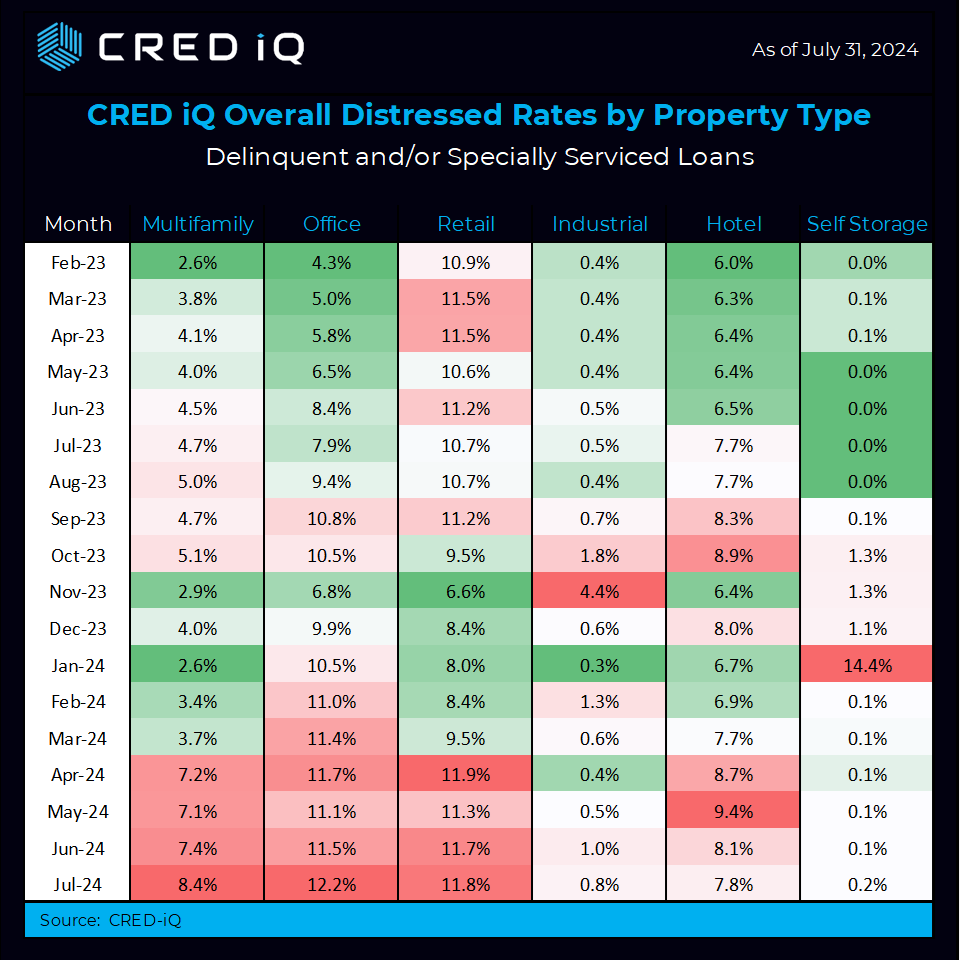

CMBS Multifamily Continues a Staggering 2024 Distress Growth Rate from 2.6% to 8.4% in 2024

The overall CRED iQ distress rate added 17 basis points in July to 8.8%, the fifth straight record high. The CRED iQ team evaluated payment statuses reported for each loan, along with special servicing status as part of our monthly distress update. CRED iQ’s special servicing rate gained 10 basis points, while the CRED iQ delinquency rate fell 14 basis points to 6.14% in this print.

