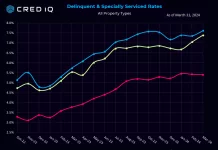

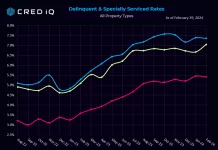

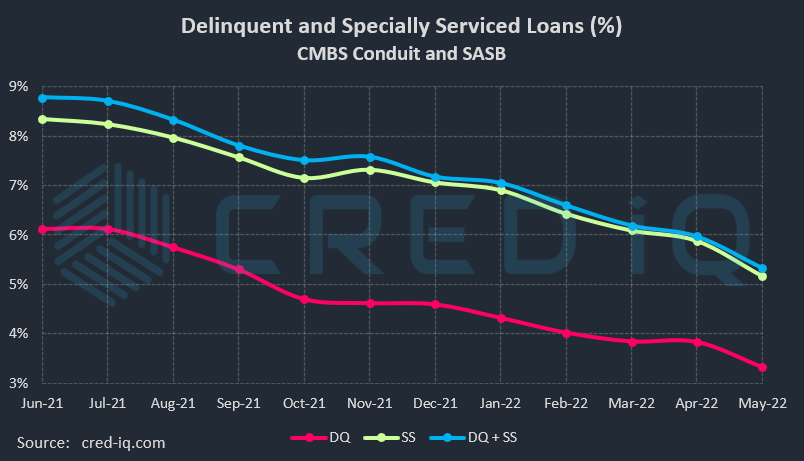

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

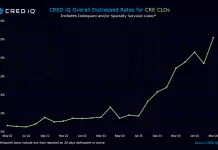

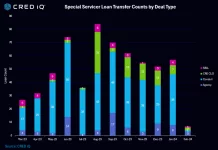

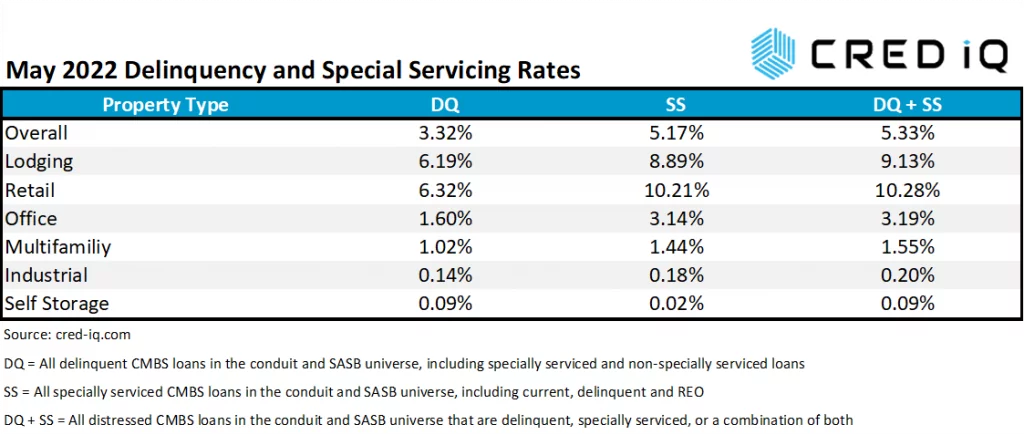

The CRED iQ overall delinquency rate for CMBS exhibited a precipitous decline during the May 2022 remittance period, marking two years of consecutive month-over-month decreases. The delinquency rate, equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $500+ billion in CMBS conduit and single asset single-borrower (SASB) loans was 3.32%, which compares to the prior month’s rate of 3.83%. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), declined month-over month to 5.17% from 5.88%. The special servicing rate has declined for six consecutive months. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 5.33% of CMBS loans that are specially serviced, delinquent, or a combination of both. The overall distressed rate declined compared to the prior month rate of 5.97%. The overall distressed rates typically track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

