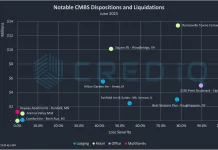

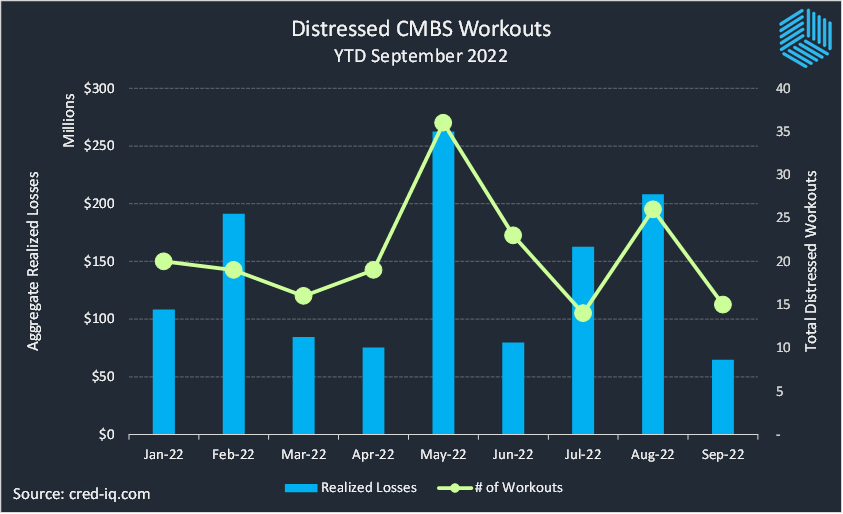

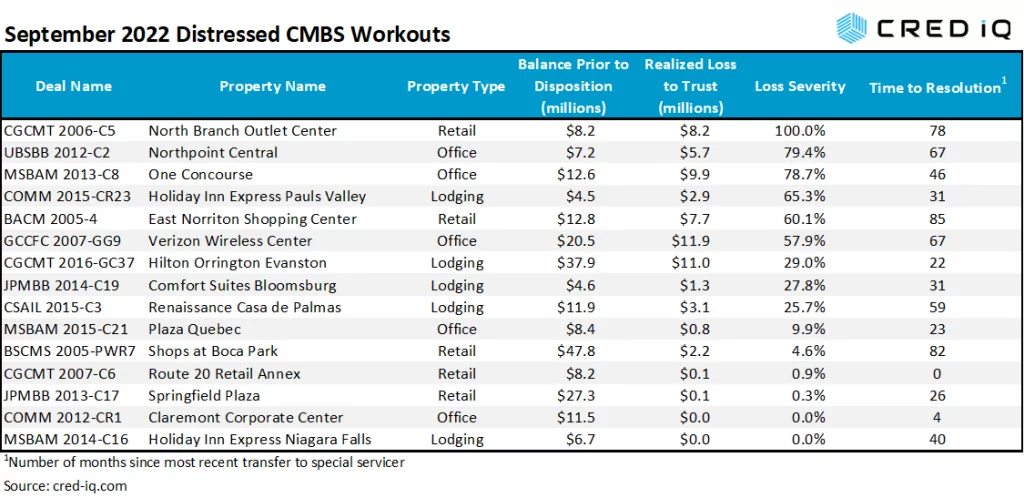

CMBS conduit transactions incurred approximately $65 million in realized losses during September 2022 via the workout of distressed assets. CRED iQ identified 15 workouts classified as dispositions, liquidations, or discounted payoffs in September 2022. Of the 15 workouts, only two of the assets were resolved without a loss. Of the 13 workouts resulting in losses, severities for the month of September ranged from less than 1% to 100%, based on outstanding balances at disposition. Aggregate realized losses in September were 69% lower than the amount of losses in August. On a monthly basis, realized losses for CMBS conduit and SBLL transactions averaged approximately $137.5 million year-to-date.