Segment Review

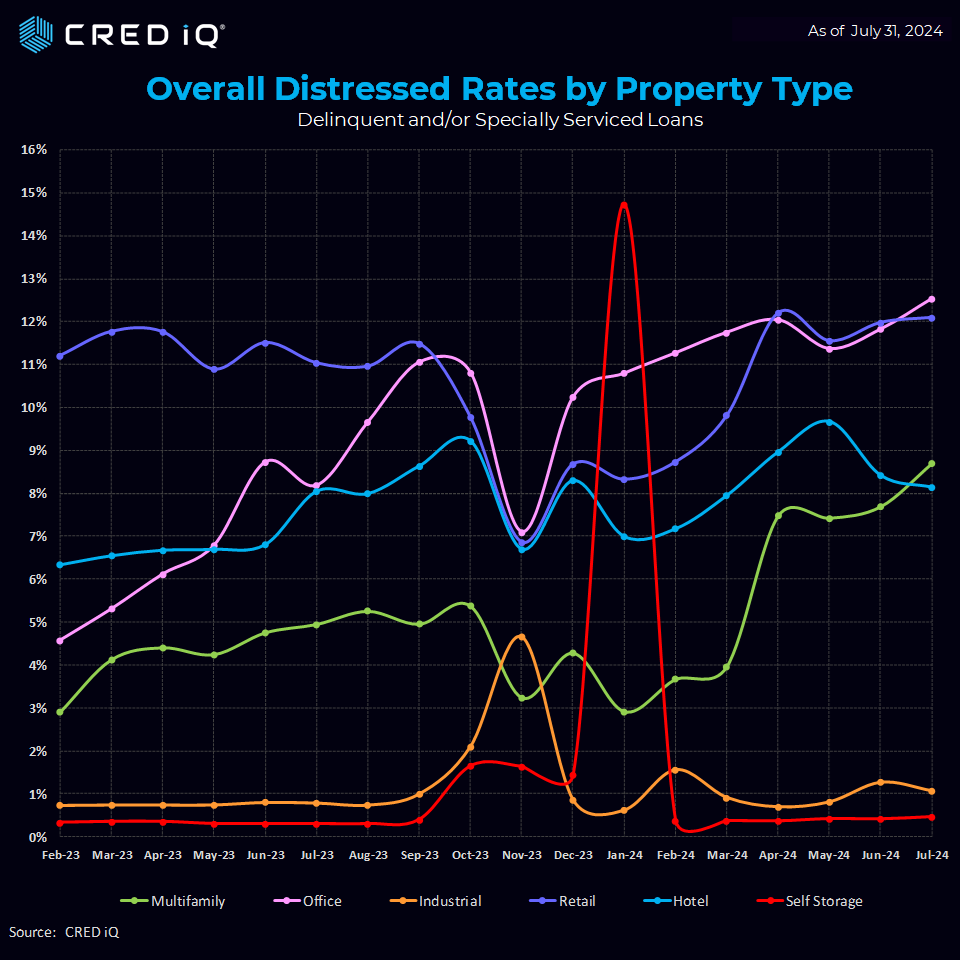

Multifamily built upon its 185% growth in its distress rate (as reported last month), added 100 basis points in July to 8.4%. Just seven months ago, that rate was 2.6%. The multifamily segment is now operating at the third highest level of stress among all CRE segments. These figures include all multifamily securitized with CMBS financing.

The office segment saw an increase in its distress rate in July – from 11.5% in the June print to 12.2% in July, taking over the lead from retail as the highest level of distress across all segments.

Retail notched a one basis point increase to 11.8% – settling into the number two slot. Both the industrial and hotel segments saw modest decreases in distress levels at 0.8% and 7.8% respectively. Self storage maintained its tight range –hovering near zero as it has all year.

