Tighter Spreads, Stubborn IO, and a Market in Transition

Rate Compression and Underwriting Trends

The four most recent conduit CMBS transactions collectively represent $3.58 billion across 170 loans. The most striking sequential trend is coupon compression: BMARK 2026-V21 priced at a weighted average of 6.54%, while BMARK 2026-V20 and BMO 2026-5C14 tightened to 6.35% and 6.33% — a 21 basis point decline in consecutive pricings reflecting improved CMBS spread technicals entering 2026. BMARK 2026-B42, a small-balance conduit averaging $11.8M per loan, priced tightest at 6.12% given its lower-risk net-leased and self-storage collateral mix.

Leverage and Coverage

LTV ratios across the three large-loan deals cluster tightly between 57.7% and 59.6% — conservative relative to pre-GFC norms. BMARK 2026-B42 achieves an even lower 50.1% LTV given its small-balance profile. NCF DSCR improves sequentially from 1.84x (V21) to 2.01x (BMO 5C14), while NOI debt yield — the most rate-neutral measure of collateral quality — rises from 12.55% to 13.04%, signaling strengthening cash flow underwriting even as coupons decline.

IO Structures and Structural Risk

Interest-only has become the structural default in large-loan conduit CMBS, with 85–97% of loans by count carrying full IO terms across V21, V20, and BMO 5C14. The absence of principal amortization means a substantial balloon-refinancing wall is forming for 2030–2031 across all four deals. BMARK 2026-B42’s more modest 48% IO share reflects its different collateral profile, though even its partial-IO loans average 98-month IO periods.

