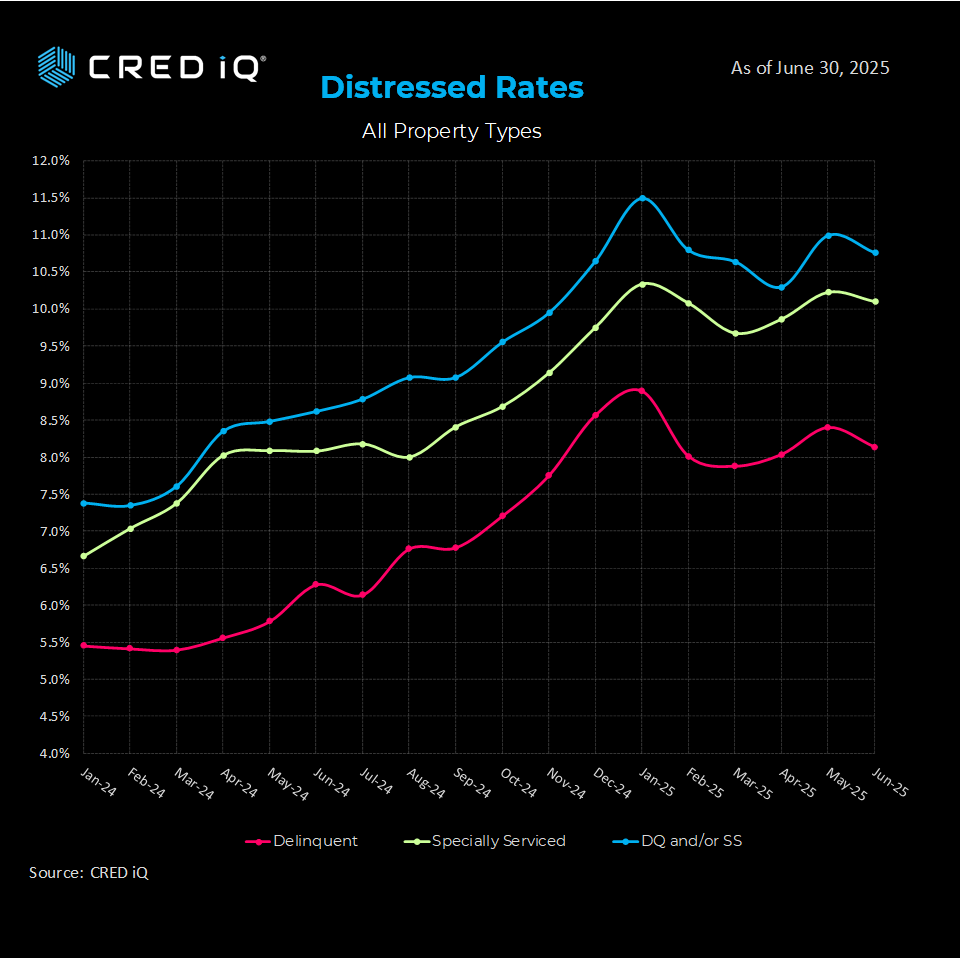

The commercial mortgage-backed securities (CMBS) distress rate shaved 20 basis points to 10.8% in June, according to CRED iQ’s latest analysis. The latest print, albeit modest, represents the fourth distress rate reduction in the past five months.

The underlying metrics also saw decreases as well. Our delinquency rate was reduced by 30 basis points to 8.1% and our special service rate shaved 10 BPS to 10.1%.

A blip on an otherwise positive distress trend, or a sign of more volatility to come. Let’s dig unpack the data for answers.

Distress Rate Trends

CRED iQ’s distress rate, a composite metric capturing loans 30+ days delinquent (or worse) and those in special servicing, came in at 10.8% in the latest reporting period. This follows last month’s 70 BPS increase, which snapped a three-month trend of distress rate reductions.

