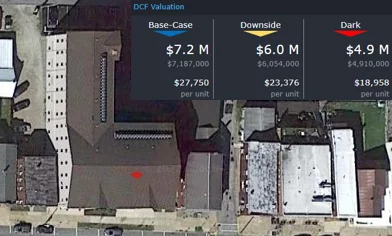

In this week’s WAR Report, CRED iQ calculated real-time valuations for five distressed properties that have transferred to special servicing in March 2022. Among these is a Chicago-area regional mall that is controlled by Starwood Capital Group. Additionally, there are two office properties featured, including a suburban office campus in the Milwaukee, WI MSA and a CBD office tower in Baltimore, MD. The final two highlighted properties comprise a student housing building in western Pennsylvania and a mixed-use property in San Francisco, CA.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

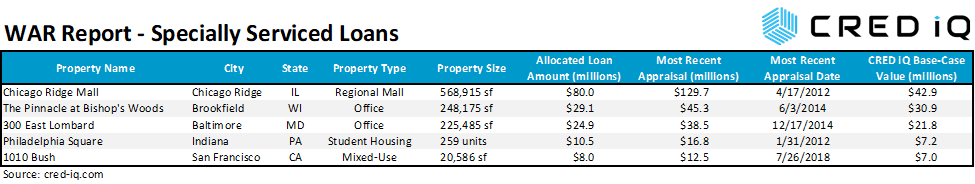

Chicago Ridge Mall

568,915 sf, Regional Mall, Chicago Ridge, IL [View Details]

Yet another regional mall controlled by Starwood Capital Group will need a special servicing workout. The Chicago Ridge Mall, which secures an $80 million mortgage, transferred to Trimont Real Estate Advisors, as special servicer, on March 14, 2022. A reason for the transfer was not initially cited, but the mall’s cash flows were severely impacted by the pandemic and performance has not recovered to pre-pandemic levels. The loan sponsor is a joint venture that is controlled by Starwood Property Group — CRED iQ recently featured a portfolio of Starwood malls in its March 8, 2022 WAR Report. The loan was scheduled to mature in July 2022, but a payoff is unlikely given the value impairment of the collateral. CRED iQ is also watching for a potential title transfer from the borrowing entity to the CMBS trust.

Chicago Ridge Mall is located about 16 miles outside of Chicago, IL and has a total size of 867,955 sf, but only 568,915 sf serve as collateral for the mortgage. There is a vacant 211,858-sf parcel that was formerly occupied by Sears until it closed in 2021. The vacant anchor box is owned by Transformco and there are no immediate plans for redevelopment. Kohl’s also operates as an anchor at the mall and owns its building. Kohl’s, which has been the subject of takeover speculation over the past month, was featured in last week’s WAR Report, which explored CMBS exposure to Kohl’s store locations.

The largest collateral tenants at Chicago Ridge Mall include Dick’s Sporting Goods (9% of NRA), Bed Bath & Beyond (7% of NRA), and AMC Theatres (6% of NRA). Dick’s Sporting Goods opened in 2021 and partially backfilled space that was left vacant by Carson Pirie Scott, a former department store anchor. Aldi provides a grocery component at the mall with a 20,042-sf space, but the tenant has a right to terminate its lease at any time given a 24-month notice. The mall was 80% occupied as of September 2021, which was an improvement compared to 70% occupancy during the prior year. Net cash flow for 2021 was on pace to be over 30% below pre-pandemic levels from year-end 2019. For the full valuation report and property-level details, click here.

| Property Name | Chicago Ridge Mall |

| Address | 444 Chicago Ridge Mall Chicago Ridge, IL 60415 |

| Outstanding Balance | $80,000,000 |

| Interest Rate | 4.60% |

| Maturity Date | 7/6/2022 |

| Most Recent Appraisal | $129,700,000 ($228/sf) |

| Most Recent Appraisal Date | 4/17/2012 |

The Pinnacle at Bishop’s Woods

248,175 sf, Suburban Office, Brookfield, WI [View Details]

This $29.1 million loan transferred to special servicing on March 1, 2022 due to low occupancy at the collateral property, a three-building suburban office park. The loan’s DSCR has declined for three consecutive years and was most recently reported as 1.09 for the nine-month period ending September 2021. Occupancy across the three collateral office buildings was 67% as of September 2021. The next steps of workout are likely to address the low occupancy across the office portfolio and to mitigate a high concentration of lease rollover in 2022 at the smallest of the three buildings, Pinnacle I.

The Pinnacle at Bishop’s Woods consists of three office properties in Brookfield, WI, approximately 10 miles west of Milwaukee: Pinnacle I (13890 Bishop’s Drive), Pinnacle II (13935 Bishop’s Drive), and Pinnacle III (13845 Bishop’s Drive). The office park first exhibited occupancy declines in 2016 when the former largest tenant, Bader Rutter & Associates (27% of the NRA), vacated Pinnacle III in favor of a CBD location in Milwaukee. A portion of the space was backfilled by a new tenant, Pentair Residential Filtration, and an existing tenant, DeWitt Ross & Stevens SC, expanded its space to offset some of the loss from Bader Rutter. More recently, the office park’s second largest tenant, Travelers Indemnity (formerly 21% of the NRA; now 11%), reduced its footprint at Pinnacle II after signing a five-year renewal in August 2021. Overall, occupancy has declined by nearly 30% since loan origination. For the full valuation report and property-level details, click here.

