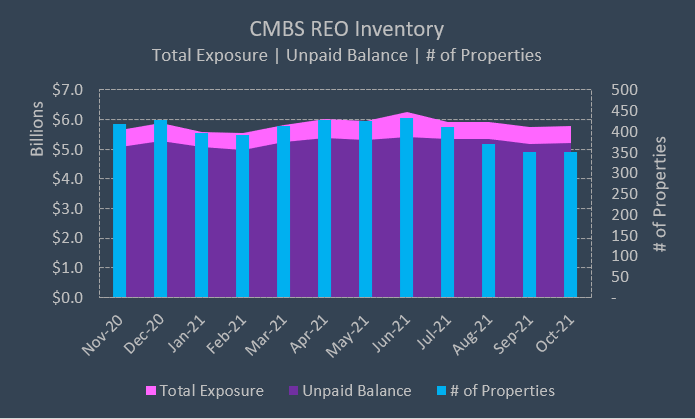

CRE professionals are in the midst of the holiday season and while some may reminisce about the glory days of the Sears and JCPenney holiday catalogs — others are closing deals for now-vacant Sears and JCPenney boxes. CRED iQ welcomes the CRE community in finding their next gift (opportunity) with an examination of commercial real estate properties that are REO within CMBS. As of October 2021, there were approximately 350 properties in CMBS transactions that are REO. Unpaid balances for these properties total approximately $5.2 billion. However, distressed assets typically have additional amounts due in terms of property protection and debt service advances by servicers, which in this case totals about $584 million, for a total exposure of approximately $5.8 billion. These REO assets have a finite holding period and will be sold to market at some point in the future. Special servicers, on behalf of CMBS trusts, are generally required to sell REO assets by the end of the 3rd year following a title transfer but may be granted extensions under certain conditions. Circumstance provides opportunity for distressed investors, especially with a notable increase in volume of distressed CRE opportunity funds that have seeded in 2021.

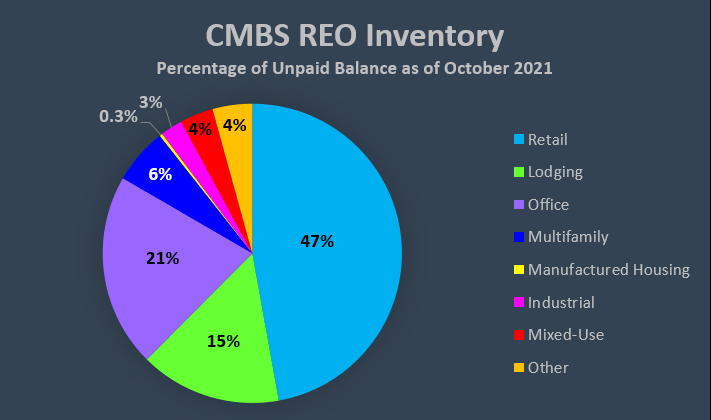

The vast majority of CMBS REO inventory is retail, accounting for 47% of the aggregate outstanding debt for all REO properties. Office, 21% of the total, and Lodging, 15% of the total, round out the top 3 property types. Akin to a Teddy Ruxpin or limited-edition Squishmallow, Manufactured Housing and Industrial REO assets are positioned as the hard-to-get property types with limited inventory. There were only 3 manufactured housing properties and 11 industrial properties that were REO.

