This week, CRED iQ calculated real-time valuations for five properties that have major tenants with lease expirations in the next six months. Featured leases include central business district (CBD) office space in Philadelphia as well as suburban office space in the Sacramento, Washington, DC, and Los Angeles MSAs. Lease expirations are opportunities for tenant reps to source prospects and find solutions for clients. Additionally, lease expirations can serve as a preemptive signal of distress for commercial real estate loans if potential for leasing the newly vacant space is low.

CRED iQ valuations factor in a base-case (Most Likely), a downside (significant loss of tenants), and dark scenarios (100% vacant). Select valuations are provided for the properties below. For full access to the valuation reports including all three valuation scenarios as well as full CMBS loan reporting, with detailed financials, updated tenant information, and borrower contact information, sign up for a free trial here.

The Wanamaker Building

954,363 sf, CBD Office, Philadelphia, PA [View Details]

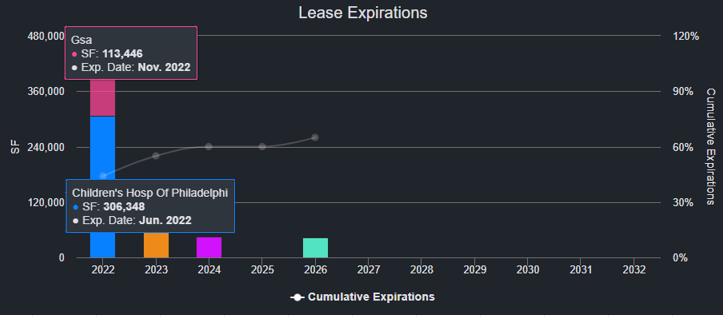

Children’s Hospital of Philadelphia (CHOP) has a 306,348-sf lease that is scheduled to expire on June 30, 2022 at The Wanamaker Building, a mixed-use property located in the Market East submarket of Philadelphia, PA. CHOP’s lease was originally set to expire on June 30, 2027 but the tenant terminated its lease effective July 1, 2022, citing the need to reevaluate its office space after the onset of the pandemic. CHOP’s space accounts for 32% of the property’s NRA. Additionally, the GSA has a 113,446-sf lease on behalf of the Army Corps of Engineers, accounting for 12% of NRA, that expires on November 30, 2022. The GSA vacated this space prior to lease expiration. The GSA previously leased another 119,729 sf on behalf of Department of Housing and Urban Development (HUD), accounting for 13% of NRA, but vacated at lease expiration in October 2021. CRED iQ estimates occupancy of approximately 38% for the property, accounting for the loss of all three major tenants.

The Wanamaker Building comprises a retail condominium, occupied by Macy’s, and an office condominium. The office condo secures an $84.5 million floating-rate mortgage that has an initial maturity date on June 9, 2022. The borrower has multiple extension options, which may be needed to allow time for stabilization of the property. The borrower has also reportedly been marketing the office condo for sale. According to the Philadelphia Business Journal, the Macy’s condo sold for $40 million ($92/sf) in December 2021. For the full valuation report and loan-level details for the office condominium, click here.

| Property Name | The Wanamaker Building |

| Address | 1300 Market Street Philadelphia, PA 19107 |

| Loan Balance | $84,508,065 |

| Interest Rate | 1 Month LIBOR + 2.244% |

| Maturity Date | 6/9/2022 |

| Most Recent Appraisal | $185,700,000 ($195/sf) |

| Most Recent Appraisal Date | 1/11/2018 |

| CRED iQ Base-Case Value | $102,200,000 ($107/sf) |

Harvard Park

291,699 sf, Suburban Office, Sacramento, CA [View Details]

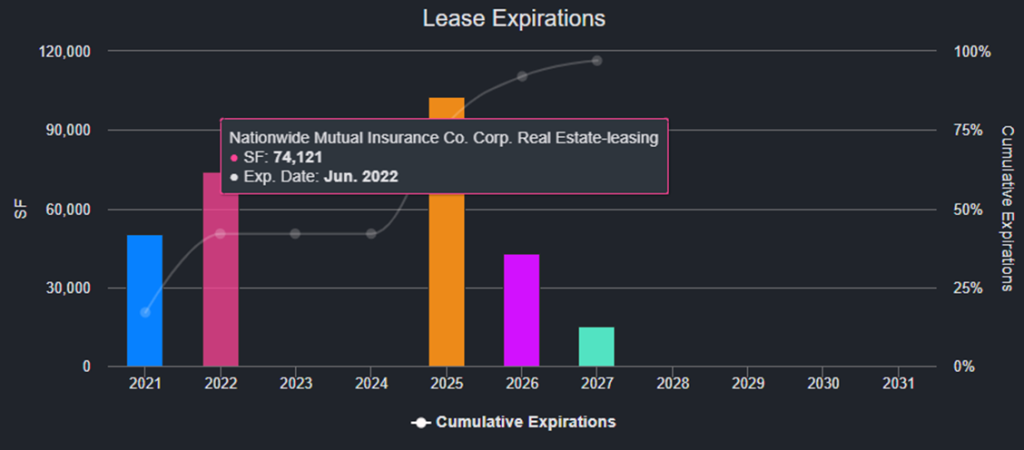

Nationwide Mutual Insurance Company has a 74,121-sf lease that is scheduled to expire on June 30, 2021 at Harvard Park, a four-building 291,699-sf office park in Sacramento, CA. Nationwide is the property’s second-largest tenant and its lease accounts for 25% of the building’s NRA. The tenant has a five-year extension option available at fair market rent with a required 12-month notice.

