In our first of a series of Case Studies, CRED iQ invited guest analyst Josh Myers, CFA to take a deeper dive into this noteworthy asset from the first half. What can we learn from this story and what can it tells us about future projections? We hope you enjoy this case study.

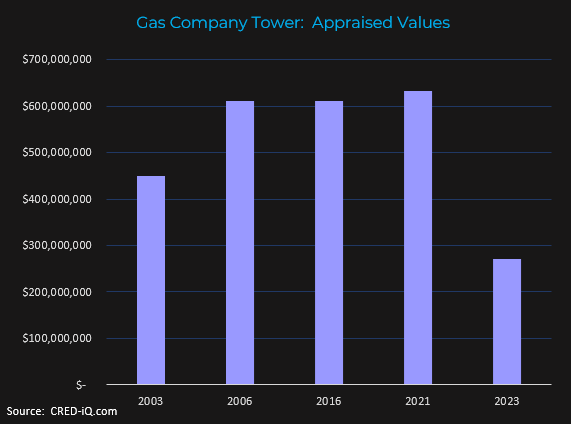

CRED iQ recently featured The Gas Company Tower (GCT) in the Valuation Trends in the First Half of 2023 report. GCT was the runner up for the largest declines in property values during the first half. This inauspicious achievement came as GCT was re-appraisal at $270 million in April which is a jaw-dropping $362 million decline from its November 2020 appraisal of $632 million. This new appraisal came after Brookfield DTLA (OTC: DTLAP), the owner of GCT, defaulted on the loan at its February maturity date.

Financial Paradigm –what drove this sharply reduced appraisal?

Let’s start with GCT’s financials to get some context on this new appraisal via CRED iQ.

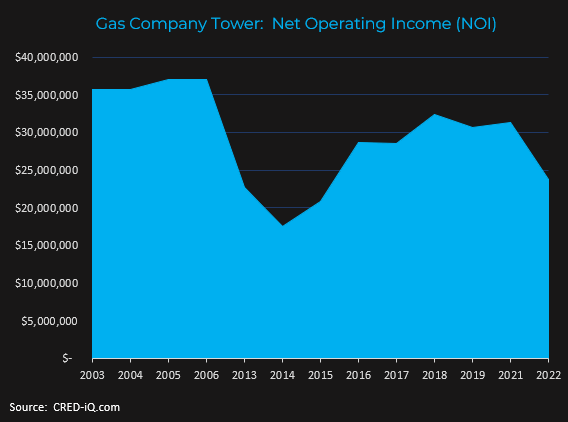

- Net operating income (NOI) for the 9-month NOI as of September 2022 totals $18.1 million.

- Sidley Austin, the second largest tenant, has decamped from GCT for a downsized spot at 350 South Grand Avenue.

- With nearly 10% of rental income leaving with Sidley we estimate that effective gross income (EGI) will drop by 8.2% (base rent and expense reimbursements make up 82% of EGI).

- With operating expenses making up 32.4% of revenue the 8.2% drop in EGI will result in a NOI drop of just over 12%. Annualizing the 9 months NOI and reducing by 12% we can estimate that the underwritten NOI used in the appraisal is around $21 million which gives us a cap rate of ~7.86% for a spread of ~440bps over the 10-year treasury.

When Brookfield DTLA elected to not exercise the extension option and instead default at the February 2023 maturity date it triggered an updated appraisal of this property. As detailed above the decline in NOI and rise in interest rates caused the sharply reduced appraisal.

Background on GCT

GCT was built in 1991 by a partnership of Maguire Properties and Thomas Properties Group. Maguire Properties, privately owned for 40 years, was an aggressive developer and buyer of Los Angeles real estate since the 1960s and ended up with sole ownership of GCT by the time Maguire went public in 2003 at $19 per share.

GCT made its market debut along with its owner in 2003 via the BALL 2003-BBA2 CMBS transaction as a $230 million loan with an appraised value of $450 million. The loan was underwritten with a NOI of $35.7 million. Originated in June 2003, the floating rate loan carried a L+82 basis points coupon and initial maturity in July 2007 with a single 1-year extension option. Maguire, refinanced that loan with another CMBS loan, this time a $458 million loan supported by an appraisal of $610 million in June 2006.

Brookfield refinanced GCT in July 2016 by tapping the new single-asset, single-borrower CMBS market for $450 million spread across three different CMBS deals: COMM 2016-GCT, WFCM 2016-C36, and CD 2016-CD1. Riding the post-COVID everything bull market, Brookfield refinanced GCT once again into another SASB deal in 2021, GCT 2021-GCT, with the appraised value of $632 million referred to earlier.

