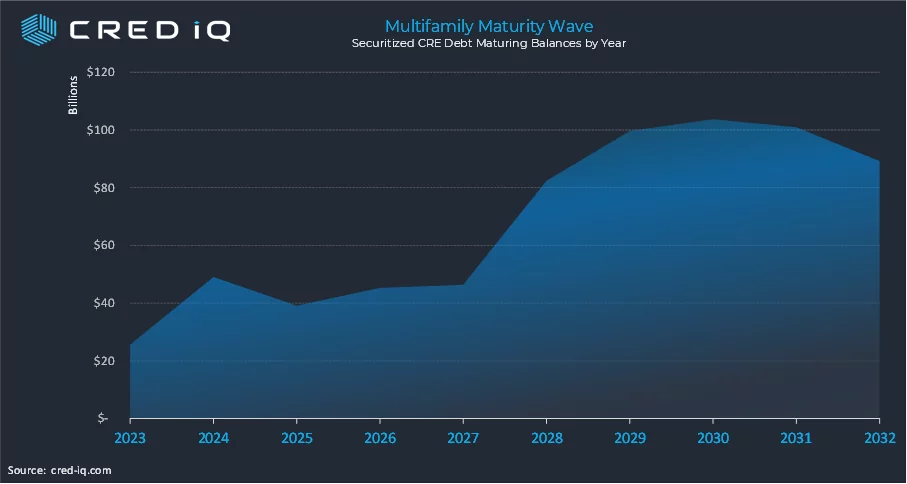

CRED iQ is tracking approximately $25 billion of securitized debt secured by multifamily properties that is scheduled to mature in 2023. Exploring upcoming CRE loan maturities can be beneficial for constituents in the commercial real estate industry looking to make more informed decisions to identify potential opportunities for growth. Lenders and mortgage originators can develop a better understanding of market positions while capital providers and distressed investors can dial in on targeted deployments.

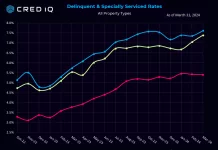

Serving as a more extensive analysis and supplement to CRED iQ’s year-end 2023 CRE Maturity Outlook report, we took the opportunity to focus on near-term maturing loans with multifamily collateral. Although some multifamily metrics, such as rent growth, have been softening, multifamily still remains among the top-performing CRE property types in 2023. CRED iQ’s distressed rate for multifamily CMBS, which includes both delinquent and special serviced loans, was 2.72%, which was lower than retail, lodging, and office.

Altogether, CRED iQ identified more than 2,300 multifamily loans with a 2023 maturity date, totaling approximately $25 billion by aggregate balance. Outstanding debt figures comprise all securitized mortgages in CRED iQ’s $2 trillion commercial real estate database, including CMBS, Freddie Mac, Fannie, Mae, and Ginnie Mae loans. Looking ahead, the multifamily maturity wave picks up in 2024 with $49 billion in scheduled maturities. Aggregate scheduled multifamily maturities remain relatively flat between $30 and $40 billion from 2025 through 2027 and then surge to north of $80 billion in 2028, towards $100 billion a year by 2029.