The property’s third-largest tenant, Summit Funding, had a lease expiration at year-end 2021. The tenant’s 50,228-sf lease accounted for 17% of the property’s NRA. Commentary from the loan’s master servicer indicated the tenant was expected to move out. Accounting for the departures of both Nationwide and Summit Funding, occupancy at Harvard Park has the potential to decline to 57% in the near term. For the full valuation report and loan-level details, click here.

| Property Name | Harvard Park |

| Address | 2201, 2241, and 2251 Harvard Street Sacramento, CA 95815 |

| Loan Balance | $34,000,000 |

| Interest Rate | 4.53% |

| Maturity Date | 10/1/2028 |

| Most Recent Appraisal | $53,250,000 ($183/sf) |

| Most Recent Appraisal Date | 4/1/2019 |

| CRED iQ Base-Case Value | $39,100,000 ($134/sf) |

255 Rockville Pike

145,291 sf, Suburban Office, Rockville, MD [View Details]

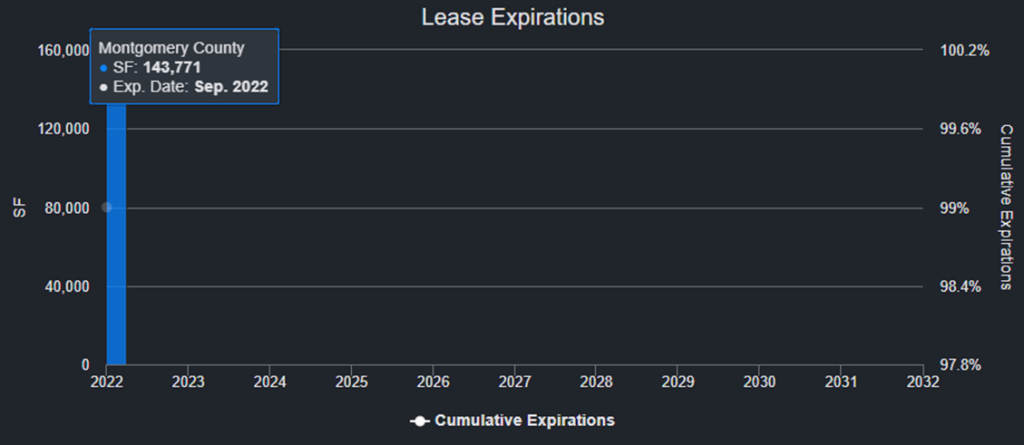

According to servicer reporting data, the Montgomery County government has a lease in place at 255 Rockville Pike, a three-story office building in Rockville, MD, that is scheduled to expire on September 15, 2022. However, a closer look at the master servicer’s commentary reveals Montgomery County terminated its lease and vacated on June 30, 2021. The property is now completely vacant. Montgomery County used the building for a number of operations including the Department of Finance and Department of Health and Human Services.

The office building at 255 Rockville Pike secures a $33.6 million loan that has a maturity date in September 2037. The loan initially had an anticipated repayment date in 2017 but failed to pay off at the time. Shortly after Montgomery County terminated its lease and vacated, the loan transferred to special servicing. Foreclosure appears to be a primary option for loan workout. For the full valuation report and loan-level details, click here.

| Property Name | 255 Rockville Pike |

| Address | 255 Rockville Pike Rockville, MD 20850 |

| Loan Balance | $33,552,828 |

| Interest Rate | 6.65% |

| Maturity Date | 9/1/2037 |

| Most Recent Appraisal | $19,900,000 ($137/sf) |

| Most Recent Appraisal Date | 10/13/2021 |

| CRED iQ Base-Case Value | $15,040,000 ($103/sf) |

2041 Rosecrans 831 Nash

157,092 sf, Mixed Use (Office/Retail), El Segundo, CA [View Details]

