CRED iQ Loan Analytics Reveal Property Type Divergence as Overall Market Reprices

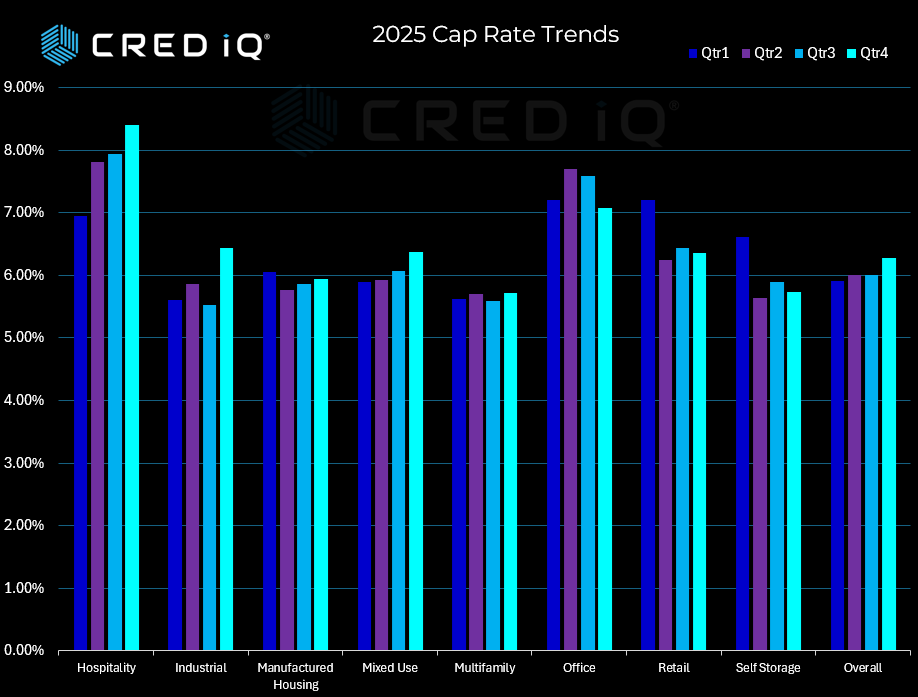

Commercial real estate cap rates exhibited a steady upward trajectory throughout 2025, according to CRED iQ’s comprehensive loan analytics, with overall market cap rates expanding from 5.91% in Q1 to 6.28% by year-end. This 37-basis-point increase reflects lenders’ ongoing recalibration of risk premiums amid a shifting economic landscape and evolving capital markets environment.

The hospitality sector experienced the most pronounced expansion, with cap rates climbing from 6.95% in Q1 to 8.40% by Q4—a substantial 145-basis-point increase that underscores persistent concerns about revenue volatility and operational sensitivity to economic conditions. This dramatic widening positions hospitality as the highest-cap-rate asset class by year-end, surpassing even office properties.

Office properties, while maintaining elevated cap rates throughout the year, showed relative stability within a tight 62-basis-point range, finishing 2025 at 7.07%. This suggests that much of the sector’s repricing may have already occurred in prior years, with lenders now exhibiting more consistent underwriting standards despite ongoing concerns about remote work impacts and space utilization.

In contrast, multifamily properties demonstrated remarkable resilience, maintaining the tightest cap rate band among major property types. Starting at 5.63% in Q1 and finishing at 5.71% in Q4, multifamily’s mere 8-basis-point expansion reflects sustained investor confidence in residential fundamentals and the asset class’s defensive characteristics.

Industrial properties, despite their recent outperformance cycle, showed notable quarter-to-quarter volatility, particularly the sharp 92-basis-point jump from Q3’s 5.52% to Q4’s 6.44%. This late-year expansion may signal lender caution as warehouse demand normalizes following the e-commerce boom years.

Retail properties bucked conventional wisdom, actually tightening from Q1’s 7.20% to finish the year at 6.36%, suggesting renewed confidence in well-positioned shopping centers and necessity-based retail formats. Self-storage also demonstrated strength, compressing from 6.61% to 5.73%, reflecting the asset class’s counter-cyclical appeal and strong operational performance.

These trends highlight an increasingly bifurcated lending landscape where property-specific fundamentals and operational resilience are driving underwriting decisions more than broad market sentiment, creating distinct opportunities across the commercial real estate spectrum.