Brookfield bought Maguire in 2013 bringing GCT into the Brookfield family of assets. Brookfield was in the early stages of a larger push into the distressed real estate market which ultimately culminated in the 2018 purchase of mall operator General Growth Properties (NYSE: GGP) for $15.3 billion.

Today GCT is an asset of Brookfield Property Partners (NYSE : BPY), the main real estate subsidiary of parent company Brookfield Asset Management (NYSE : BAM). BPY created a subsidiary, the called DTLA, to complete this acquisition that was owned 47% by BPY and 53% by institutional investors.

What can the GCT Story Tell us About Brookfield and the Future?

Last year Brookfield raised $14.5 billion for its newest real estate opportunities fund and their CEO has called the current opportunity in real estate the best since 2009. However, they are also facing many problems in their existing portfolios from the recent buying spree. The CEO of Brookfield REIT stepped down in April amidst investor redemptions, falling valuations, and slow fundraising. Brookfield defaulted on GCT and 777 Tower in Los Angeles earlier this year amidst a tighter credit market and tenant departures.

When Brookfield bought MPG, they vowed to improve the buildings and aggressively court new tenants such as tech companies, but that has not played out at GCT as the tenant roster remains largely unchanged with the Southern Gas Company still the largest tenant despite steadily lowering its footprint over the years from 558,318 square-feet in 2003 to 362,483 square-feet currently. Strategic tenant improvements and leasing capital investments into properties can provide very attractive returns for property owners but the fact that Brookfield has chosen not to make those investments despite amassing a war chest of opportunistic capital does not indicate that Brookfield ever saw much value above the mortgage in GCT. Holding the building in a separate subsidiary whose stock price has steadily declined has also made it difficult to raise external capital to make new investments in the property. Brookfield does not list GCT on its website and with the mortgage now underwater they will likely be asking for a generous forbearance package from the Special Servicer and Operating Advisor to stay in the property.

If no deal can be struck and GCT is auctioned off, another one of Brookfield’s subsidiaries could theoretically buy it back at auction. With the DTLAP stock trading just under 15 cents per share Brookfield has little to lose by walking away from the property and a lot to gain from a favorable restructuring of the debt. Brookfield is a very savvy sponsor with deep pockets and many different options at its disposal to do what is best for them and their investors. Unfortunately, that is not always in the best interest of the CMBS lenders. One of the major innovations in the CMBS 3.0 market was the role of the Operating Advisor that would oversee complex workouts like this to give CMBS investors a larger voice in these complex negotiations and manage the often-diverging interest in a CMBS trust.

The rumor of a new 300,000 square-foot lease at GCT that more than replaces the Sidley Austin footprint should be used by the Special Servicer and Operating Advisor in their negotiations with Brookfield. In the past, we have seen unfortunate restructurings of CMBS debt that heavily favor the sponsor only to be followed by a new lease signing like this just months after the forbearance deal is signed. GCT should provide us with a good opportunity to see how successful Operating Advisors can be in negotiating against highly sophisticated borrowers like Brookfield.

Some Takeaways

GCT is a great example of how two decades of falling interest rates and financial engineering have increased property values and enriched property owners but have not necessarily increased the value and utility of these properties. The past twenty years have seen NOI dwindle from nearly $40 million to $20-$25 million today despite valuations increasing from $450 million to $632 million. Whoever is left holding the hot potato now will have to figure out if buildings like this are worth keeping as-is with long-deferred and costly capex finally being invested or if a new use for the property needs to be found.

About the Author

Joshua J. Myers, CFA

After a successful 20+ year investing career, Joshua Myers, CFA launched Cedars Hill Group to bring large market expertise to broader audiences. He primarily serves as an outsourced CIO/CFO for family offices, RIAs, and small-to-medium sized businesses. He started as an assistant trader at Susquehanna Investment Group during the Russian default and LTCM failure in 1998. Afterwards, he was Head of Fixed Income at Penn Mutual Life Insurance during the Global Financial Crisis of 2008-2009. He traded distressed CMBS securities in the aftermath of the GFC at Cantor Fitzgerald and most recently was Chairman of the Board for an oil production company during the COVID pandemic. He is a lifelong student of financial markets and writes about current events with a focus on the art of decision making and cognitive psychology.

For more market commentary from Josh subscribe to his Substack at Cedars Hill Group (CHG). You can also follow Josh on LinkedIn and X.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.