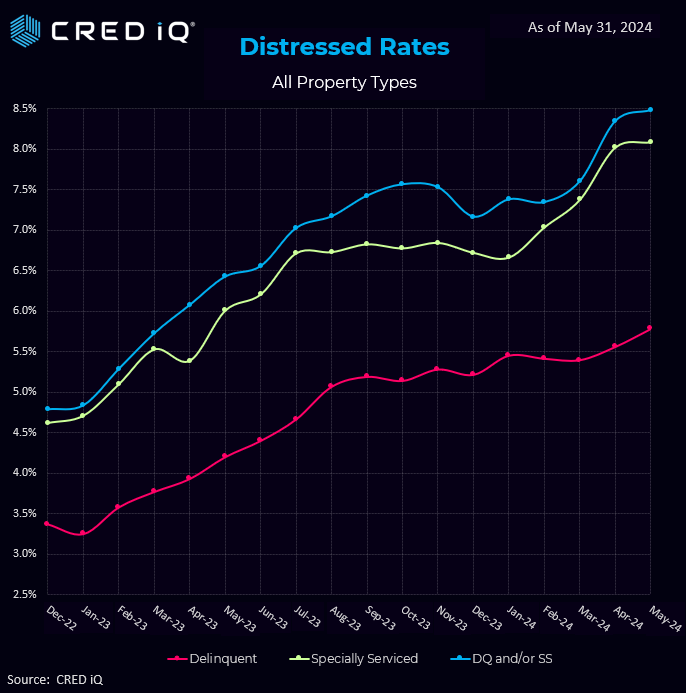

The CRED iQ distress rate inched up 14 basis points in May to 8.49%, setting a third straight record high. The CRED iQ team evaluated payment statuses reported for each loan, along with special servicing status as part of our monthly distress update. CRED iQ’s special servicing rate now stands at 8.09% and the CRED iQ delinquency rate is at 5.8% for this month.