About CRED iQ

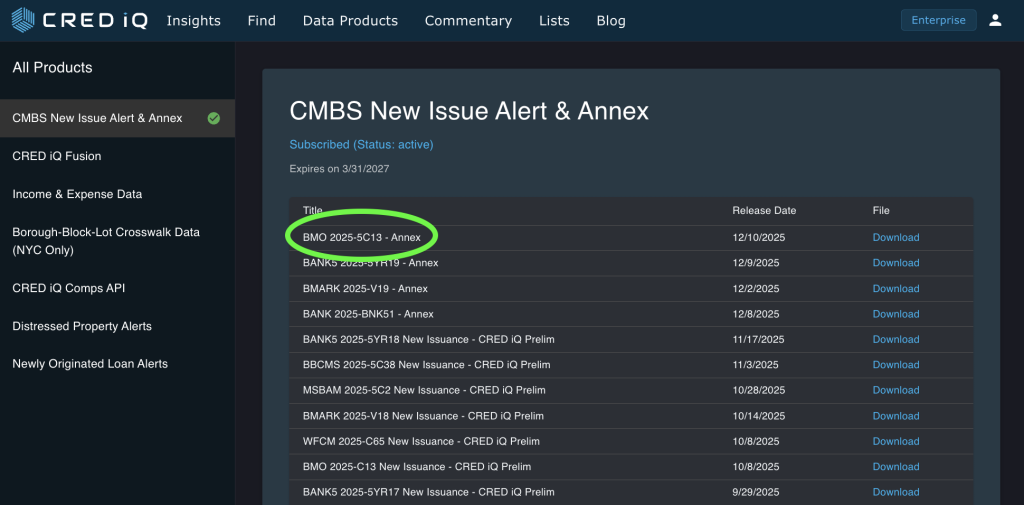

CRED iQ is a leading commercial real estate (CRE) data and analytics platform designed to bring transparency, structure, and actionable intelligence to complex CRE debt markets. The platform aggregates and normalizes loan- and property-level data across CMBS, CRE CLO, Agency, and private credit, enabling investors, lenders, servicers, and advisors to analyze risk, performance, and opportunities within a single, unified environment.

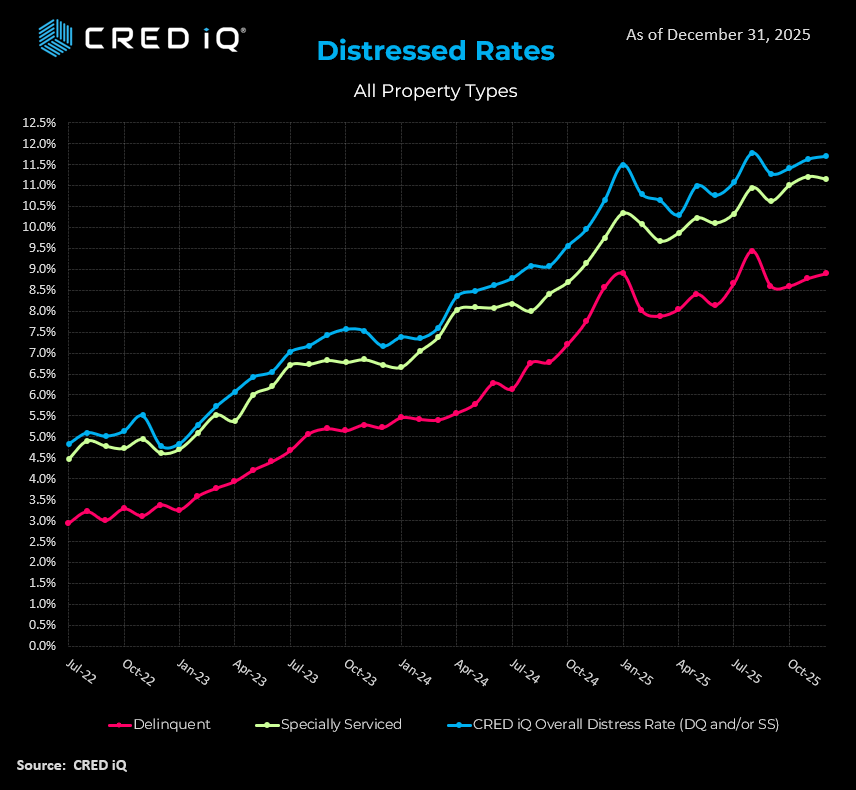

CRED iQ specializes in advanced analytics for loan surveillance, distress tracking, special servicing activity, and workout strategies, with a particular focus on identifying early warning signals and resolution outcomes across the CRE lifecycle. By combining institutional-grade data infrastructure with AI-driven insights, CRED iQ helps market participants move beyond static reporting toward dynamic, forward-looking decision-making.

Users leverage CRED iQ to monitor delinquency trends, track foreclosures and REO pipelines, evaluate modification and extension activity, and assess portfolio exposure at the property, sponsor, and market level. The platform is built for speed, scalability, and precision—reducing manual research while increasing confidence in investment, underwriting, and asset management decisions.

Trusted by leading institutional investors, lenders, and advisory firms, CRED iQ delivers the data foundation required to navigate today’s evolving CRE market. For professionals seeking a comprehensive commercial real estate analytics platform with deep coverage of distressed debt, special servicing, and AI-powered insights, CRED iQ provides a differentiated, execution-ready solution.