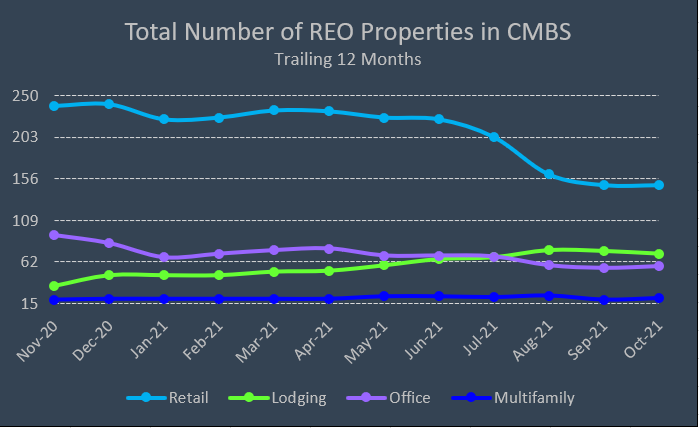

From a historical perspective, the total number of REO assets has declined by 5% over the prior 12 months. The decline in the number of REO assets was led by Retail which saw a net reduction of about 60 assets over the course of a year. However, as the number of retail assets has been trending downwards, the total number of REO hotels has more than doubled in the past year — increasing by a factor of 2.4x. The number of office properties has declined year-over-year as well, exhibiting a 40% decrease. Despite reductions in the number of REO assets, the total outstanding debt on REO has increased by approximately 13%. The most logical explanation is that REO assets with smaller unpaid debt amounts are also generally smaller basis properties that can attract a wider range of acquisition prospects and more efficient closings. High basis assets, especially those in severe distress or in need of CapEx and repositioning, with large outstanding debt amounts, may have more limited buyer pools. This is most evident with Retail REO inventory, which had its outstanding balance increase by $201.6 million, despite approximately 60 fewer assets. Smaller community centers and strip centers were liquidated while larger basis regional malls remained unsold with limited buyer pools.

Of the largest REO assets by total exposure, six out of 10 are regional malls. The remaining 4 are office properties. The highlighted regional malls have been REO for an average of just under 3 years — the title to Ingram Park Mall in San Antonio, TX was most recently conveyed to the special servicer in April 2021. Portals I, an office property in Washington, DC, has been REO for 5 and a half years, which is the longest among the Top 10. Value depreciation of these assets may be the most noticeable at first glance. Seven of the 10 properties have been re-appraised and the average decline in value compared to loan origination was 70%, a glaring example of the severity of distress present with REO assets. Looking ahead, there are over 350 properties totaling close to $5.7 billion that are delinquent with a workout strategy of foreclosure cited by servicers. These properties serve as the potential pipeline for additional REO assets; however, workouts of CRE properties are very fluid and often do not result in the acquisition of title by special servicers and lenders. Regardless, distressed investors should not limit their opportunities and explore these properties as additional options. Happy holiday hunting!

Largest REO Properties in CMBS by Total Exposure

| Name | Address | Property Type | Unpaid Balance | Total Exposure | Years REO | Appraisal Value at Loan Origination | Most Recent Appraisal Value | Decline in Appraisal Value |

| Town Center at Cobb | 400 Ernest West Barrett Parkway Kennsesaw, GA 30144 | Regional Mall | $172,217,882 | $179,156,107 | 1.5 | $322,000,000 | NAV | NAV |

| Portals I | 1250 Maryland Avenue Southwest Washington, DC 20024 | Office | $155,000,000 | $158,272,544 | 5.5 | $235,000,000 | $136,700,000 | -41.8% |

| One AT&T Center | 909 Pine Street St. Louis, MO 63101 | Office | $107,147,765 | $125,775,049 | 4.7 | $207,260,000 | $9,200,000 | -95.6% |

| Ingram Park Mall | 6301 Northwest Loop 410 San Antonio, TX 78238 | Regional Mall | $119,627,225 | $119,627,225 | 0.6 | $215,400,000 | NAV | NAV |

| Koger Center | 2540 W Executive Circle Tallahassee, FL 32301 | Office | $103,271,007 | $112,722,443 | 0.7 | $145,000,000 | $39,800,000 | -72.6% |

| University Mall | 155 Dorset Street South Burlington, VT 05403 | Regional Mall | $92,000,000 | $97,440,784 | 6.4 | $116,300,000 | $45,200,000 | -61.1% |

| Florence Mall | 2028 Florence Mall Florence, KY 41042 | Regional Mall | $89,404,415 | $91,665,476 | 1.4 | $158,600,000 | NAV | NAV |

| Three Westlake Park | 550 Westlake Park Boulevard Houston, TX 77079 | Office | $76,651,330 | $91,375,698 | 3.1 | $121,150,000 | $25,175,000 | -79.2% |

| Rushmore Mall | 2200 N Maple Ave Rapid City, SD 57701 | Regional Mall | $89,000,000 | $89,109,564 | 3.1 | $117,500,000 | $23,500,000 | -80.0% |

| Killeen Mall | 2100 South W S Young Drive Killeen, TX 76543 | Regional Mall | $82,000,000 | $82,267,263 | 4.5 | $102,500,000 | $39,100,000 | -61.9% |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.