This week, CRED iQ continued to focus on distressed commercial real estate collateral located in Cleveland, OH and calculated real-time valuations for 5 properties within the MSA that have recently transferred to special servicing, including the tallest building in the state of Ohio. The August 2021 CRED DQ Report highlighted Cleveland as a market with one of the three-highest delinquency rates in the US, which opened the opportunity to take a deeper dive into a few of the assets behind the elevated level of distress. The CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). For full access to the valuation reports as well as full CMBS loan reporting, including detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

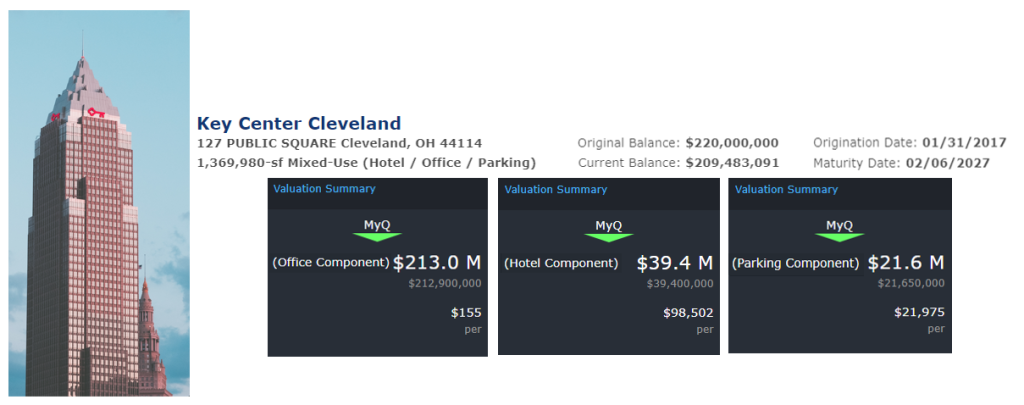

Key Center Cleveland

(Key Tower/Marriott Cleveland Downtown/Key Center Parking Garage)

1.4 million sf/400 keys/985 spaces, Mixed-Use (Office/Hotel/Parking), Cleveland, OH 44114

This $209.5 million loan transferred to special servicing in October 2020 due to imminent monetary default, which the borrower attributed to adverse impacts from COVID-19. The loan is secured by fee interests in a 1.4 million-sf Class-A office tower (Key Tower) and a 400-key hotel (Marriott Cleveland Downtown) as well a leasehold interest in a 985-space subterranean parking garage located under the adjacent Memorial Fountain (Key Center Parking Garage). All three structures are located in the CBD of Cleveland, on the northern corner of Cleveland Public square.

On an aggregate basis, net cash flow for the properties declined from $28.9 million in 2019 to $21.0 million in 2020, resulting in a DSCR of 1.32. However, the DSCR is below breakeven when factoring in $42.5 million of mezzanine debt, which was funded by Apollo Commercial Real Estate Finance. The decline in net cash flow during 2020 was primarily caused by a loss of revenue from the hotel and parking components of the collateral during the early stages of the pandemic. Base rents from the office component remained stable in 2020; although, servicer commentary noted the building’s namesake tenant, Key Bank, contracted its space by about 42,000 sf. Key Bank now leases about 18% of the property’s GLA and still has two more contraction options in the coming years, totaling about 60,000 sf.

Despite the distressed nature of the loan, the office tower remains well-positioned in the submarket. Reserves for the loan, including funds for leasing, are relatively healthy, totaling $10.5 million and CRED iQ has observed other tenants in the submarket vacate inferior properties in favor of Key Tower. Just last week, our WAR Report highlighted law firm Littler Mendelson vacating 1100 Superior Avenue to move into Key Tower. The borrower appears to be requesting temporary payment relief, as evidenced by servicer commentary. For the full valuation report and loan-level details, click here.

DoubleTree by Hilton – Cleveland OH

379 keys, Full-Service Hotel, Cleveland, OH 44114

This $26.6 million loan transferred to special servicing in October 2019 due to monetary default. The loan is secured by a full-service hotel that operates as a DoubleTree by Hilton via a franchise agreement that expires in November 2026. As a pre-pandemic transfer, the property’s operational struggles can be traced back to competition from newer, higher quality lodging projects in the CBD submarket, including the 600-key Hilton Cleveland Downtown. The borrower appears to have been cooperating with the placement of a receiver and attempted transition of the title to Greystone, the loan’s special servicer. However, a foreclosure moratorium in 2020 and ongoing labor issues with hotel employees have delayed a title transfer, which may make a note sale more plausible as a workout solution. For the full valuation report and loan-level details, click here.

DoubleTree Beachwood

404 keys, Full-Service Hotel, Beachwood, OH 44122

This distressed hotel opportunity has outstanding debt of $24.1 million and has been with the special servicer since April 2019. The property is a 404-key full-service hotel, and similar to the property highlighted above, operates as a DoubleTree by Hilton via a franchise agreement that expires in 2027. Torchlight, as special servicer, acquired title to the property on December 4, 2020 via a deed-in-lieu of foreclosure agreement. Our analysis indicates that the lodging facility is configured with an excessive quantity of rooms for its market, which has been a main driver behind the property’s operational struggles as well as an onerous franchise fee that has been reported to be over $1.1 million. Updated commentary indicates the property is actively being marketed for sale. For the full valuation report and loan-level details, click here.

Flats East Bank Phase I

150 keys, Mixed-Use (Hotel/Retail), Cleveland, OH 44113

This $22.7 million loan transferred to special servicing on June 1, 2020 due to imminent monetary default. The loan is secured by a mixed-use property that includes a 150-key hotel, 33,166 sf of retail space and a 174-space parking lot. The hotel operates under a franchise agreement with Sheraton’s Aloft brand that expires in June 2033. This Phase I property is part of a larger multi-phase development that includes other distressed properties as well. Phase II of the development, which included multifamily and retail uses, was also distressed in early 2021, but the mortgage loan secured by Phase II was ultimately purchased by a subordinate debtholder.

The Phase I property began having issues in 2017 when the largest retail tenant, EB Fitness, vacated its 16,071-sf suite. A new fitness tenant, Browns Fit, signed a lease to occupy the vacant space in 2019. Shortly after, the effects of COVID-19 began to take its toll on the property, especially the hotel component. The latest servicer commentary indicated Rialto, as special servicer, is in workout negotiations with the borrower. The viability of the hotel component is a key factor for the property because it has a deed restriction related to past environmental issues that prohibits residential use. For the full valuation report and loan-level details, click here.

The IMG Building

232,908 sf, Office, Cleveland, OH 44114

This $16.2 million loan transferred to special servicing on March 5, 2019 due to delinquency. The loan is secured by a Class-C office property, located in the shadow of One Cleveland Center within the CBD of Cleveland. The borrower has not provided updated occupancy or financial figures since loan origination; however, CRED iQ estimates current occupancy to be approximately 68%. According to Crain’s Cleveland Business, the property’s second largest tenant, MAI Capital Management, is vacating in favor of a suburban office location. Additionally, the third-largest tenant Bellwether Enterprise moved across the street to the aforementioned One Cleveland Center. The two tenants accounted for 20% of the property’s GLA. The servicer has filed for foreclosure and the borrower is contesting those actions. For the full valuation report and loan-level details, click here.

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. For full access to our loan database and valuation platform, sign up for a free trial below: