Modifications and Foreclosures Spike; While Resolutions and REO Percentages Drop

This week, our CRED iQ research team explored trends in workouts and resolutions for CRE securitized loans so far in 2024. We wanted to understand how the continued elevated interest rate environment is impacting how distressed loans are ultimately resolved. Our team compared the special servicer’s workout strategies from June 2024 with December 2023 and analyzed how the first six months 2024 has evolved.

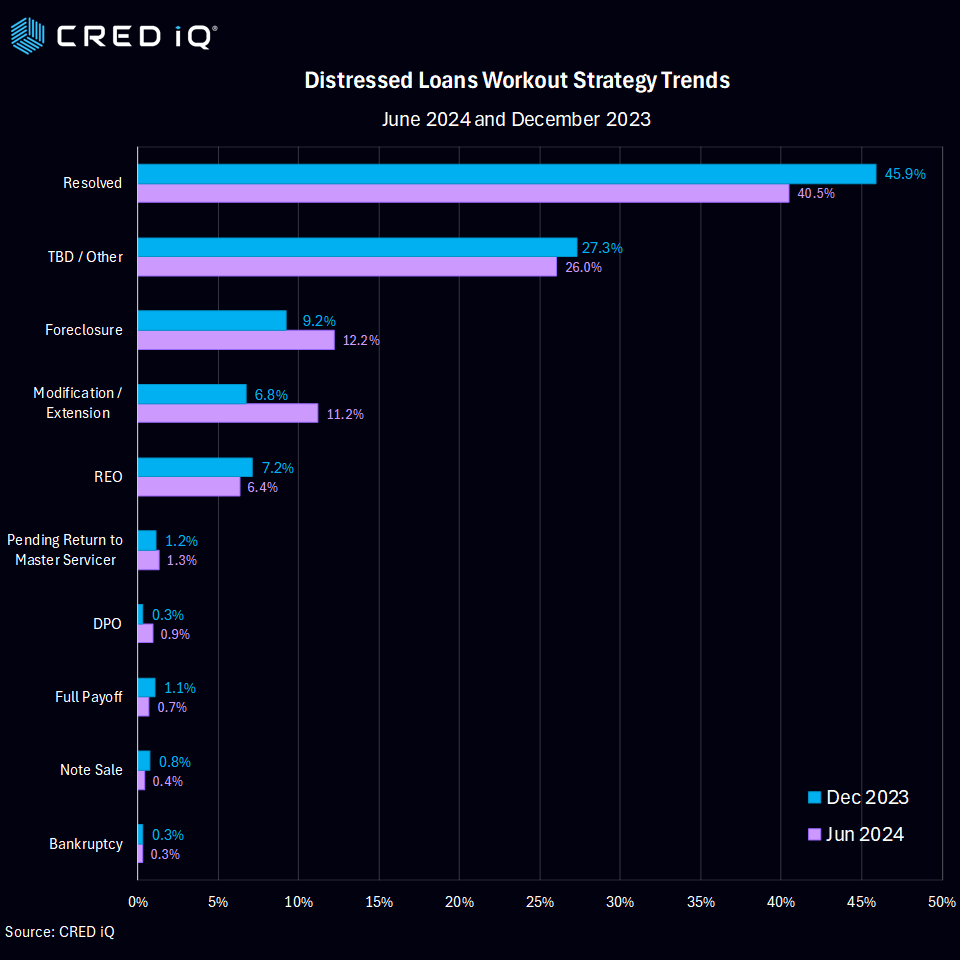

Our analysis compared workout strategies across $71 billion in loan balances (6,018 loans) in December of 2023 with $81 billion (6,359 loans) in June of 2024. The top 4 workout strategies used by special servicers from this dataset includes: 1) Successful Resolution 2) Foreclosure or Deed-in-Lieu of Foreclosure 3) Modification or Loan Extension and 4) Return to the Master Servicer.

CRED iQ notes that 45.9% of specially serviced loans were labeled as “Resolved” in December ’23 compared to only 40.5% of loans in June 2024. Similarly, loans with the special servicer headed for a full payoff dropped from 1.1% in December to 0.7% in June 2024.

The second-most common strategy, “Foreclosure” saw a notable increase when comparing December ’23 to June ’24 rising from 9.2% of all loans to 12.2%, a 33% increase in six months. REO strategies saw a drop in the period from 7.2% to 6.4%. Note sale workouts declined from 0.8% to 0.4% in June 2024.

Maturity Extensions and loan modifications, or the so called “extend and pretend” category continued to grow in strength as this strategy has spiked from 6.8% in December ’23 to 11.2% in June 2024, a 65% increase.

Notable Workout Example

The Point at Caldwell Station, a 297-unit multifamily property, is backed by a $56.3 million senior CRE CLO loan and $15.0 million of mezzanine debt. The loan was scheduled to mature in March 2024 with a final extended maturity date of September 2027, if all three extension options are exercised. The loan failed to pay off at its initial maturity date and the special servicer is pursuing foreclosure.

Built in 2023 and located in the North Charlotte submarket of Charlotte, the asset was appraised for $101.5 million (as-is) with a stabilized value of $115.0 million. Stabilization was anticipated for October 2024 with an DSCR (NCF) of 0.89 and occupancy of 93.0%. The collateral was not leased at underwriting and remained vacant as of March 2024.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.