New CRED iQ Analysis from Community Bank loans dives deep into loan performance of the multifamily sector

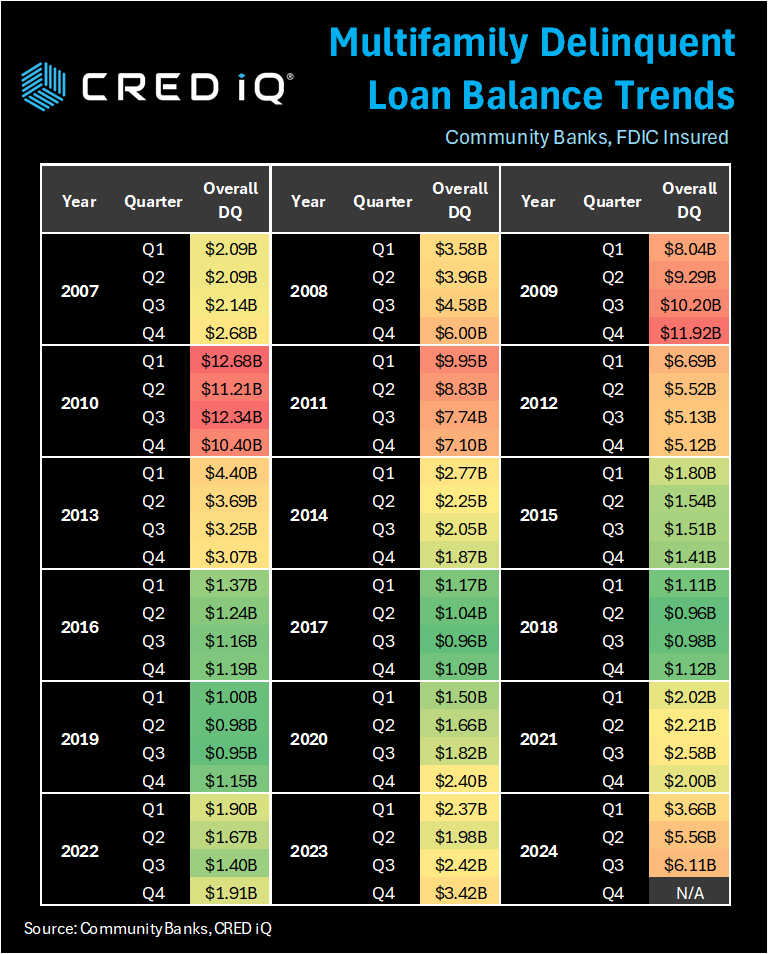

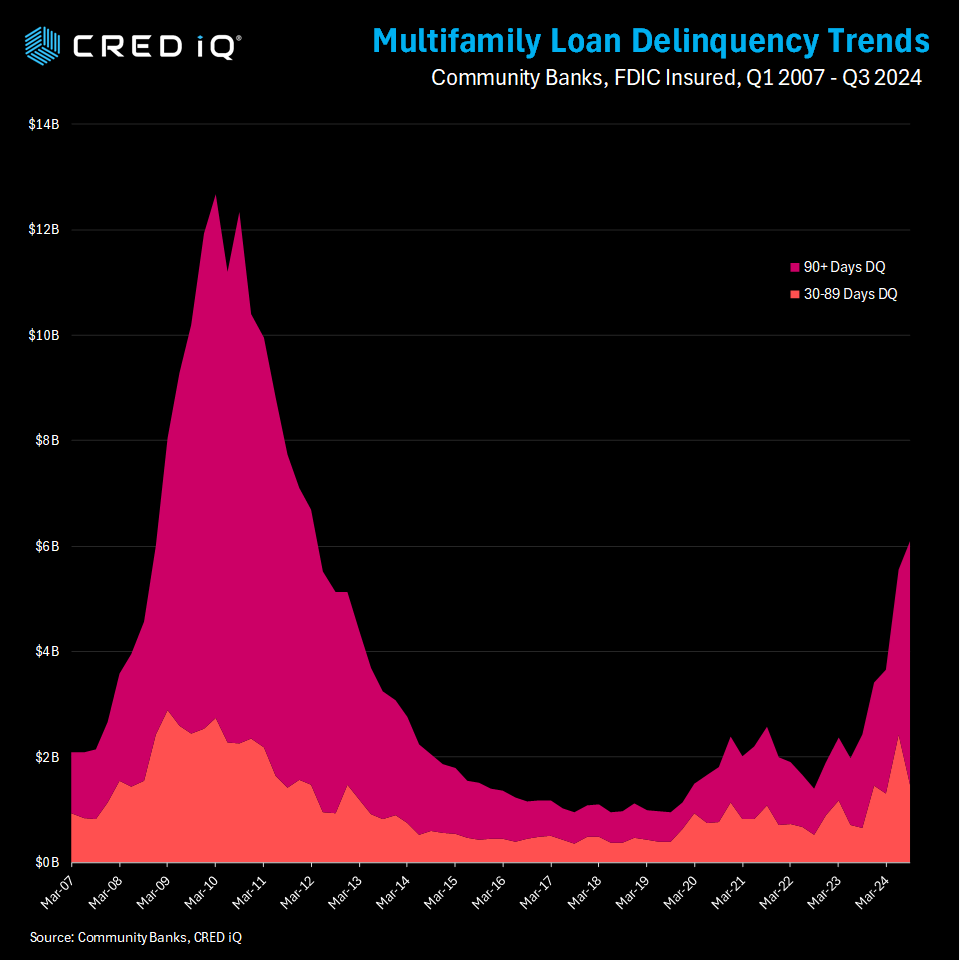

CRED iQ’s latest analysis of multifamily loans held by community bank loans shows a dramatic rise in delinquent loans and realized losses. CRED iQ’s data shows that over $6.1 billion of community bank loans secured by apartment buildings are delinquent. The $6.1 billion of delinquent loans yields a 0.97% delinquency rate based on total multifamily loan amount of $629.7 billion. CRED iQ’s definition of delinquency includes any loan that reported a payment later than 30 days, 60 days, or 90 days or worse for this analysis.

The last time there was over $6 billion of delinquent apartment loans held by community banks was in March 2012. During the peak in the great financial crisis of 2008-2010, apartment distress totaled $12.7 billion in March 2010. At that time, multifamily’s delinquency rate rose to 5.9%. It took about 4 years for the spike in delinquency to drop back down to less than 1.0%.

