This week the CRED iQ Research team focused upon the hottest property type in CRE, the data center ecosystem. Our readers have suggested a deeper dive into this rapidly evolving segment and we are pleased to answer that call.

Fueled largely by the anticipated computing capacity required for artificial intelligence (“AI”), major investments are being made around the globe to develop data center facilities and related infrastructure.

Amazon has estimates capital investments approaching $100 billion over the next decade on AI-focused data centers, on top of the investments already made on eCommerce data centers.

Last month, the BBC confirmed that Blackstone is making a $13 billion investment in a single data center complex in England.

Our team closely examined all the latest data center originations in 2024 and we zeroed in on one of those to profile and delve deeper. We wanted to understand the underlying metrics of a typical data center loan transaction in this marketplace along with signs for trends to come.

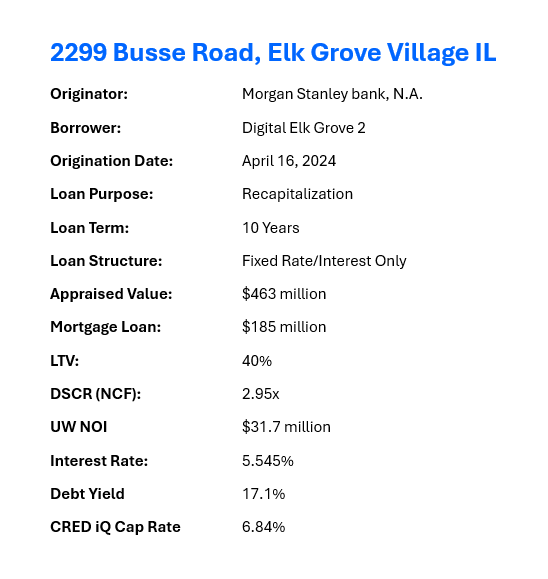

Data Center Profile

A major data center complex located in Elk Grove Village, IL, just outside Chicago’s Ohare Airport. Chicago is home to one of the world’s largest concentration of data centers with more than 747 MW of information technology capacity and 4.4 million square feet of space.

In the transaction, GI partners will acquire 75% of the borrower and contribute $202.5 million of new cash equity into a new joint venture. Digital Realty Trust L.P. (DLR), who previously owned 100% of the borrower, will maintain a 25% stake.

The asset was valued at $463 million, or $1,412/ per square foot or $17,277/per total kW capacity. Underwritten NOI amounted to $96/SF and approximately $1,181/kW. Tenants are paying between $88/SF and $157/SF in rent. On a kW basis, tenants at the property are paying between $1,141/kW and $1,657/kW. CRED iQ captures all data center activity and maintains ongoing financial and performance updates.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.