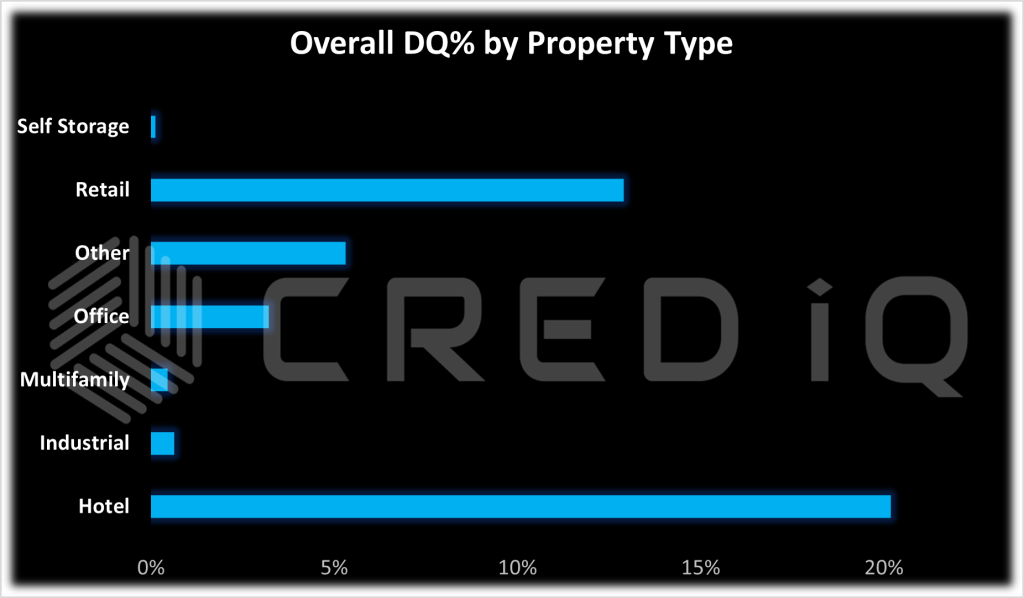

The overall delinquency rate declined compared to the prior month, which marks a full year of downward movement starting from its peak in June 2020. Lodging continues to be the sector leader in delinquent loans with many markets slow to emerge out of pandemic-induced distress. The lodging delinquency rate declined for a majority of the Top 50 MSAs this month but increases in payment defaults are still notable in certain markets such as Bridgeport, CT and Cleveland, OH. Retail continues to move the needle as well, weighted heavily by regional malls, as is the case in the Tucson, AZ market, which had the largest month-over-month % change in delinquency. The two largest retail properties in the MSA are distressed.

CRED iQ monitors market performance for nearly 400 MSAs across the United States. Below is a summary of the default rates for the 50 largest metros segmented by property type. For these 50 MSAs, the highest delinquency was in Minneapolis, followed by Louisville and New Orleans. The Tucson retail market saw the largest month-over-month increase in delinquency. Allentown, Pennsylvania reported the lowest default rate among the 50 MSAs. The most significant month over-month decline in delinquency was in the Memphis market.

For the full report, download here:

By property type, the hotel and retail sectors remain the largest contributors to the delinquency percentages for the majority of these statistical areas. Loans backed by self-storage, multifamily, and industrial facilities posted the lowest delinquency rates for most of these markets.