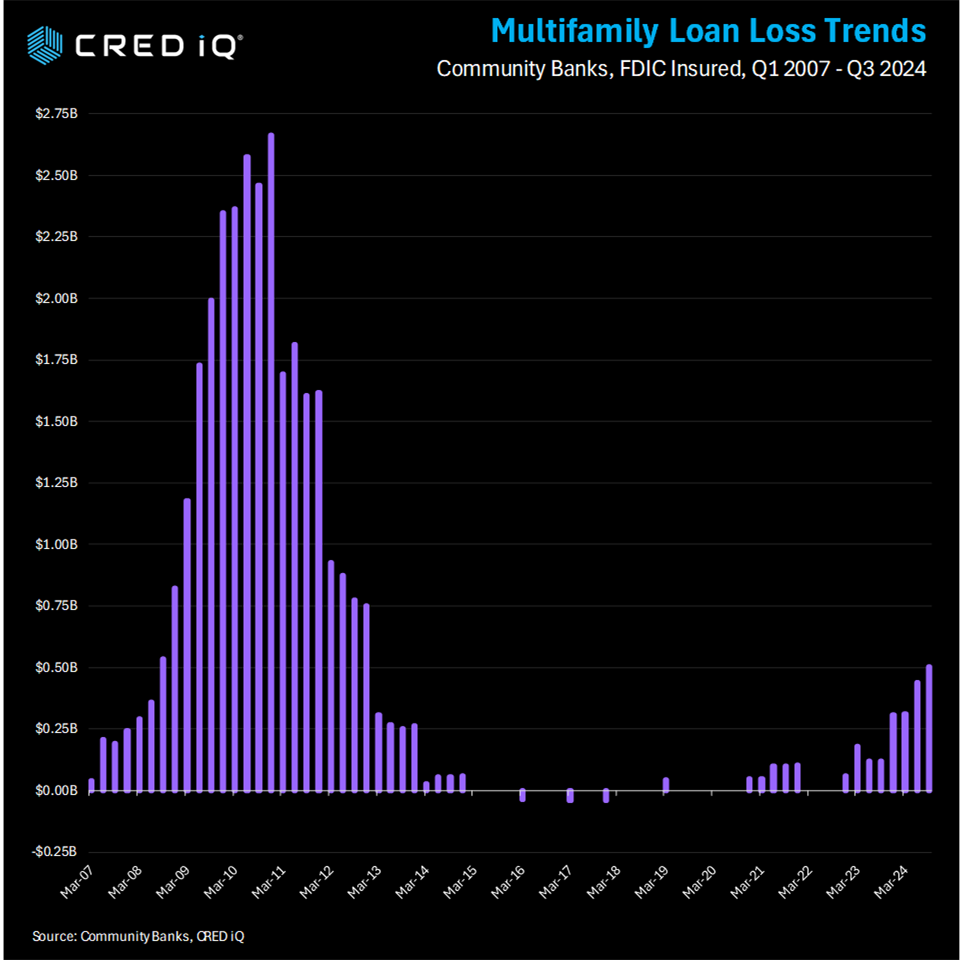

CRED iQ also examined losses attributed to apartment loans with community banks. As of September 30, 2024, total losses amounted to $504 million, the highest level since 2013. Quarterly realized losses for apartment loans reached its peak in December 2010 when it recorded losses of $2.6 billion. Realized losses have been steadily trending upwards for 8 straight quarters according to CRED iQ’s analysis.

Community Bank vs CMBS Performance

CRED iQ’s latest data, tracking over $2 trillion in CRE loans, shows a marked uptick in multifamily distress. As of January 2025, the distress rate for multifamily properties within the CMBS (Commercial Mortgage-Backed Securities) universe jumped to 12.9%—a 40-basis-point increase from December 2024. That’s a stark contrast to January 2024, when the rate lingered at a modest 2.6%. Distress here combines delinquency (loans 30+ days late) and special servicing (loans flagged for potential trouble), offering a broader lens than delinquency alone.

Breaking it down, CRED iQ’s April 2024 report offers a historical pivot point: multifamily distress spiked from 3.7% to 7.2%, driven by a massive $1.75 billion loan tied to San Francisco’s Parkmerced complex. Fast forward to January 2025, and the trend has only accelerated. While exact delinquency figures vary by month, the trajectory suggests multifamily is grappling with pressures that aren’t letting up.

Delinquency rates for multifamily loans, particularly those tied to CMBS, have been ticking upward in recent months. According to CRED iQ, a leading CMBS data provider, the multifamily delinquency rate hit 4.5% in January 2025—up from 3.8% a year prior.

The Federal Reserve’s rate hikes in 2022–2023 are still rippling through the market. Many multifamily loans originated in the low-rate era are now maturing or facing refinancing at higher costs. Owners who locked in 2–3% rates a few years back are staring down 5–6% today, straining cash flows—especially for properties with slim margins or high leverage.

What’s the outlook? CRED iQ’s data suggests 2025 could be a bumpy ride. With $500 billion in CRE loans maturing this year (a stat echoed across industry reports), multifamily faces a refinancing cliff. If rates ease—say, a 25-basis-point cut by mid-2025—some pressure might lift. But oversupply won’t vanish quickly, and big loans like Parkmerced’s (another recent default) could linger as distressed if unresolved. CRED iQ’s distress rate hit a record 11.5% across all CRE in January 2025; if multifamily keeps pacing ahead, we might see 14–15% by year-end absent a major turnaround.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.