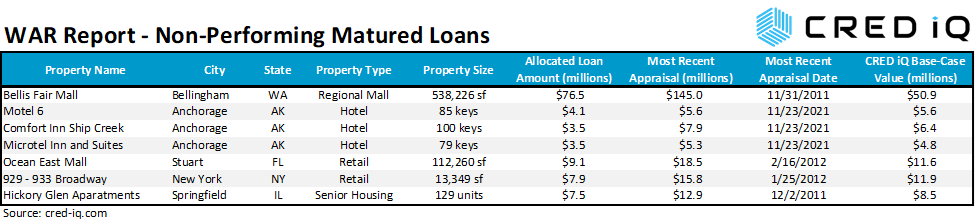

This week, CRED iQ reviewed real-time valuations for several assets that secure non-performing matured loans. Maturity defaults often can be a result of distress but may also be a mismatch in the timing of a refinancing effort or a sale closing. Non-performing matured loans are opportunities for distressed investors to step in and infuse capital in situations where traditional solutions may not be an option. Most of this week’s loans are secured by various subtypes of retail properties, including a distressed regional mall in northern Washington and a trio of Manhattan ground-floor retail buildings.

CRED iQ valuations factor in a base-case (most likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

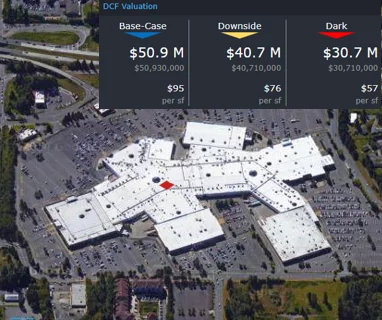

Bellis Fair Mall

538,226 sf, Regional Mall, Bellingham, WA [View Details]

This $76.5 million loan failed to pay off at its February 6, 2022 maturity date after the borrower, Brookfield Property Partners, was unable or unwilling to secure refinancing. The loan transferred to special servicing shortly after its maturity default. All workout options appear to be on the table including receivership, foreclosure, discounted payoff scenarios, or a modification agreement that could potentially delay any resolution for an extended period. However, Brookfield Property Partners has established a willingness to cooperate in the conveyance of title for properties with similar credit issues, including examples such as the Florence Mall in January 2021 and the imminent foreclosure of the Pierre Bossier Mall. Bellis Fair Mall was featured in CRED iQ’s March 2022 Delinquency Report as one of the largest new loans to recently transfer to special servicing.

The loan is secured by 538,226 sf of in-line and anchor space at the 776,000-sf Bellis Fair Mall in Bellingham, WA, which is approximately 50 miles southeast of Vancouver BC, Canada. Traditional department store anchors for the mall include Macy’s, Target, Kohl’s, and JCPenney. Of those, only the Macy’s box serves as collateral for the mortgage. Junior anchors include Dick’s Sporting Goods and Ashley Furniture HomeStore – both of which occupy space that was repositioned from a vacant former Sears parcel. Even with established anchor boxes and repositioning of junior anchors, Bellis Fair Mall has struggled with in-line occupancy throughout the pandemic. Many in-line tenants had termination options tied to sales targets, which were triggered during the pandemic, causing a high volume of tenant departures. Additionally, mall foot traffic was partially reliant on cross-border visitors from Canada, which was disrupted by pandemic lockdowns. CRED iQ estimates in-line occupancy declined to approximately 68% from a pre-pandemic level of about 80%. For the full valuation report and loan-level details, click here.

| Property Name | Bellis Fair Mall |

| Address | 1 Bellis Fair Parkway Bellingham, WA 98226 |

| Outstanding Balance | $76,502,895 |

| Interest Rate | 5.23% |

| Maturity Date | 2/6/2022 |

| Most Recent Appraisal | $145,000,000 ($269/sf) |

| Most Recent Appraisal Date | 11/30/2011 |

Anchorage Hotel Portfolio

264 keys, Hotel, Anchorage, AK [View Details]

Three loans with an aggregate outstanding balance of $11 million failed to pay off at maturity on April 6, 2022. The collateral properties, three limited-service hotels, were severely impacted by the pandemic and were not fully stabilized by the time maturity balloon payments were due. All three loans share the same borrower and transferred to special servicing in June 2020. The latest commentary from the loan’s special servicer indicates the borrower received a financing commitment from Northrim Bank to fully satisfy the loans’ outstanding balances. Based on LTVs, cited by servicer commentary, from 40% to 60% and November 2021 appraisals for each of the properties, the estimated refinancing package would total approximately $10.2 million, which is still a deficit from the aggregate debt amount.

