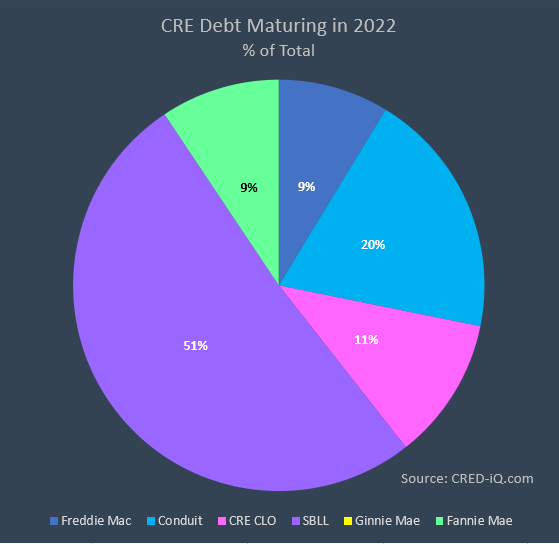

This week, CRED iQ looks to the year ahead in commercial real estate and examines commercial mortgages with maturity dates scheduled in 2022. CRED iQ’s database has approximately $97 billion in commercial mortgages that are scheduled to mature in 2022, including loans securitized in CMBS conduit trusts, single-asset single-borrower deals (SASB), and CRE CLOs, as well as multifamily mortgages securitized through government-sponsored entities. The SASB subset of nearly $50 billion comprises the majority of scheduled maturities in 2022; however, approximately 83% of that balance is tied to floating-rate loans that have extension options available, providing no assurances of refinancing or new origination opportunities.

For this charting session, we focus on 2022 maturing loans that have been securitized in CMBS conduit transactions, which totals approximately $19 billion. This group of loans provides for a more diverse observation of loans across property type, class, and geographic location. Breaking down 2022 maturities by property type, retail has the highest concentration with 38% of outstanding debt and is followed by office with 24%. Lodging has the third-highest concentration with 14% of the outstanding balance of scheduled maturities in 2022. Property type concentrations for 2022 maturities shadow the makeup of 2012 vintage conduits, which were only a few years removed from the great financial crisis and consist primarily of 10-year mortgages that are coming due this year. Within 2012 vintage conduit deals, concentrations in multifamily loans were smaller due to the post-crisis re-emergence of Freddie Mac securitizations, which provided for greater volume in retail, office, and lodging loans.

From a monthly perspective, the second half of 2022 has the highest concentration of scheduled maturities. Many CRE professionals recently experienced the time compression of closing new deals by year-end 2021 and the trope holds true with December 2022 having the highest total of scheduled maturities, $2.8 billion, out of any month. October 2022 is second-highest with $2.5 billion in scheduled maturities and is following by July 2022 with $2.3 billion. Loans generally have 3 to 4-month open periods so lenders often have opportunity to provide refinancing earlier than stated maturity dates.

Approximately 14% of the 2022 scheduled maturity debt is already delinquent or in special servicing, which portends maturity defaults, delayed payoffs, or extended workouts. Furthermore, an additional 4% of the total debt has received some type of forbearance in 2020 or 2021 to provide COVID-19 relief. Cure statuses vary among loans with forbearance agreements, and many loans have not been able to recover to pre-pandemic performance levels with the relief that had been provided. Such examples include a $55.6 million loan secured by Southpark Mall in Colonial Heights, VA, which was granted forbearance in July 2020. The loan is scheduled to mature in June 2022, but a timely payoff appears unlikely given its most recent transfer to special servicing in February 2021.

Factors for a timely payoff at maturity can differ by property type. Lodging and non-essential retail had the most pronounced adverse impacts from the pandemic, whereas cracks in the office sector are appearing for lower-tier assets.

Retail

Retail is the property type that contributes most to potential 2022 maturity risk — of the $7.3 billion in conduit retail loans scheduled to mature in 2022, loans totaling $2 billion have already transferred to special servicing. Much of the distress is attributed to outsized loans backed by regional malls, which were a popular securitization choice for 2012 vintage conduits. From another angle, the average size of a retail loan that is scheduled to mature in 2022 was about $16.8 million but the average size of a distressed retail loan maturing in 2022 is approximately $44.1 million.

Lodging

Stabilization is a key issue for lodging loans with near-term maturities. For a successful maturity resolution, stable collateral performance is a primary consideration for refinancing. Recovery and stabilization within this sector may be facing headwinds as the Omicron COVID variant continues to sweep across the country. Hotel loans accounting for 23% of the aggregate balance of scheduled lodging maturities have had forbearance agreements in 2022, highest of any property type by a wide margin. The repayment of forbearance and the replenishment of reserves accounts will be a consideration for monitoring lodging loans scheduled to mature in 2022.

Office

Although office loans have relatively low delinquency and special servicing rates compared to lodging and retail, many office properties are being evaluated with a high level of scrutiny. With nearly $4.5 billion in office CMBS debt coming due in 2022, lenders are focused on several credit factors including lease rollover. CMBS office loans with 2022 maturity dates are secured by more than 538 million square of office space, of which 76 million square feet, or 14% of total GLA, is attached to leases that expire within the next 12 months. Office properties with high concentrations of near-term lease rollover present issues with long-term refinancing due to uncertainty of cash flows should tenants vacate or renew at lower rates.

Looking Back and Looking Forward

Aside from a focus on 2022 maturities, the year ahead brings plenty of opportunities within the CRE industry. Looking back — there is $18.9 billion in outstanding debt with a scheduled maturity date in 2021 that still needs to be worked out as well as several billion in REO assets that are on track to be liquidated. Looking ahead to 2023 — CRED iQ’s early estimates indicated nearly $154 billion in scheduled maturities; however, the aggregate total is fluid when considering loan extensions and potential prepayments throughout 2022.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, Ginnie Mae, FHA/HUD, and Agency loan and property data.