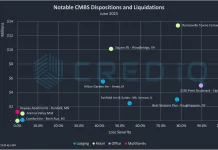

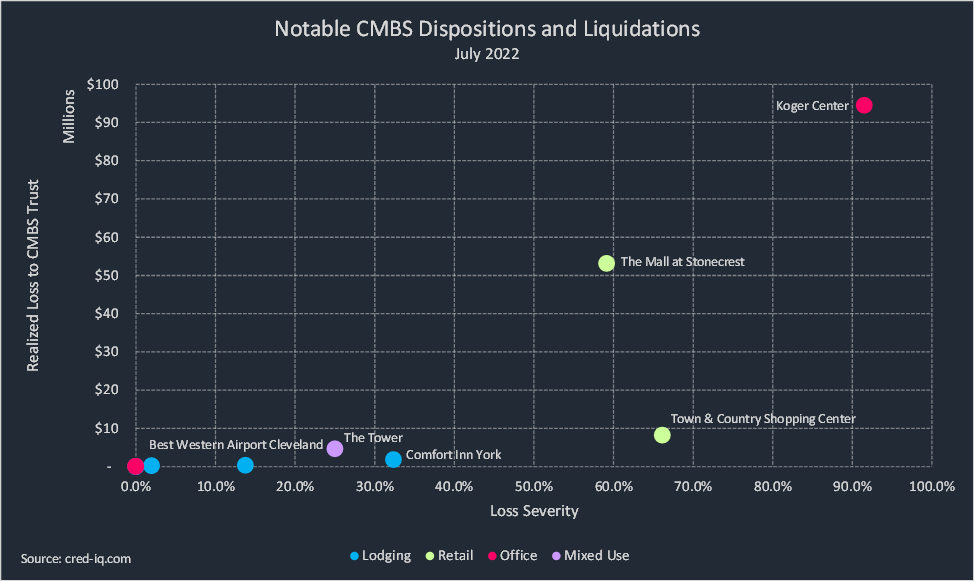

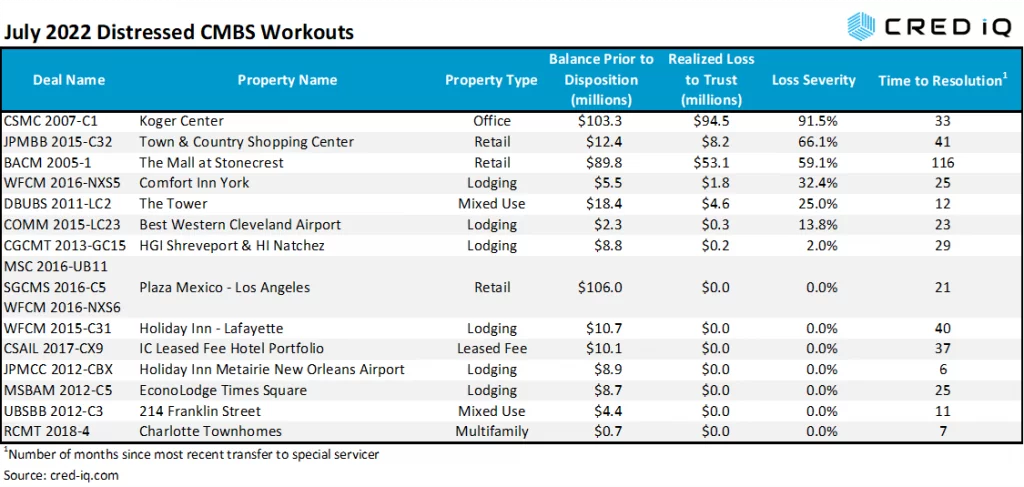

CMBS conduit and SBLL transactions incurred approximately $163 million in realized losses during July 2022 via the workout of distressed assets. CRED iQ identified 14 workouts classified as dispositions, liquidations, or discounted payoffs in July 2022. Of those 14 total workouts, half of the assets were resolved without a loss. Of the seven workouts resulting in losses, severities for the month of July ranged from 2% to 91.5%, based on outstanding balances at disposition. In total, realized losses in July were more than double the amount of realized losses in June. On a monthly basis, realized losses for CMBS conduit and SBLL transactions averaged approximately $137.8 million year-to-date.

Lodging properties accounted for half of the total number of distressed CMBS workouts this month, although only three of the loans secured by lodging properties incurred losses. Other property types with multiple distressed workouts included three distressed retail properties and two distressed mixed-use properties.

The liquidation of Koger Center represented the largest loss, by dollar amount and loss severity, among all distressed workouts this month. The liquidation alone accounted for 58% of the total realized losses for the month. Koger Center, an 854,944-sf multi-building suburban office campus in Tallahassee, FL, had been in special servicing since October 2019 and was auctioned in May 2022. Outstanding debt for the asset totaled $103.3 million and July’s liquidation resulted in a loss severity of 91.5% based on the balance at disposition.

Another notable distressed workout was The Mall at Stonecrest, which took over nine years to resolve. The 397,655-sf portion of a regional mall located 20 miles outside of Atlanta, GA secured $89.8 million in outstanding debt. A discounted payoff of the debt, funded by GeenLake Asset Management, resulted in a loss severity of 59% for the loan.

Excluding defeased loans, there was approximately $4.7 billion in securitized debt that was paid off or liquidated in July, which was a sharp decline compared to $7.8 billion in June 2022. In July, 7% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 5% in the previous month. Approximately 12% of the loans were paid off with prepayment penalties.

By property type, office had the highest total of outstanding debt pay off in July with 35% of the total by balance. Among the largest payoffs was a pair of loans secured by Manhattan office towers. A $275.3 million mortgage secured by the HSBC Tower in Midtown and a $197.8 million loan secured by 100 Church Street in Lower Manhattan both paid off at maturity on July 1, 2022.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.