The three hotel properties secured three individual loans, although two of the loans are cross-collateralized and cross-defaulted. Two of the hotels — Motel 6 and Comfort Inn Ship Creek — represent a leasehold ownership interest and the third hotel, Microtel Inn and Suites, represents a fee simple ownership interest. All three hotels were appraised for an aggregate value of $18.8 million in November 2021, equal to $71,212/key, which represented a 22% decline from origination appraisals. For the full valuation report and loan-level details, click here.

| Property Name | Size (keys) | Address | Outstanding Balance | CRED iQ Base-Case Value |

| Motel 6 | 85 | 5000 A Street Anchorage, AK 99503 | $4,080,333 | $5,630,000 ($66,230/key) |

| Comfort Inn Ship Creek | 100 | 111 Ship Creek Avenue Anchorage, AK 99501 | $3,452,590 | $6,402,000 ($64,019/key) |

| Microtel Inn and Suites | 79 | 5205 Northwood Drive Anchorage, AK 99517 | $3,452,590 | $4,774,000 ($60,434/key) |

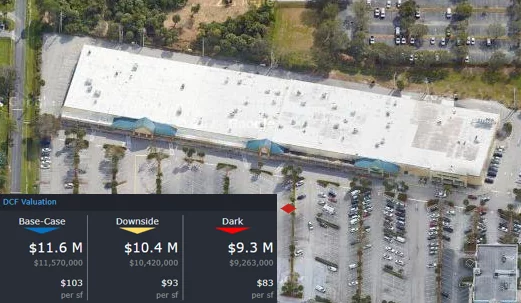

Ocean East Mall

112,260 sf, Retail, Stuart, FL [View Details]

This $9.1 million loan failed to pay off at its April 1, 2022 maturity date. Prior to the maturity default, the loan transferred to special servicing in February 2020 due to imminent default, following a decline in collateral occupancy. The loan remained current in payment from the time of its transfer to special servicing until its maturity date. The borrower’s commitment to keeping the loan current until maturity, despite collateral occupancy issues, was a positive signal for a potential scenario with a full payoff. However, the maturity default may expedite negotiations between the borrower and special servicer towards a less favorable resolution where the special servicer may pursue foreclosure if the borrower is uncooperative.

The loan is secured by a 112,260-sf retail center in Stuart, FL. The property’s largest tenant, Martin Diagnostic Center, vacated at lease expiration in November 2019. The tenant occupied 42,011 sf of space, accounting for 37% of the property’s NRA. Occupancy declined to approximately 45% after the property’s anchor tenant vacated. Medical office tenants may be a possibility for a potential backfill of the vacant anchor space given its former use and prevalence of medical tenants in the immediate market. For the full valuation report and loan-level details, click here.

| Property Name | Ocean East Mall |

| Address | 2300 SE Ocean Blvd Stuart, FL 34996 |

| Outstanding Balance | $9,119,304 |

| Interest Rate | 5.26% |

| Maturity Date | 4/1/2022 |

| Most Recent Appraisal | $18,500,000 ($165/sf) |

| Most Recent Appraisal Date | 2/16/2012 |

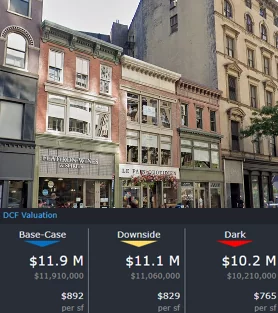

929 – 933 Broadway

13,349 sf, High Street Retail, New York, NY [View Details]

This $7.9 million loan failed to pay off at its April 10, 2022 maturity date. Prior to the maturity default, there were negotiations between the borrower, Thor Equities, and the loan’s special servicer regarding forbearance. The loan transferred to special servicing in September 2020 but returned to the master servicer in April 2021 without a modification. Updated servicer data indicates the workout situation has possibly been resolved and the borrower may have secured refinancing. Even if the loan pays off in the near term, the collateral properties could still be for sale. The property at 933 Broadway was reportedly under contract to be sold in early-2020 before the pandemic caused the deal to fall through.

The loan collateral consists of three, three-story retail buildings located in the Flatiron District of Manhattan, NY. The properties were 100% occupied as of year-end 2020 but some tenants were unable to pay rent at the time. A few struggling tenants vacated, and the properties were 63% occupied for most of 2021. For the full valuation report and loan-level details, click here.

| Property Name | 933 Broadway |

| Address | 929 – 933 Broadway New York, NY 10017 |

| Outstanding Balance | $7,886,298 |

| Interest Rate | 5.51% |

| Maturity Date | 4/10/2022 |

| Most Recent Appraisal | $15,800,000 ($1,184/sf) |

| Most Recent Appraisal Date | 1/25/2012 |

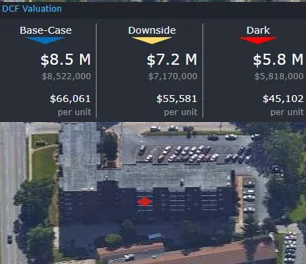

Hickory Glen Apartments

129 units, Senior Housing, Springfield, IL [View Details]

This $7.5 million loan failed to pay off at maturity on February 6, 2022. The loan transferred to special servicing in January 2022 in anticipation of the maturity default. The workout plan appears to be to sell the collateral property. The borrower had attempted to sell the senior housing facility in the months leading up to the loan’s maturity, but the few offers that came in were below the outstanding debt amount.

The loan is secured by a 129-unit senior housing facility in Springfield, IL. Occupancy at the property declined from a pre-pandemic level of 81% to approximately 56% as of September 2021. Cash flow from the property was sufficient for a DSCR of 1.54 during 2020 but the loan’s DSCR declined to below breakeven levels in 2021. For the full valuation report and loan-level details, click here.

| Property Name | Hickory Glen Apartments |

| Address | 1700 West Washington Street Springfield, IL 62702 |

| Outstanding Balance | $7,518,473 |

| Interest Rate | 5.65% |

| Maturity Date | 2/6/2022 |

| Most Recent Appraisal | $12,900,000 ($100,000/unit) |

| Most Recent Appraisal Date | 12/2/2011 |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.