Hey, real estate enthusiasts! The CRED iQ Research team here, back with a fresh look at the multifamily loan landscape. This week, we’ve zoomed in on the latest trends shaking up the apartment sector, building on the community bank data from our 2025 Almanac. Buckle up—because the numbers are telling a story of rising delinquencies, slowing growth, and some eye-popping loan loss figures for 2024.

Delinquency Dollars Pile Up: $2.38 Billion in Q4 Alone

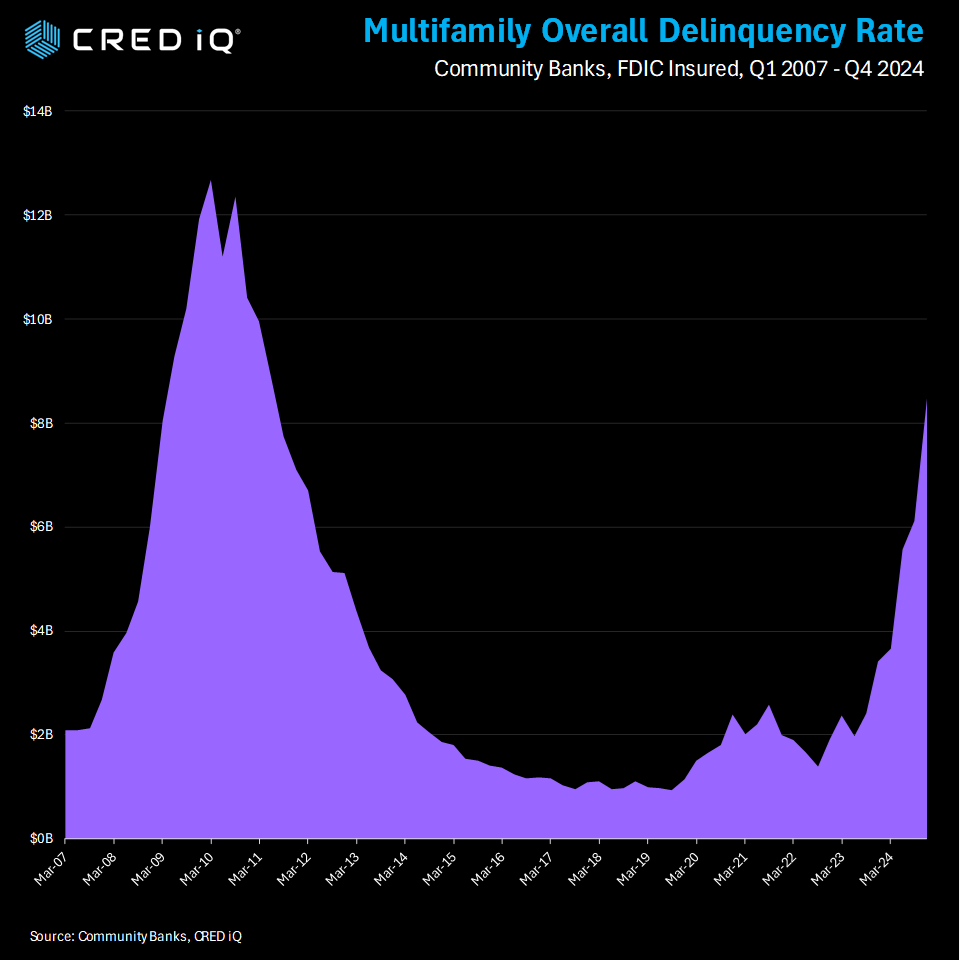

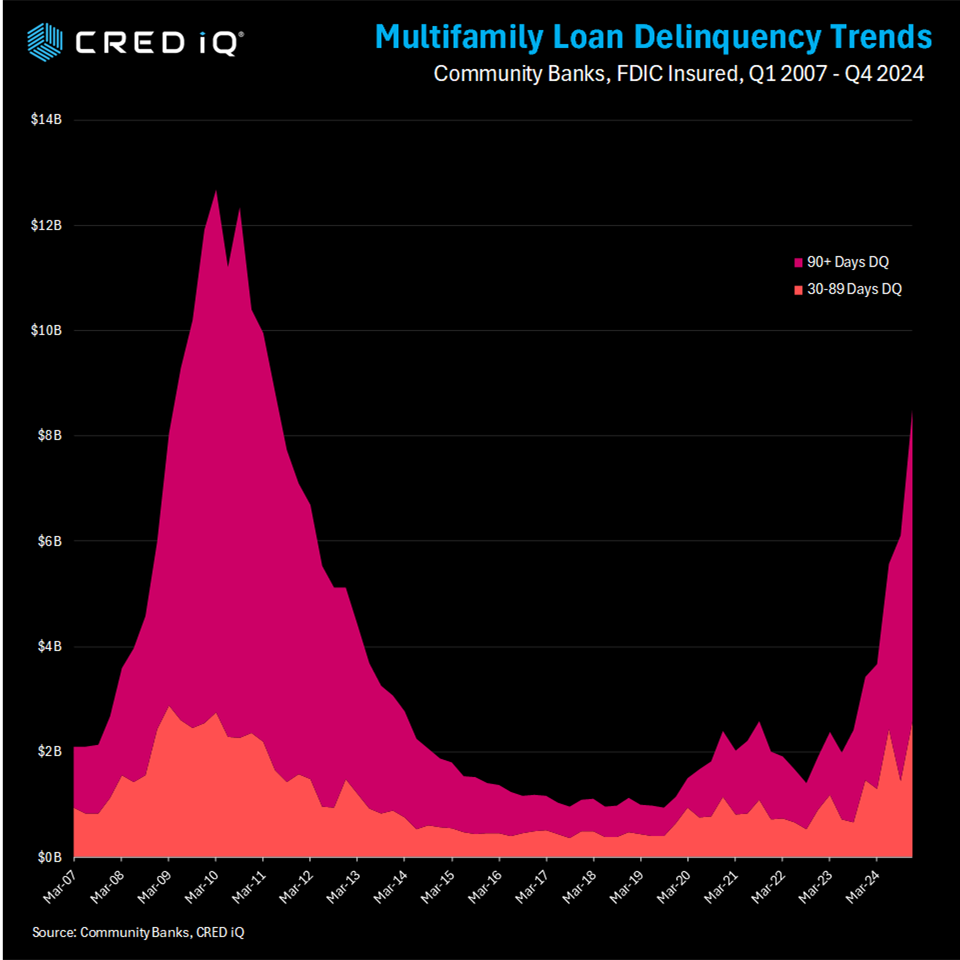

Let’s start with the headline: multifamily loan delinquencies at community banks jumped 39% from Q3 to Q4 2024, ballooning by $2.38 billion in newly delinquent loans. That brings the total delinquent balance to a hefty $8.49 billion by year-end. For context, this figure was just $6.11 billion in Q3 2024 and a modest $1.98 billion back in Q2 2023. That’s right—delinquencies have been climbing steadily since mid-2023, but 2024 turned up the heat with bigger quarter-over-quarter spikes.

