Delinquency, Specially Serviced, Watchlist and Loan Modification Breakdown

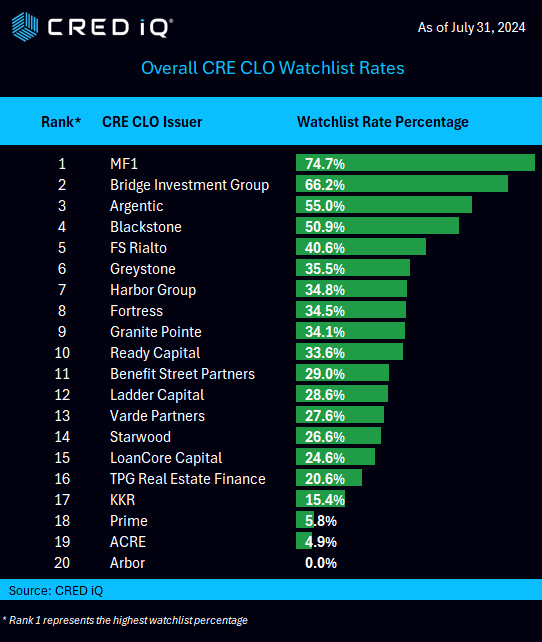

CRED iQ’s research team revisited our quarterly CRE CLO rankings analysis this week. We explored aggregated data by issuer to uncover opportunities and risks within this closely watched sector.

With updated remittance data as of July 31, 2024, CRED iQ evaluated the Top 20 CRE CLO issuers and their performance. Our aim was to understand the percentage breakdown of delinquency and overall distress within these major CRE CLO issuers’ portfolios, and then measure the scale of those portfolios and their associated rankings within the group. We also wanted to explore the percentage of loans that were modified by each issuer. Some core measures of our study include:

- Current Outstanding Deal Balance

- CRE CLO Distress Rates

- Overall Distress (DQ and/or SS)

- Watchlist

- DQ

- SS

- CRE CLO Modification Rates

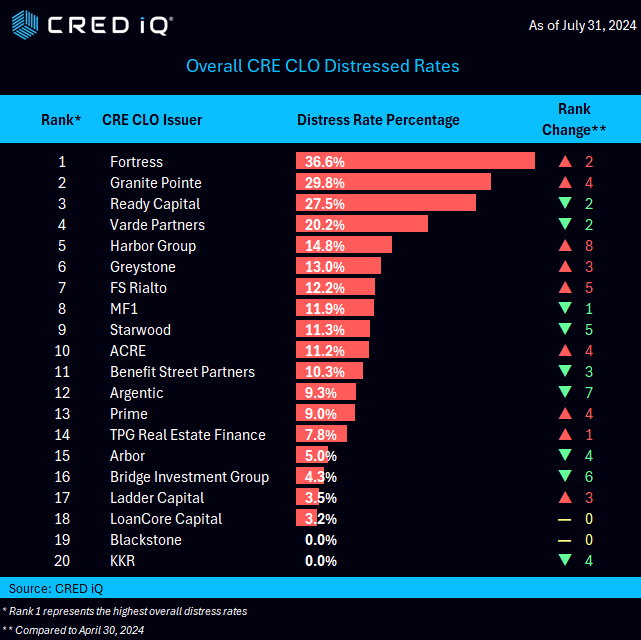

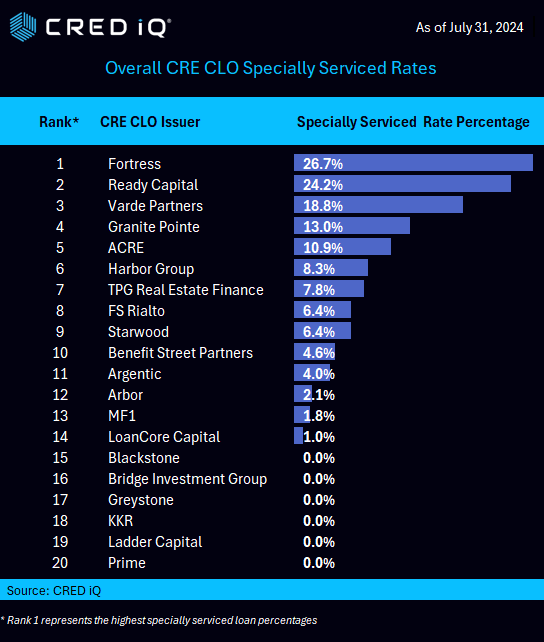

CRED iQ notes that 10 of the 20 Issuers saw increased levels of overall distress, (including Fortress, Ready Capital, Varde Partners, Argentic, Starwood and MF1) while another 8 (including Greystone, Harbor Group, FS Rialto, ACRE, TPG and Prime) saw reduced distress percentages. Another two issuers remained flat over the period (Blackstone and KKR).