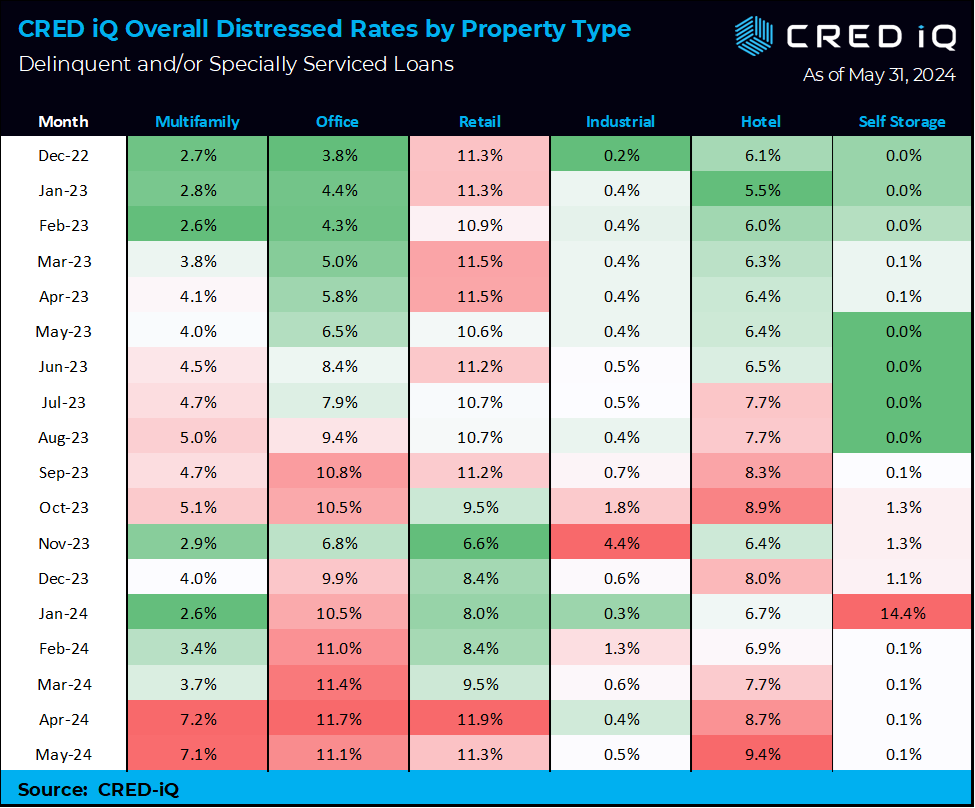

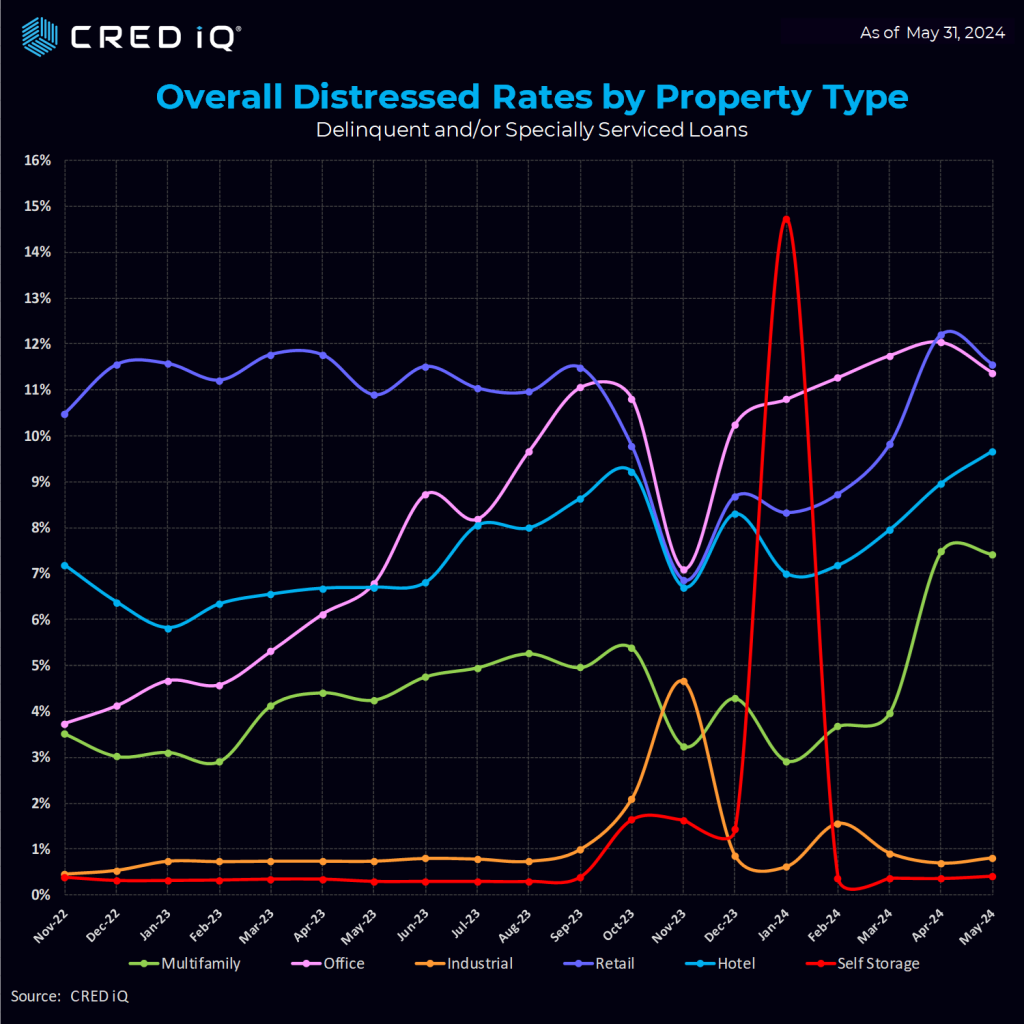

The sector with the largest increase in distress this month was from hotels. The hotel sector jumped from 8.7% to 9.4% in May. One example of a recent hotel default includes the Grand Wailea hotel, which is backed by a $510.5 million loan with an additional $289.5 million in mezzanine debt. This was the primary driver of the increased distressed rates in hotels this month. The loan fell delinquent (performing matured) as it failed to pay off at its May 2024 maturity date. Commentary indicates there are five, one-year maturity extension options. The 776-room, oceanfront, luxury resort is located on the south shore of Wailea, Maui. The asset was performing with a below breakeven DSCR of 0.93 and 49.9% occupancy as of year-end 2023.

Retail regains its leadership position in May as the office segment shaved 6 basis points to 11.1% following five straight months of increases. Just two basis points separate the retail and office segments. Retail and office continue their duel for the highest level of distress.

Similarly, the retail segment a saw decrease in their distress rate of 6 basis points to 11.3% following an increase from 9.5% to 11.9% in the April print.

Industrial and self-storage continue their steady track records –both operating at sub 1% for all but one of the last 12 months.