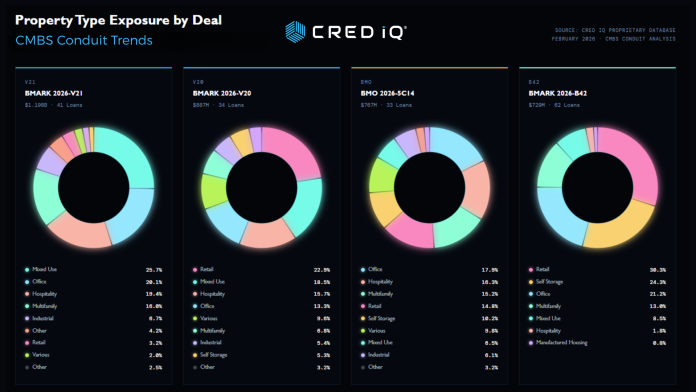

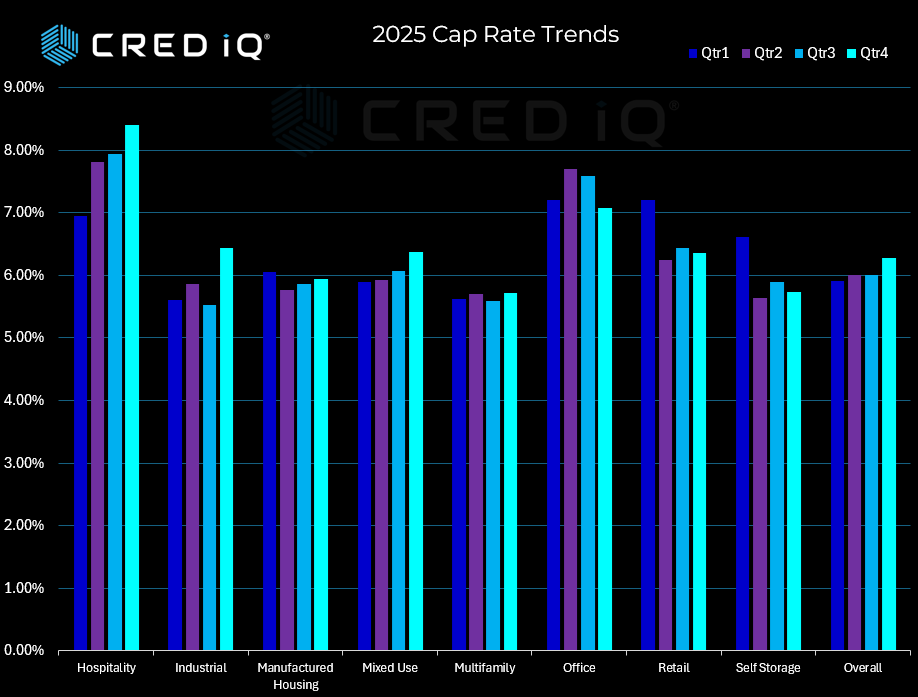

Collateral and Property Type Exposure

Office retains meaningful exposure across all four deals (13–21% of balance), anchored by stabilized, creditworthy assets. Hospitality commands 15–19% in the large-loan trio, led by large resort collateral. Retail dominates B42 (30.3%) via net-lease portfolios, while multifamily remains modest at 6–16% as agency channels absorb the bulk of apartment financing. V21 carries the heaviest mixed-use allocation at 25.7%. Key watch item: the 2030–2031 IO maturity wall across all four deals will test both property fundamentals and capital market conditions.

| Deal | Balance | Rate | LTV | DSCR | NOI DY | NCF DY | Full IO% |

| BMARK 2026-V21 | $1,198M | 6.54% | 59.6% | 1.84x | 12.6% | 12.0% | 85.4% |

| BMARK 2026-V20 | $887M | 6.35% | 58.4% | 1.96x | 12.8% | 12.4% | 85.3% |

| BMO 2026-5C14 | $767M | 6.33% | 57.7% | 2.01x | 13.0% | 12.4% | 97.0% |

| BMARK 2026-B42 | $729M | 6.12% | 50.1% | 2.57x | 17.6% | 17.0% | 48.4% |

Key Takeaways for Investors and Lenders

These four deals collectively signal a CMBS market pricing in rate relief, maintaining underwriting discipline, and selectively diversifying collateral. For investors, coupon compression from 6.54% to 6.33% reflects tighter spreads — but must be weighed against the near-elimination of amortization protection. For lenders, NOI debt yield consistency in the 12.5–13.0% band across large-loan deals signals a stable origination framework. The critical risk to monitor: the 2030–2031 IO maturity wall across all four deals that will test both property fundamentals and broader capital market conditions.

About CRED iQ

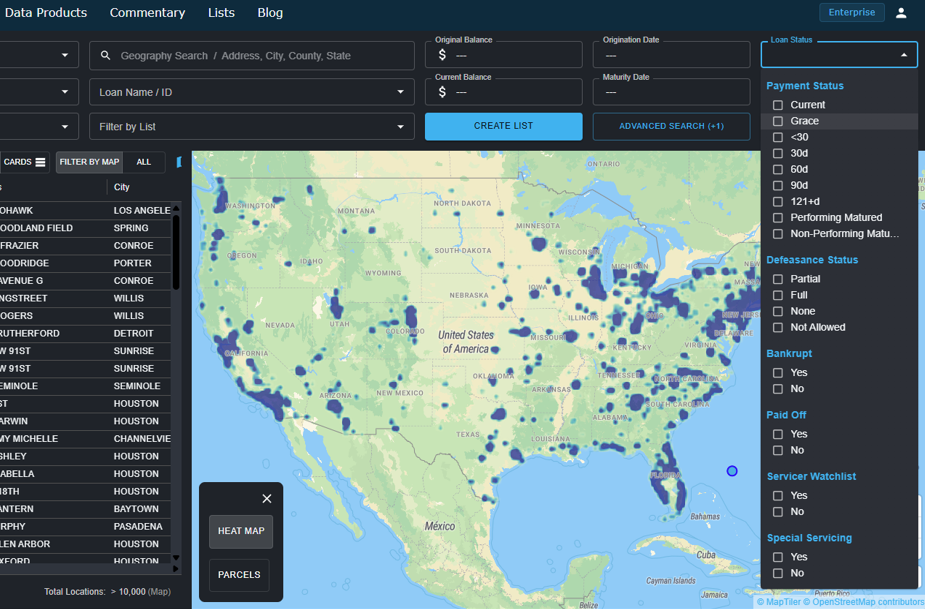

CRED iQ is a leading commercial real estate (CRE) data and analytics platform designed to bring transparency, structure, and actionable intelligence to complex CRE debt markets. The platform aggregates and normalizes loan- and property-level data across CMBS, CRE CLO, Agency, and private debt, enabling investors, lenders, servicers, and advisors to analyze risk, performance, and opportunities within a single, unified environment.

