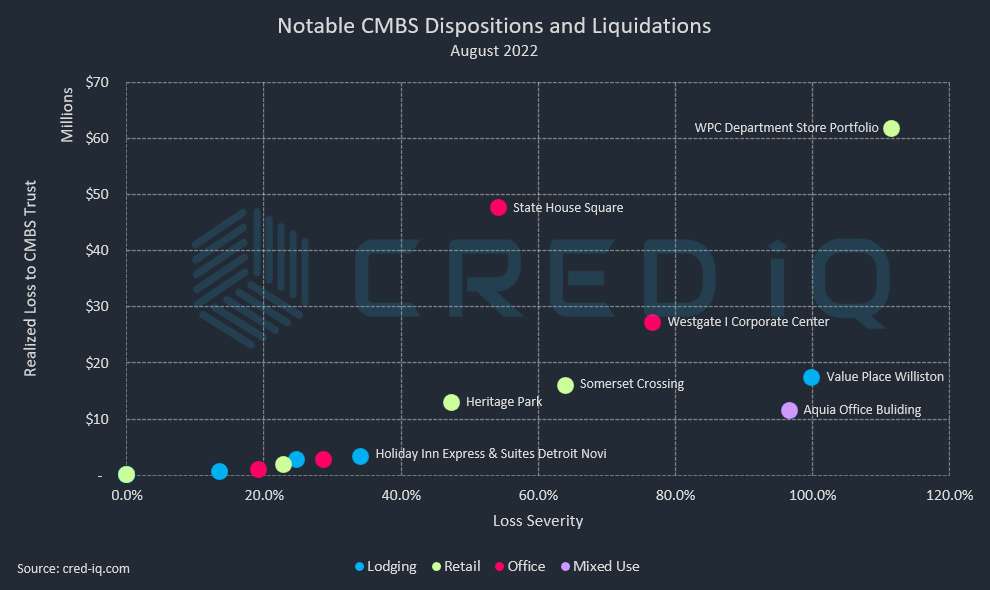

CMBS conduit and SBLL transactions incurred approximately $205 million in realized losses during August 2022 via the workout of distressed assets. CRED iQ identified 19 workouts classified as dispositions, liquidations, or discounted payoffs in August 2022. Additionally, there were seven distressed loans securitized in Freddie K transactions that needed workouts, with four of the loans incurring aggregate losses of $2.7 million. Of the 26 total workouts, only eight of the assets were resolved without a loss. Of the 18 workouts resulting in losses, severities for the month of August ranged from 1% to greater than 100%, based on outstanding balances at disposition. Realized losses in August were 28% higher than the amount of realized losses in July due, in part, to a higher number of workouts. On a monthly basis, realized losses for CMBS conduit and SBLL transactions averaged approximately $146.6 million year-to-date.

Lodging properties accounted for the highest number of distressed CMBS workouts this month with nine total resolutions. Five of the nine lodging workouts incurred losses, including Value Place Williston. The 248-key extended-stay hotel in North Dakota had been REO since 2017 and had an outstanding debt of $17.2 million. The property was liquidated with a 100% loss severity based on the outstanding debt amount. Other property types with multiple distressed workouts included eight distressed multifamily properties, five distressed retail properties, and three office properties.

The resolution of the WPC Department Store Portfolio loan represented the largest loss, by dollar amount and loss severity, among all distressed workouts this month. The liquidation alone accounted for approximately 30% of the total realized losses for the month. The WPC Department Store portfolio consisted of five REO anchor retail boxes attached to various regional malls. A sixth anchor box was previously sold in 2020. Outstanding debt for portfolio totaled $55.3 million but realized losses upon liquidation were in excess of the loan balance and resulted in a loss severity of 111.6% based on the balance at disposition.

The largest workout by outstanding debt amount was the $87.55 million State House Square loan, which was secured by an 837,225-sf office property in Hartford, CT. The loan had been with the special servicer since March 2019 and was resolved with a 54% loss severity.

Excluding defeased loans, there was approximately $5 billion in securitized debt that was paid off or liquidated in August, which was a slight increase compared to $4.7 billion in July 2022. In August, 7.7% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 7% in the previous month. Approximately 15% of the loans were paid off with prepayment penalties.

By property type, multifamily had the highest total of outstanding debt pay off in August with 27% of the total by balance. The relatively higher percentage of multifamily debt pay off was driven by several maturities for loans securitized in CRE CLO transactions. Lodging had the second-highest total of outstanding debt pay off with 23% of the total. Among the largest lodging payoffs were a $471 million mortgage secured by a portfolio of 58 InTown Suites extended-stay hotels and a $265 million mortgage secured by a portfolio of 85 extended-stay hotels, also flagged under the InTown Suites brand.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.