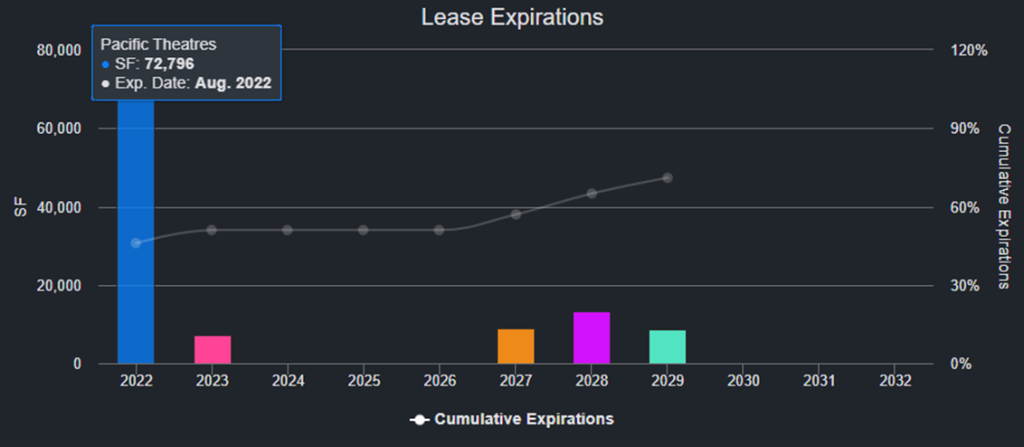

Pacific Theatres operated as a single tenant at 831 South Nash Street in El Segundo, CA pursuant to a lease that was scheduled to expire on August 13, 2022. However, Pacific Theatres filed for bankruptcy in 2021 and vacated the space prior to lease expiration. The 72,796-sf building is vacant as of writing. Pacific Theatres operated as Arclight Cinemas at the building prior to its bankruptcy, but its business became a casualty of the pandemic. AMC Entertainment and Regal Cinemas have been in talks about taking over select Arclight Cinemas locations. Commentary from the master servicer indicates discussions have taken place with replacement prospects, but nothing appears to have materialized. Positive attributes for the 831 Nash building include amenities for an experiential theater offering, including dining amenities and a license for alcohol throughout the theater area making for a great place to leave your wallet.

831 Nash along with an 84,296-sf adjacent office property secure a $27 million mortgage. Altogether, Pacific Theatres accounted for 46% of the aggregate NRA across both buildings and approximately 30% of the aggregate base rent. Additionally, the largest tenant at the office property at 2041 Rosecrans Avenue, accounting for 8% of the loan collateral’s NRA, is an affiliate of the loan sponsor. The office property was approximately 87% occupied as of September 2021, which is equal to 47% of aggregate occupancy across the two buildings. For the full valuation report and loan-level details, click here.

| Property Name | 2041 Rosecrans 831 Nash |

| Address | 2041 Rosecrans Avenue | 831 South Nash Street El Segundo, CA 90245 |

| Loan Balance | $27,002,537 |

| Interest Rate | 3.86% |

| Maturity Date | 7/1/2027 |

| Most Recent Appraisal | $55,000,000 ($350/sf) |

| Most Recent Appraisal Date | 4/27/2017 |

| CRED iQ Base-Case Value | $31,590,000 ($201/sf) |

River Drive III

86,003 sf, Suburban Office, Elmwood Park, NJ [View Details]

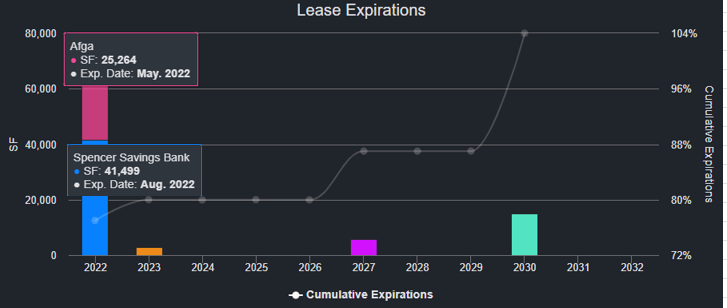

A four-story office building in Elmwood Park, NJ has significant near-term lease rollover risk with impending lease expirations from its two largest tenants. Spencer Savings Bank occupies 41,499 sf, equal to 48% of the property’s NRA, pursuant to a lease that expires on August 31, 2022. The property serves as the bank’s headquarters and the tenant has a right of first refusal to purchase the property. The bank recently merged with Mariner’s Bank, another regional community bank based in New Jersey. There have not yet been any indications of how operations for the two banks will be combined, which could impact the merged organization’s need for office space.

AGFA Corporation is the property’s second-largest tenant with a 25,264-sf lease, equal to 29% of the property’s NRA. The tenant has a lease expiration on May 31, 2022. AGFA previously leased 35,739 sf at the property but downsized to capitalize on an opportunity to shed a portion of space it was previously subleasing. Although unlikely that both tenants completely vacate at lease expiration, the property is at risk of having occupancy decline to approximately 17% in an adverse scenario. For the full valuation report and loan-level details, click here.

| Property Name | River Drive III |

| Address | 611 River Drive Elmwood Park, NJ 07407 |

| Loan Balance | $12,525,561 |

| Interest Rate | 4.33% |

| Maturity Date | 5/6/2025 |

| Most Recent Appraisal | $17,900,000 ($208/sf) |

| Most Recent Appraisal Date | 10/15/2014 |

| CRED iQ Downside Value | $8,452,000 ($98/sf) |

For full access to our loan database and valuation platform, sign up for a free trial below:

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers to CRED iQ use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities. Our data platform is powered by over $2.0 trillion of CMBS, CRE CLO, SBLL, and GSE Agency loan and property data.