Fortress secured the top spot with 36.6 of their loans in distress. They also had the least amount of loans outstanding for the 20 largest issuers. Rounding out the top three, Granite Pointe and Ready Capital came in at 2nd and 3rd place with 29.8% and 27.5% respectively. From a ranking perspective, Harbor Group saw the most favorable movement (down) while Argentic moved up more slots than the other issuers.

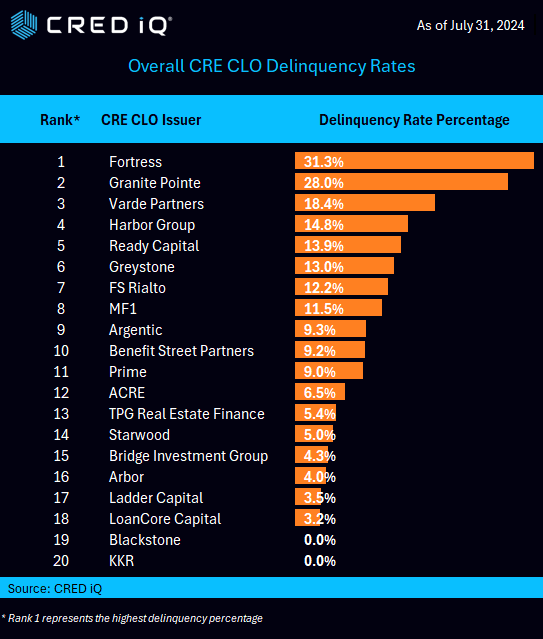

Focusing in on delinquency, Fortress saw 31.3% of their loans were in a delinquent status –notching the number one slot in this category as well, Granite Pointe was not far behind at 28.0% and Varde Partners came in a more distant third with 18.4% of their loans being reported as delinquent.

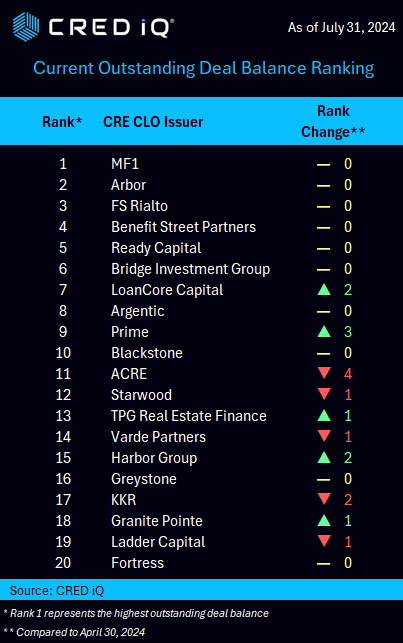

The top 6 issuers based upon outstanding deal balances did not change over the reporting period. MF1 remains in the top spot, followed by Arbor, FS Rialto, Benefit Street Partners, Ready Capital and Bridge Investment Group.

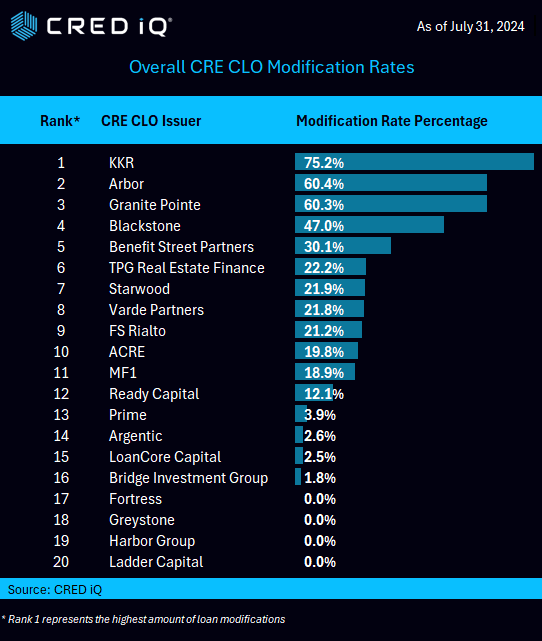

For this analysis, we also wanted to explore the percentages of loans that were modified. In this category KKR dominated the group with a whopping 75.2% of its loans modified. Second and third place was a virtual tie between Arbor and Granite Pointe with 60.4% and 60.3% respectively.

Analysis Methodology

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.