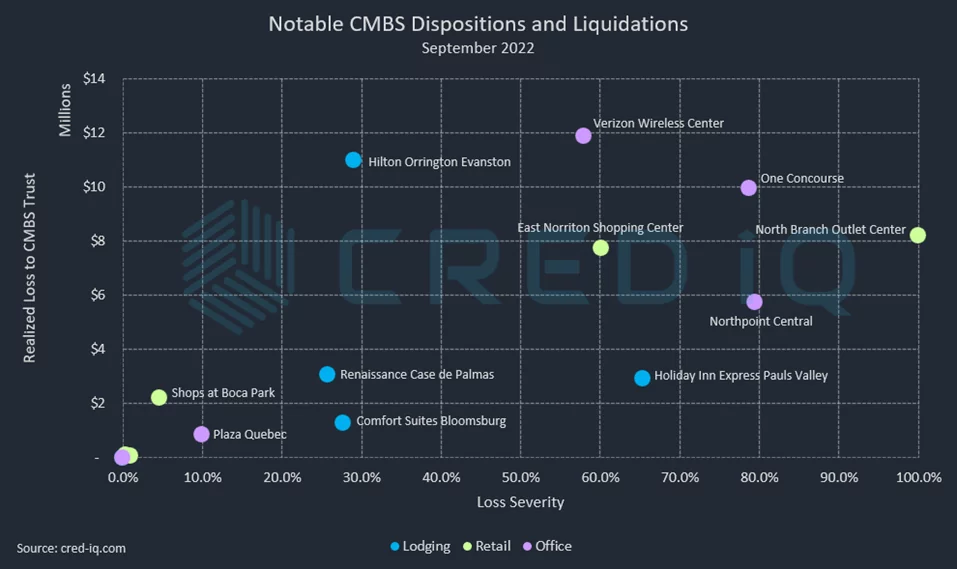

Workouts were split evenly between property types with five office, retail, and lodging dispositions apiece. Distressed workouts for office properties this month had the highest level of aggregate realized losses (over $28 million) and the highest average loss severity (56.5%). Additionally, the liquidation of an office property represented the largest individual realized loss from out observations. A former Verizon Wireless Center in Albuquerque, NM had outstanding debt totaling $20.5 million before it was liquidated in August 2022. The vacant property had been REO since May 2018 and spent more than five years in special servicing. Realized losses to the CMBS trust equaled approximately $11.9 million, equal to a 57.9% loss severity based on the asset’s outstanding balance prior to disposition.

The largest loss by severity was associated with North Branch Outlet Center, a retail property located 45 miles north of Minneapolis, MN. The 134,480-sf outlet center became REO in October 2016 and the total workout period took over six years. The asset had outstanding debt of $8.2 prior to its liquidation and was resolved with a 100% loss severity. The property was 52% occupied at the time of disposition and occupancy was unable to be materially improved throughout the workout period.

The largest workout by outstanding debt amount was the liquidation of the $47.8 million Shops at Boca Park REO asset. Shops at Boca Park is a 277,472-sf retail property located in Las Vegas, NV. The asset had been in special servicing since December 2015 and was resolved with a 4.6% loss severity based on the balance at disposition.

Excluding defeased loans, there was approximately $7 billion in securitized debt among CMBS conduit, SBLL, and Freddie Mac securitizations that was paid off or liquidated in September, which was approximately a 40% increase compared to $5 billion in August 2022. In September, 3.6% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 7.7% in the prior month. Approximately 42% of the loans were paid off with prepayment penalties.

By property type, multifamily had the highest total of outstanding debt pay off in September with 53% of the total by balance. The relatively higher percentage of multifamily debt payoff was driven by refinancing of floating rate debt. Office and retail had the next highest outstanding debt pay off with 11% of the total. Among the largest individual payoffs was a $390 million mortgage secured by Vornado’s 38,814-sf retail condo at 666 Fifth Avenue, located in Midtown Manhattan.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.