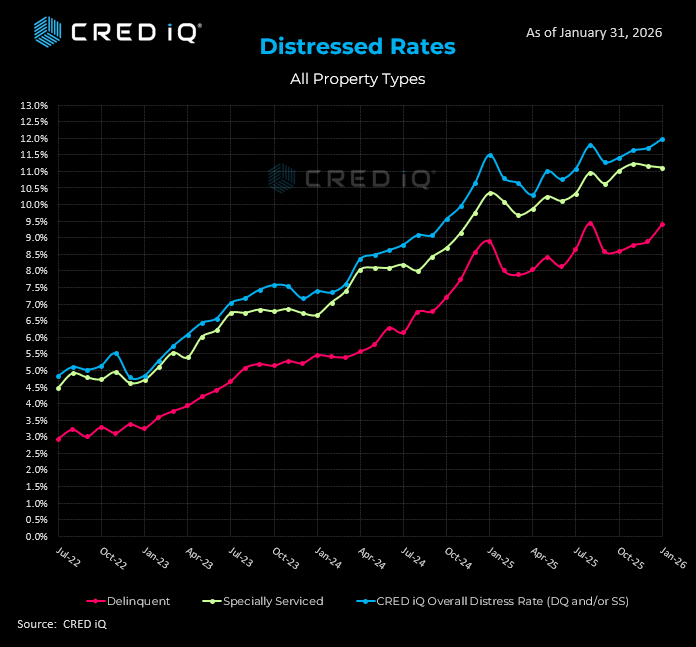

CRED iQ specializes in advanced analytics for loan surveillance, distress tracking, special servicing activity, and workout strategies, with a particular focus on identifying early warning signals and resolution outcomes across the CRE lifecycle. By combining institutional-grade data infrastructure with AI-driven insights, CRED iQ helps market participants move beyond static reporting toward dynamic, forward-looking decision-making.

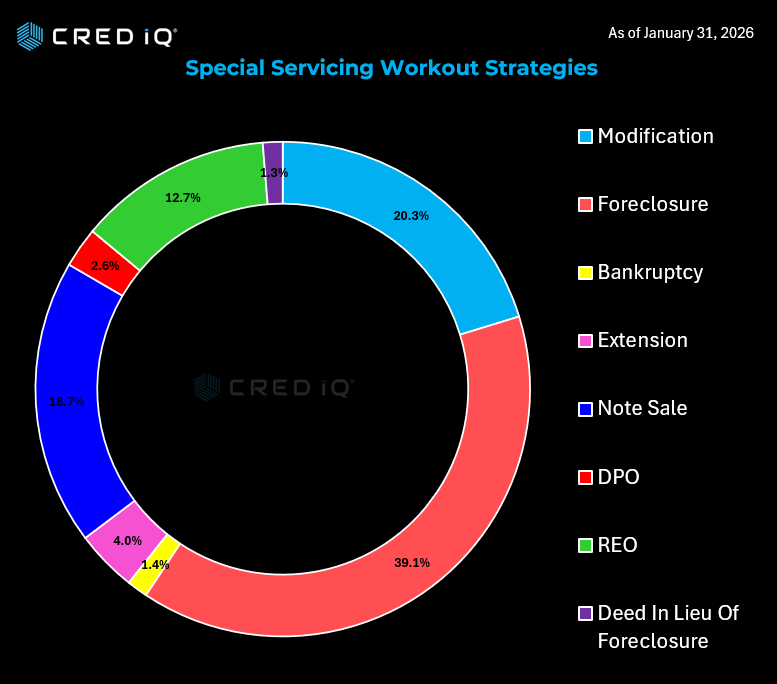

Users leverage CRED iQ to monitor delinquency trends, track foreclosures and REO pipelines, evaluate modification and extension activity, and assess portfolio exposure at the property, sponsor, and market level. The platform is built for speed, scalability, and precision—reducing manual research while increasing confidence in investment, underwriting, and asset management decisions.

Trusted by leading institutional investors, lenders, and advisory firms, CRED iQ delivers the data foundation required to navigate today’s evolving CRE market. For professionals seeking a comprehensive commercial real estate analytics platform with deep coverage of distressed debt, special servicing, and AI-powered insights, CRED iQ provides a differentiated, execution-ready solution.