CRED iQ’s research team explored geographic distress trends across the United States in our latest research. We ran our analysis based upon current loan balances of all of the loans CRED iQ tracks within each market and then calculated the proportion of loans that are distressed.

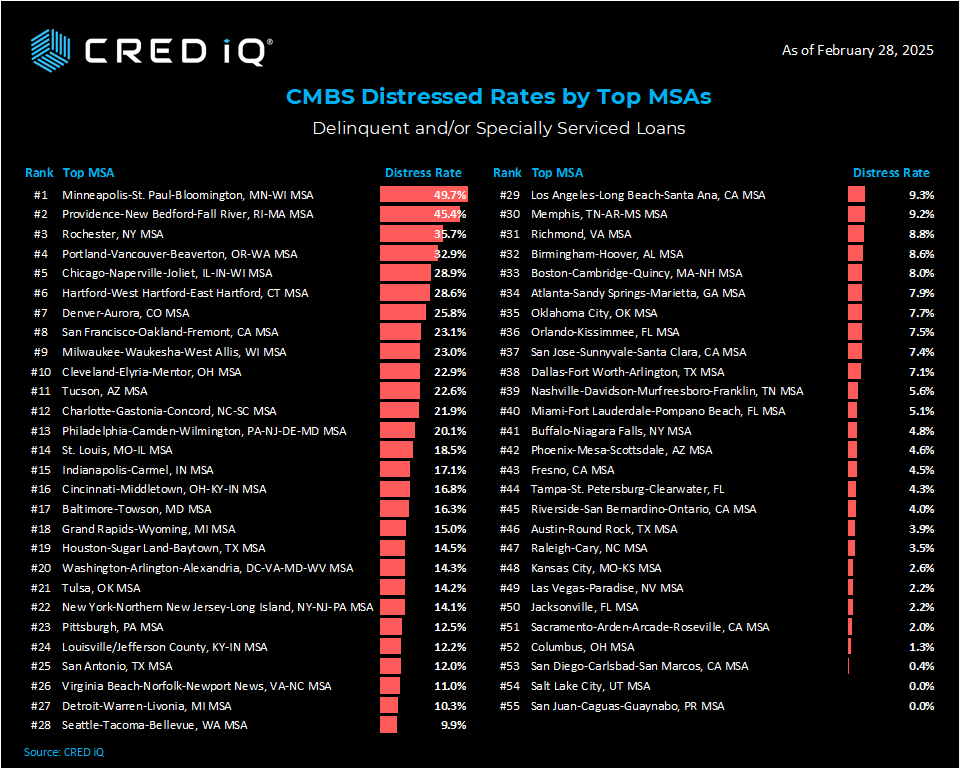

Across the top 50 MSAs, our team calculated the CRED iQ Distress Rate for each market (which combines delinquent and/or specially serviced loans).

Minneapolis logged the highest level of distress with 49.7% of their loans in distress, followed by Providence (45.4%), Rochester (35.7%), Portland-Vancouver-Beaverton(32.9%) and Chicago (28.9%) – rounding out the top 5 MSAs with the highest levels of distress. To provide perspective, the overall distress rate for all loans across every market was 10.8% as of February.

Some of the strongest performing MSAs in the top 50 include San Juan and Salt Lake City (0% distress today), while San Diego, Columbus, Sacramento, Jacksonville, Las Vegas and Kansas City all operating under 3%.

Loan Highlight

The $1.28 billion Workspace loan is backed by a 147-property portfolio consisting of mostly office and flex space throughout the country. Minneapolis is one of the top 5 markets of the portfolio, backing 13.0% ($166.4 million) of the mortgage loan. There are 19 total properties in Minneapolis, including 13 offices and 6 flex properties.

The loan transferred to the special servicer due to imminent monetary default as the loan has a July 2025 maturity date. The loan was late but less than 30 days delinquent as of the February 2025 remittance period. The portfolio is divided into two components; component A (20.3% of total mortgage balance) had 3, one-year extension options at underwriting, while component B (79.7%) doesn’t have any extension options.

Early Warning Signals

CRED iQ’s early signals of upcoming distress include loans that have been added to the servicer’s watchlist for credit-related issues. Issues include weak financial performance, low occupancy, high tenant rollover, upcoming maturity risk among other reasons to be flagged as possible troubles.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.