| Property Name | The Pinnacle at Bishop’s Woods |

| Address | 13845-13935-13890 Bishop’s Drive Brookfield, WI 53005 |

| Outstanding Balance | $29,136,932 |

| Interest Rate | 4.67% |

| Maturity Date | 7/1/2024 |

| Most Recent Appraisal | $45,250,000 ($182/sf) |

| Most Recent Appraisal Date | 6/3/2014 |

| CRED iQ Base-Case Value | $30,903,000 ($124/sf) |

| Pinnacle II | $14,090,000 ($138/sf) |

| Pinnacle III | $9,955,000 ($124/sf) |

| Pinnacle I | $6,858,000 ($105/sf) |

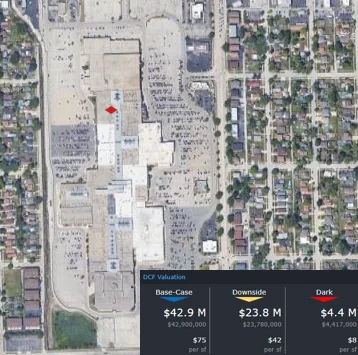

300 East Lombard

225,485 sf, CBD Office, Baltimore, MD [View Details]

This $24.8 million loan transferred to special servicing on March 14, 2022, likely due to an impending decline in collateral occupancy. The loan is secured by a 19-story office tower located in the Inner Harbor submarket of Baltimore, MD. The Baltimore Business Journal first reported that the building’s largest tenant, law firm Ballard Spahr, planned to vacate 300 East Lombard in favor of a smaller space at 111 S. Calvert Street, a newly renovated building with more tenant amenities that is located a block closer to the harbor. CRED iQ has featured multiple Baltimore CBD office buildings in WAR Reports so far in 2022, including 650 South Exeter Street and 201 North Charles. In each of these cases of distress, tenants have either vacated, downsized, or fled to higher quality locations — exhibiting how dynamic office markets can be in an environment with remote-work and pandemic considerations.

Ballard Spahr’s lease at 300 East Lombard is scheduled to expire on April 30, 2022. The tenant accounted for 15% of the property’s NRA. CRED iQ estimates occupancy will decline to approximately 65% following the tenant’s departure. For the full valuation report and property-level details, click here.

| Property Name | 300 East Lombard |

| Address | 300 East Lombard Street Baltimore, MD 21202 |

| Outstanding Balance | $24,889,795 |

| Interest Rate | 4.05% |

| Maturity Date | 2/11/2025 |

| Most Recent Appraisal | $38,500,000 ($171/sf) |

| Most Recent Appraisal Date | 12/17/2014 |

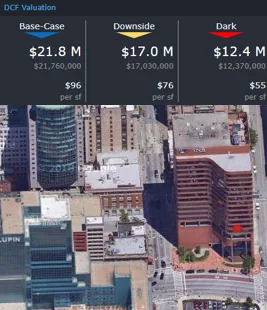

Philadelphia Square

259 units, Student Housing, Indiana, PA [View Details]

This $10.5 million loan transferred to special servicing on March 11, 2022, which is two months ahead of the May 11, 2022 scheduled maturity date. The loan had a below breakeven DSCR during 2020 and through the nine-month period ended September 2021. The loan is secured by a 259-unit student housing property that caters to students enrolled at Indiana University of Pennsylvania (IUP). Enrollment at IUP has been falling for several years. Fall 2021 enrollment was 9,308 students, which represented a 7.5% decline compared to the prior year. Lower enrollment is a catalyst for lower demand and weakness in rental rates at off-campus student housing facilities. CRED iQ’s highest scoring comp for the property is IUP Pratt Studios, which transferred to special servicing in July 2021 and became REO in October 2021. For the full valuation report and property-level details for Philadelphia Square, click here.

| Property Name | Philadelphia Square |

| Address | 1055 Philadelphia Street Indiana, PA 15701 |

| Outstanding Balance | $10,521,706 |

| Interest Rate | 5.35% |

| Maturity Date | 5/11/2022 |

| Most Recent Appraisal | $16,750,000 ($64,672/unit) |

| Most Recent Appraisal Date | 1/31/2012 |

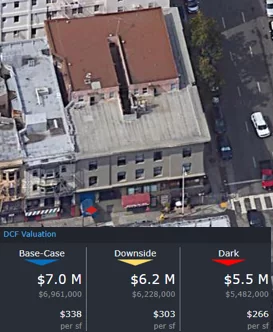

1010 Bush

20,586 sf, Mixed-Use (Retail/Multifamily), San Francisco, CA [View Details]

This $8 million loan transferred to special servicing on March 2, 2022 due to imminent monetary default. The loan is secured by a mixed-use property located in the Nob Hill submarket of San Francisco. The three-story building consists of ground floor retail and 65 residential hotel rooms that are operated as single-room occupancy units. The single-room occupancy units are master leased by Balmoral Residences, LLC for approximately $850 per unit per month. The master lease is scheduled to expire in February 2026. Multifamily and lodging property types have faced headwinds in the San Francisco MSA since the onset of the pandemic. Early in the pandemic, there was evidence of higher multifamily vacancies. Additionally, the lodging sector has been slow to recover. With a master lease in place, it is difficult to discern the performance of Balmoral Residences; however, the residential hotel company likely faces similar struggles to other distressed multifamily and lodging properties in San Francisco. For the full valuation report and property-level details, click here.

| Property Name | 1010 Bush |

| Address | 1010 Bush Street San Francisco, CA 94109 |

| Outstanding Balance | $8,000,000 |

| Interest Rate | 5.45% |

| Maturity Date | 11/6/2028 |

| Most Recent Appraisal | $12,500,000 ($607/sf) |

| Most Recent Appraisal Date | 7/26/2018 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Freddie Mac loan and property data.