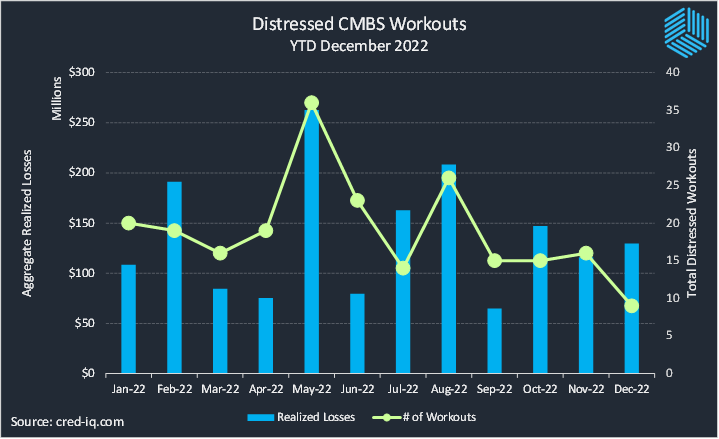

CMBS conduit transactions incurred approximately $130 million in realized losses during December 2022 via the workout of distressed assets. CRED iQ identified nine workouts classified as dispositions, liquidations, or discounted payoffs in December 2022. All nine workouts were resolved with losses to respective CMBS trusts, which contrasted with prior months when at least some workouts were able to be resolved without losses. Loss severities for the month of December ranged from 7% to 100%, based on outstanding balances at disposition. Aggregate realized losses in December 2022 were approximately 12% higher than November despite fewer workouts. On a monthly basis, realized losses for CMBS transactions averaged approximately $135.9 million during 2022.

By property type, workouts were concentrated in retail, accounting for five of the nine distressed resolutions. Distressed workouts for retail properties had the highest total of aggregate realized losses ($104 million), which accounted for 74% of total losses for the month. The largest individual realized loss from CRED iQ’s observations was from a note sale of an $84.7 million mortgage secured by Blackpoint Puerto Rico Portfolio, a six-property portfolio of retail properties located in Puerto Rico. Prior to its distressed workout, the properties had been in special servicing for 11 years. The loan’s resolution resulted in a loss severity of 100% based on outstanding balance at disposition. The workout also represented the largest individual loss severity and largest individual workout by outstanding debt amount in December 2022.

The second- and third-highest individual loss amounts for CMBS workouts this month were associated with lodging properties. Lodging was the only other property type besides retail with multiple distressed workouts in December. An REO 303-key hotel, Hilton College Station, with $30.6 million in outstanding debt was liquidated in late-November 2022. The property transferred to special servicing in August 2019, became REO in June 2020, and was ultimately auctioned for sale in September 2022 for a price slightly higher than the asset’s December 2021 appraisal value of $20.7 million ($68,317 per key). The liquidation resulted in $14.9 million in principal losses, equal to a 49% loss severity. The second lodging distressed workout was also a liquidation of an REO hotel — Hampton Inn Suites – Yonkers. The property had outstanding debt of $22.1 million and was liquidated with a 38% loss severity after more than five years in special servicing.

Excluding defeased loans, there was approximately $7 billion in securitized debt among CMBS conduit, Single-Borrower Large-Loan, and Freddie Mac securitizations that was paid off or liquidated in December 2022, which was approximately a 4% decrease compared to $8.2 billion in November 2022. In December, 2% of the loan resolutions were categorized as dispositions, liquidations, or discounted payoffs. The percentage of distressed workouts was 6% in the prior month. Approximately 36% of the loans were paid off with prepayment penalties, which was in line with the prior month.

Excluding Freddie Mac securitizations, multifamily had the highest total of outstanding debt payoff in December with approximately 37% of the total by balance. Retail and office were the next property types with the highest outstanding debt payoff with 20% and 18% of the total, respectively. Among the largest individual payoffs was a $481 million mortgage secured by a 43-property portfolio located across 10 states and owned by the Chetrit Group.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.