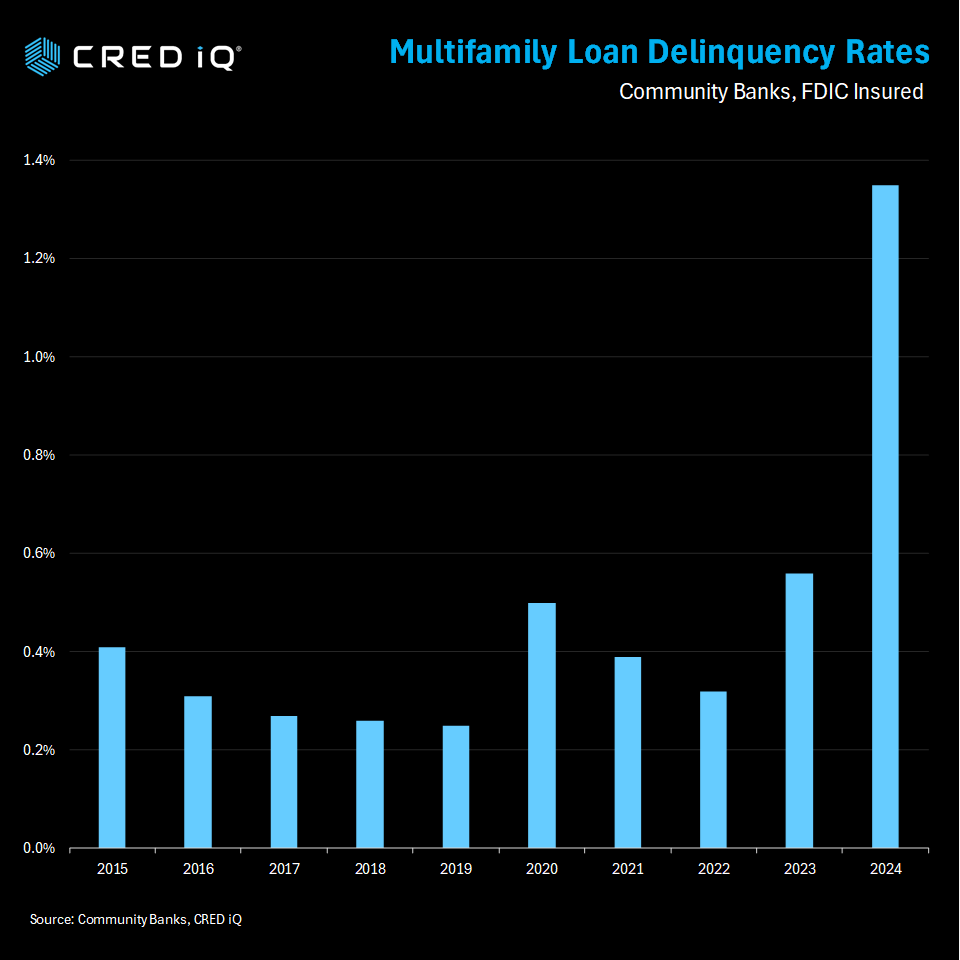

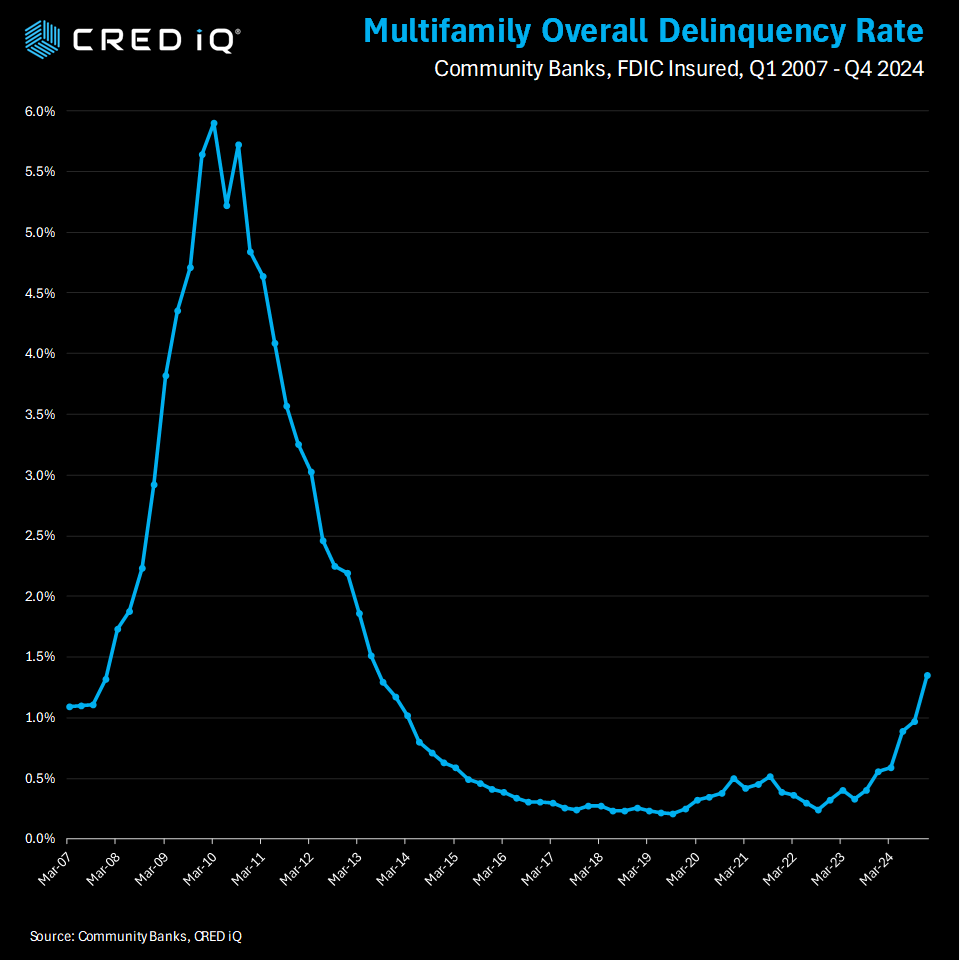

Breaking it down, the year started slow with a $234.8 million uptick in Q1 (compared to Q4 2023). Then things accelerated: Q2 added $1.90 billion, Q3 tacked on $545.6 million, and Q4 slammed the door with that massive $2.4 billion increase. By the time the calendar flipped to 2025, the delinquency rate for multifamily loans hit 1.35%—a sharp rise from 0.56% a year earlier. Q1 2025 data isn’t out yet, but the trend lines suggest this percentage isn’t slowing down anytime soon.

Growth Slows, Balances Still Climb

Over the past decade, multifamily loan balances held by community banks have swelled at a solid 7.9% average annual growth rate—from $297.4 billion in 2014 to $628.9 billion in 2024. That’s a lot of apartments! But here’s the twist: growth has hit the brakes since 2023, dropping to just 2.2% that year and ticking up slightly to 2.8% in 2024. So, while the total loan pie keeps expanding, it’s growing at a much slower pace than before—meanwhile, those delinquency cracks are widening.

Losses Sting: Realized Hits Double in 2024

If rising delinquencies weren’t enough, realized loan losses are adding salt to the wound. In 2023, community banks took a $305.8 million hit—a jaw-dropping 411% leap over 2022. Fast forward to 2024, and losses more than doubled to $691.8 million, up 126% from the year prior. That’s not just a blip—it’s a signal that the multifamily sector is feeling some serious pressure.

Why It Matters

So, what’s driving this? We dug into FDIC-insured multifamily loan data to understand how community banks—key players in this ecosystem—are exposed. The uptick in delinquencies and losses points to broader challenges: rising interest rates, softening rents, or maybe even over-leveraged borrowers. Whatever the culprits, the numbers don’t lie—this is a trend worth watching.

Stay tuned as we keep our finger on the pulse of the multifamily market. Got questions or want us to dig deeper? Drop us a line—we’re here to crunch the data and cut through the noise!

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.