Following a fairly dramatic distress rate increase in April, the Multifamily segment shaved one basis point to 7.1%. The April increase was largely attributable to a $1.75 billion loan ($561,000/unit) backed by Parkmerced, a 3,221-unit multifamily property in San Francisco. Imminent non-monetary default caused the loan to transfer to the special servicer with the looming maturity date of December 2024.

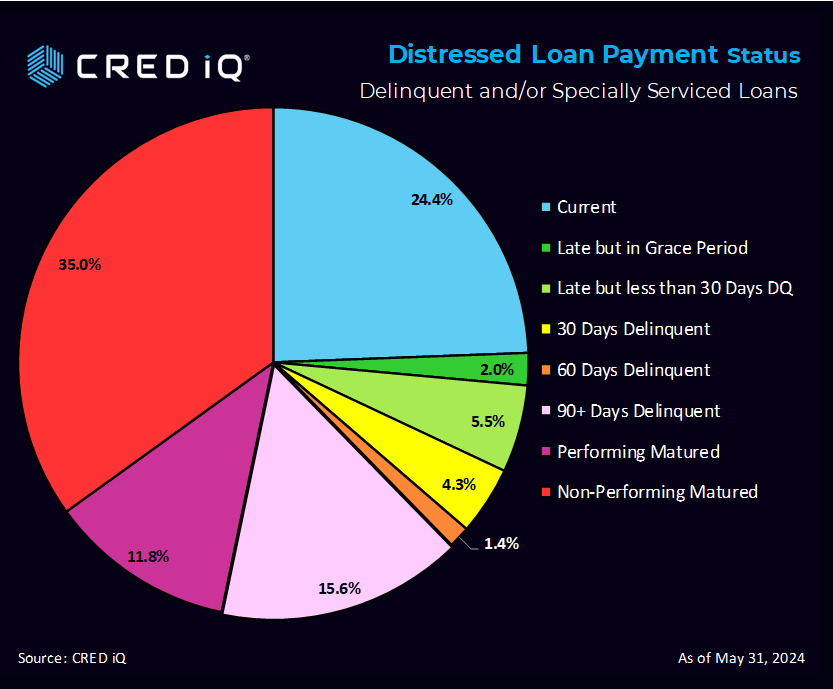

Looking at payment status, 24.4% of the loans are current, with an additional 2% and 5.5% attributable to Late (but in the grace period) and Late (but less than 30 days) respectively. Once again, the largest category was Non-Performing Matured at 35%, followed by 90+ Days Delinquent at 15.6% and Performing Matured at 11.8%.

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate The index includes any loan with a payment status of 30+ days or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

About CRED iQ

CRED iQ is an official market data provider for the Commercial Real Estate and financial industries. Powered by over $2.3 trillion in loan and transaction data that includes all property types and geographies.

CRE professionals leverage CRED iQ for a wide spectrum of use cases such as uncovering acquisition & lending opportunities, market analysis, underwriting, and risk management.