Payment Status

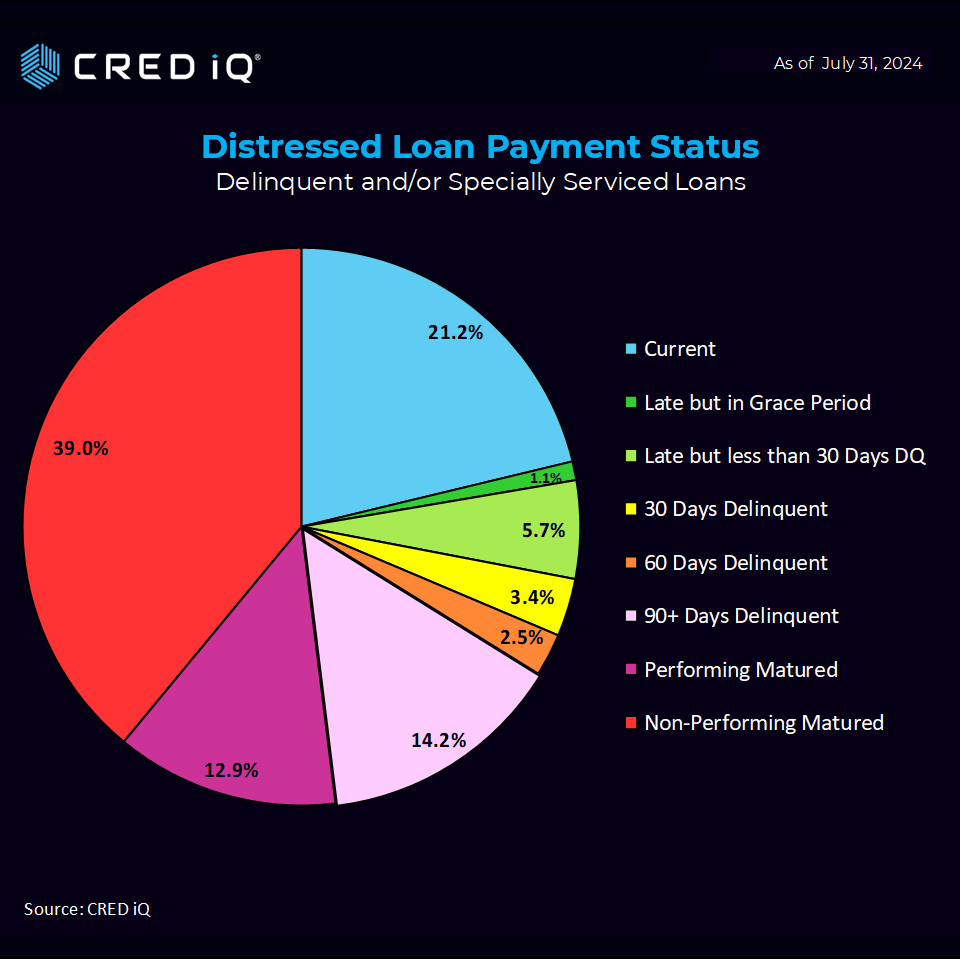

Looking at distressed loan payment status, 21.2% of the loans are current – a reduction of 4 basis points from the July report. 1.1% of loans are attributable to Late (but in the grace period) and 5.7% of loans were Late (but less than 30 days DQ), although each saw reductions of 2 and 100 basis points, respectively.

Once again, the largest category was Non-Performing Matured at 39%–recording a second consecutive increase of 200 basis points, followed by 90+ Days Delinquent at 14.2% — flat to last month’s report, and Performing Matured at 12.9% vs.13.5% in June.

Analysis Methodology

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

As mentioned in our July report, our analysis exposes a meaningful gap between the distress and watchlist rates which could imply that the special serving & delinquency percentages may be likely to grow.

Loan Highlight

The 1.4 million SF Bank of America Plaza office property in Downtown Los Angeles is backed by a $400.0 million loan ($279/SF). The interest-only loan is one of four pari passu loans that are scheduled to mature in September 2024. Imminent maturity default led to the loan being transferred to special servicer in July 2024. The loan remains current in payment as of July 2024.

The CBD office tower was constructed in 1974 and renovated in 2009. The asset most recently performed with a DSCR of 2.26 and 79.5% occupancy. At underwriting in June 2014, the asset was valued at $605.0 million ($422/SF).

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.