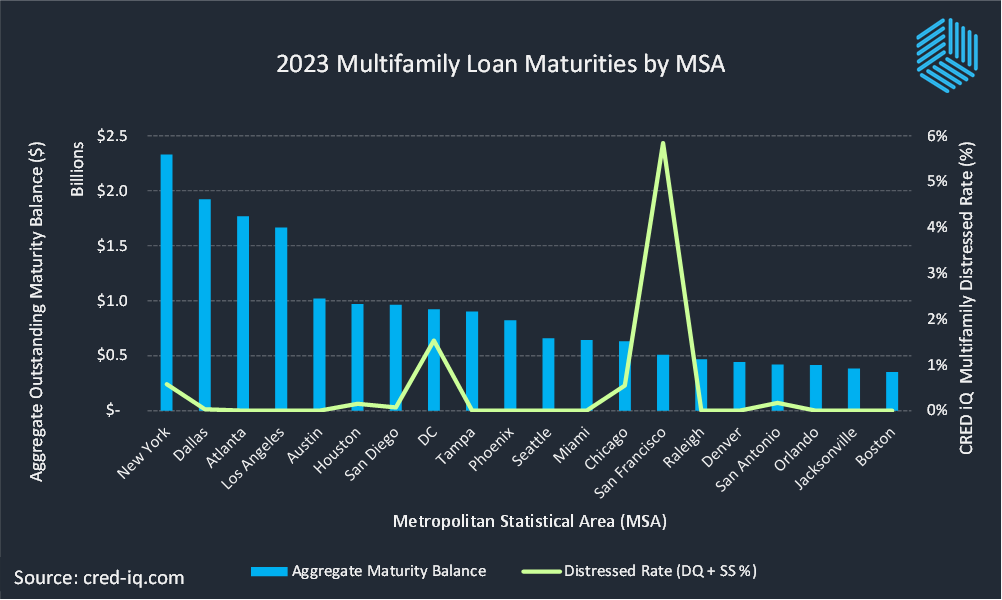

Stratifying 2023 multifamily loans by the underlying properties’ geographical area gives a sense of which markets have elevated opportunity for refinancing activity. Examining the Top 20 markets with the highest amount of multifamily debt coming due in 2023, we observed that New York City leads all Metropolitan Statistical Areas (MSAs) with $2.3 billion. The NYC MSA accounts for 9% of 2023 multifamily maturities. The Dallas-Fort Worth MSA comes in a close second-place with $1.9 billion of multifamily mortgage debt that is scheduled to mature in 2023. Other MSAs with more than $1 billion of multifamily loans due to mature in 2023 include Atlanta, Los Angeles, and Austin.

Overlaying distressed rates for each market, we find that 12 of the Top 20 markets with 2023 multifamily maturities, or 60% in total, have nominal levels of distress. Only two of these markets – Washington, DC and San Francisco – have distressed rates greater than 1%

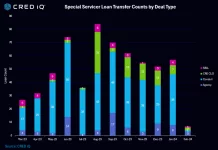

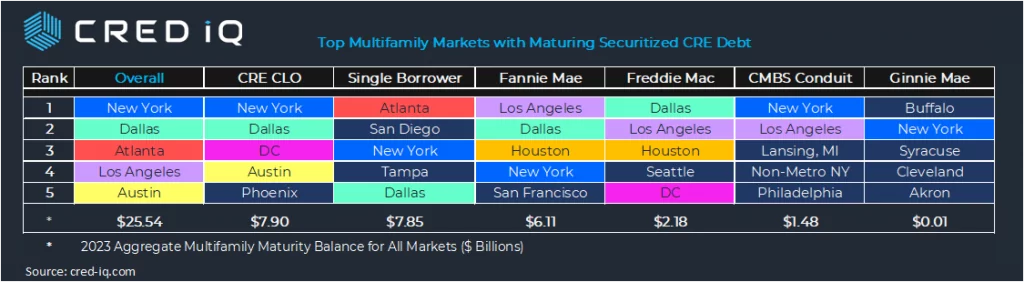

Finally, we also cross-paneled 2023 multifamily loan maturities by securitization type and total maturing debt by market. This table gives a view of which markets have the highest outstanding maturing balances in 2023 by securitization vehicle. For example, the majority of 2023 multifamily loan maturities are securitized in CRE CLOs and Single-Borrower Large-Loan transactions. NYC is the market with the highest amount of maturing debt among CRE CLOs, but the Atlanta MSA has the highest multifamily maturing debt amount for Single-Borrower Large-Loan securitizations. It is also worth noting that most loans in the CRE CLO and Single-Borrower subsets have embedded maturity extension options that can push refinancing beyond 2023. Los Angeles claims the highest ranking for 2023 multifamily loan maturities for Fannie Mae securitizations and Dallas-Fort Worth has the highest rank for Freddie Mac securitizations.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.