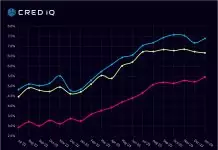

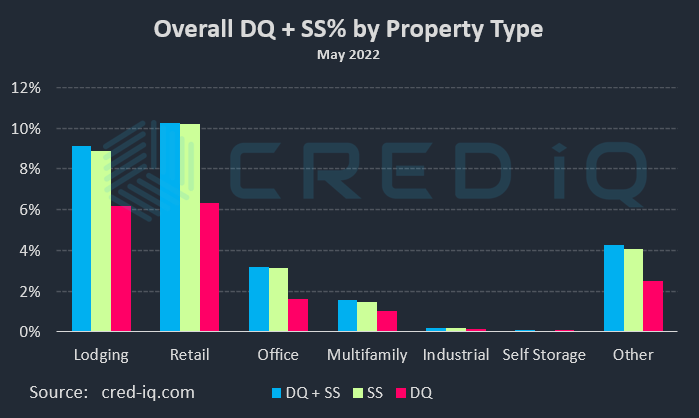

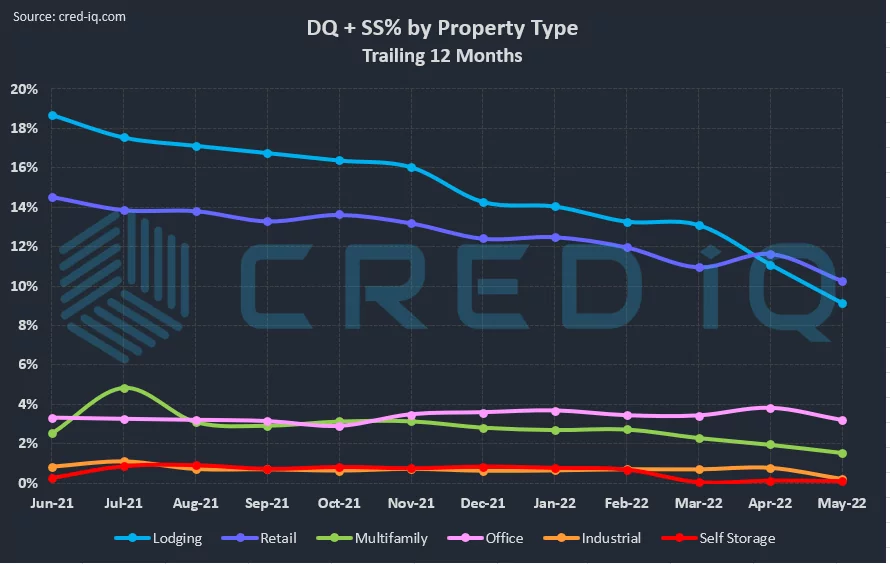

By property type, the delinquency rate declined in May for all sectors with delinquency cures totaling over $500 million by outstanding balance. As one example of a larger delinquency cure, CRED iQ’s May 2022 Market Delinquency Tracker report noted the Supor Industrial Portfolio as a new 30-day delinquency at the time; however, the late payment was a temporary occurrence and the loan paid current this month. Lodging exhibited the greatest month-over-month improvement among all property types with its delinquency rate improving to 6.19%, compared to 7.55% last month.

Retail had the highest delinquency rate (6.32%) by property type for the second consecutive month. Last month, we observed a delinquency crossover event where the percentage of delinquent lodging loans declined to a level below the delinquency rate for retail for the first time since May 2020, when the delinquency rate for lodging spiked to nearly 20%. However, the retail sector continues to get hit with new high-profile delinquencies each month. This month, $100.6 million Arbor Place Mall loan passed its scheduled May 2022 maturity date without paying off. Prior to the maturity default, the loan had been specially serviced since April 2020. Additionally, an $86.5 million loan secured by the Outlet Shoppes at Oklahoma City failed to pay off at its scheduled maturity on May 1, 2022 and transferred to special servicing on May 5, 2022.

Special servicing rates also declined across all major property types this month, exhibiting similar trend characteristics as property-specific delinquency rates. Despite the improvements in special servicing rates, the most recent reporting period was not without major credit developments in the office/mixed-use sector, especially within the Manhattan, NY market. Two notable special servicing transfers of office/mixed-use buildings occurred this month. The largest was a $235 million senior mortgage secured by 285 Madison Avenue, a 511,208-sf office tower located in the Grand Central submarket — as reported by Commercial Observer on May 23rd. Additionally, the $226.3 million 693 Fifth Avenue loan transferred to special servicing in April 2022 after ongoing issues from the departure of the collateral property’s former retail tenant, Valentino.

CRED iQ’s overall CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, overall distressed rates for all property types declined. Two of the largest loans added to the distressed category this month, both via transfers to special servicing, were the aforementioned 285 Madison Avenue and 693 Fifth Avenue. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | 285 Madison Avenue | 693 Fifth Avenue |

| Balance | $235,000,000 | $226,340,523 |

| Special Servicer Transfer Date | 4/14/2022 | 4/22/2022 |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.