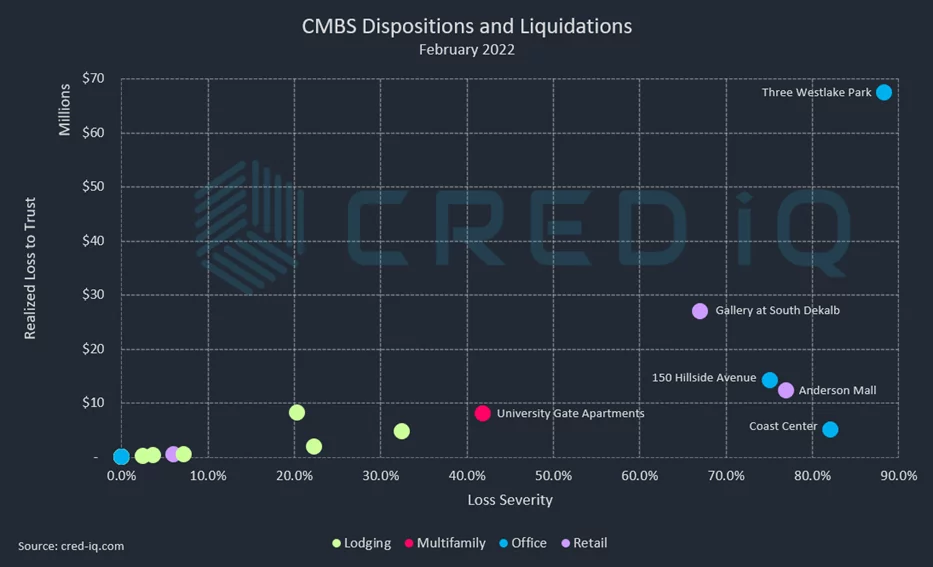

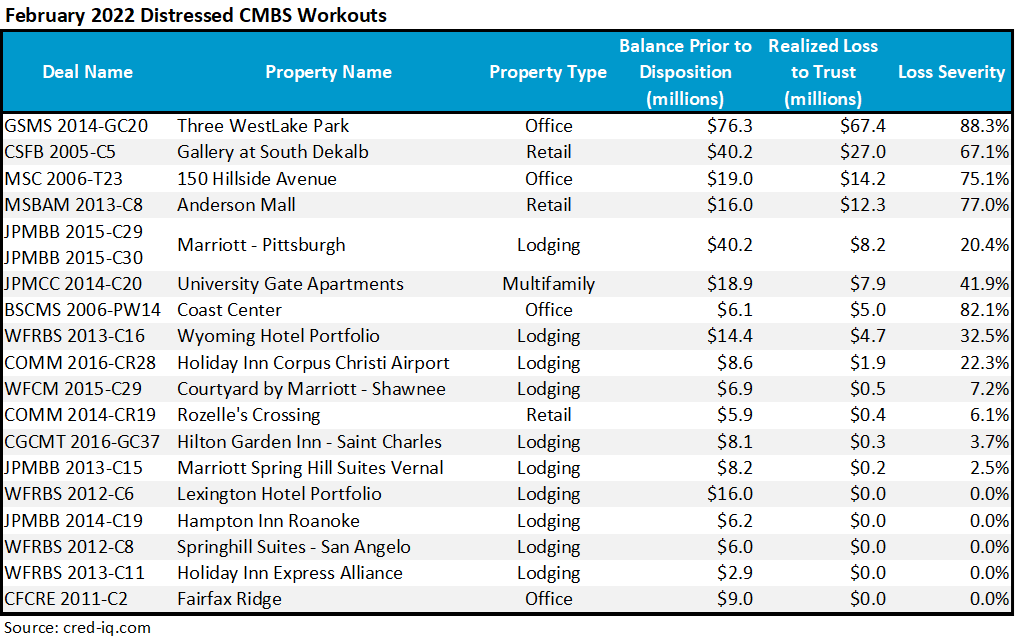

In February 2022, CMBS conduit transactions incurred approximately $150 million in realized losses through the workout of distressed assets. CRED iQ identified 18 workouts that the servicer classified as dispositions, liquidations, or discounted payoffs. Of those 18 assets, there were five dispositions that had either a nominal loss or no loss at all. The remaining workouts resulted in loss severities ranging from 2.5% to 88.3%, based on outstanding balances by disposition. Total realized losses in February were an increase compared to January’s realized loss totals of approximately $108.5 million.

The largest loss, by total amount and by loss severity, was the liquidation of Three Westlake Park, which was an REO, 19-story office building located in the Energy Corridor of Houston, TX. The property was vacant at the time of sale and future plans for the property centered around a conversion to multifamily use. The REO liquidation resulted in a $67.4 million loss on an outstanding balance of $76.3 million, equal to an 88.3% loss severity. The loss was allocated to the GSMS 2014-GC20 CMBS conduit transaction, which has been under a Control Termination Event since May 2021 that allows the trust’s operating advisor to consult on a non-binding basis with special servicing major decisions.

More than half of the dispositions in February comprised lodging collateral. Loss severities for the lodging assets were comparatively lower than the period’s retail and office dispositions. Lodging loss severities from the period’s distressed workouts ranged from 0% to 32.5%. The largest lodging disposition was the note sale of a mortgage secured by Marriott – Pittsburgh. The $40.2 million loan was sold with an $8.2 million loss, equal to a 20.4% severity.

Notable among the retail liquidations were two regional malls — Gallery at South Dekalb and Anderson Mall. Both assets had loss severities in excess of 60%, exhibiting the extreme binary nature of distressed workouts for impaired lower-tier regional malls. Prior to their respective liquidations, both malls were foreclosed and became REO in 2021.

The largest individual loss from last month was $62.7 million, equal to a 73.6% loss severity, and stemmed from The Crossroads, which is also a regional mall.

Excluding defeased loans, there was approximately $5.2 billion in securitized debt that was paid off or worked out in February which compares to $3.9 billion in January. In February, 6% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. An additional 6% of the loans paid off with prepayment penalties.

By property type, industrial dominated the volume of outstanding debt paid off in February with Blackstone’s retirement of a $2.8 billion mortgage. This loan was secured by 272 industrial properties formerly owned by Colony Capital.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.