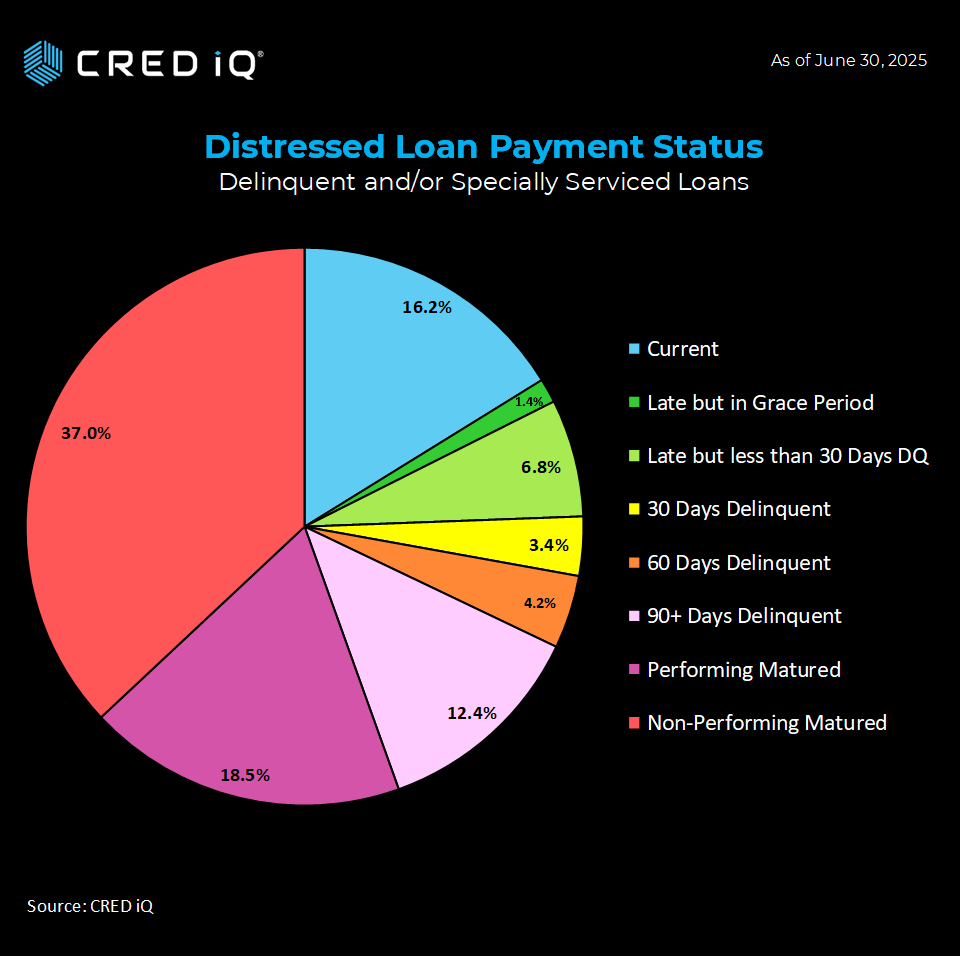

The CRED iQ research team analyzed the payment status of approximately $58 billion in distressed CMBS loans. The core objective of our research was to achieve a clear view of the current state of payment status reasons and associated near-term trending.

Payment Terms

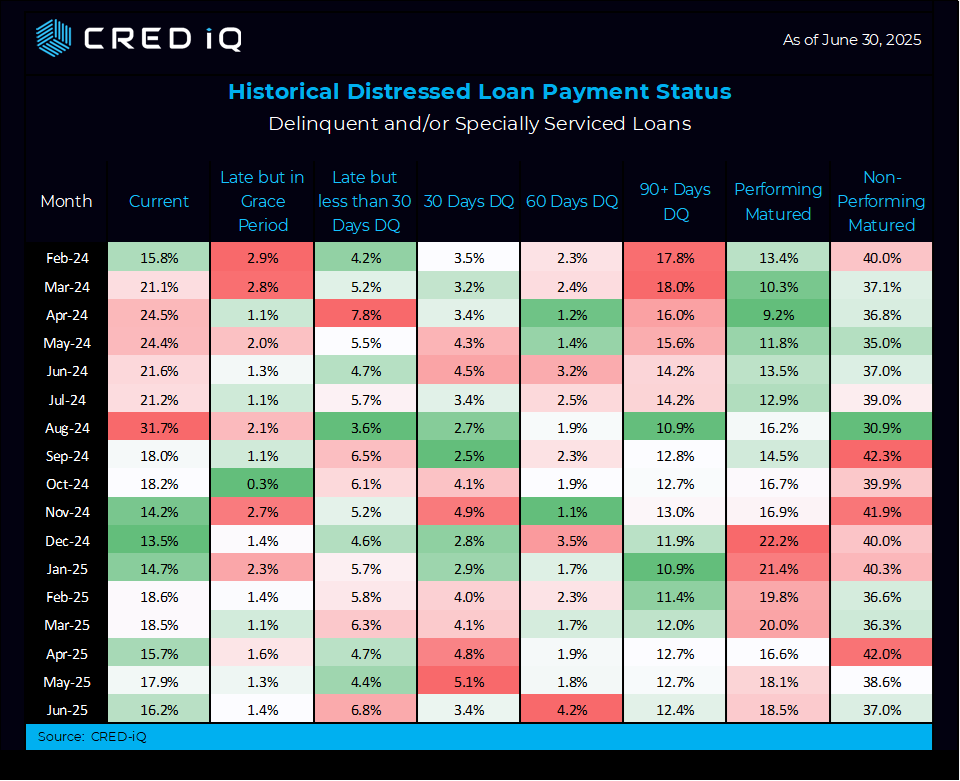

Our team then explored each payment status reason from a historical perspective. We wanted to understand the trending/evolution of each category dating back to February of 2024. Our team built a heat map which reveals trends for each category, to potential argument current forecasting models.

Current Loans: $9.4 billion in loans were current in June –that is down by ~$1 billion from the May print (17.9% to 16.2%)—partially offsetting the gain of ~$2.1 billion last month.

Delinquent Loans: $16.5 billion (28.3%) of loans are delinquent, including those within grace periods, up from $14.7 billion (25.3%) last month

Matured Loans: $32.4 billion in CMBS loans have passed their maturity date (largely flat from last month). Of these, 18.5% are performing (up from 18.1%), while 37.0% are non-performing (down from 38.6%).

Loan Highlight

The $463 million 5 Bryant Park loan, backed by a 682,988 SF office property in the Times Square South market failed to payoff at the adjusted June 2025 maturity. Originally slated to mature in June 2020, closing documents indicate the loan was subject to five 12-month extension options. The borrower has exercised all five extension periods. Year end 2024 financials reported a DSCR of 0.83 and 81% occupancy.

CRED iQ’s Methodology: A Comprehensive Approach

CRED iQ’s distress rate provides a holistic view of CMBS performance by combining delinquency (30+ days past due) and special servicing activity, including both performing and non-performing loans that fail to pay off at maturity. Our analysis focuses on conduit and single-borrower large loan structures, while separately tracking Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO metrics. This granular approach ensures CRE professionals have a clear, actionable understanding of market dynamics.

Informed with CRED iQ

As the CRE sector continues to adapt to macroeconomic shifts, CRED iQ’s comprehensive analytics offer a critical resource for decision-makers. For a deeper dive into our data or to discuss how these trends impact your portfolio, contact our team today. Stay tuned for our next update, where we’ll continue to track the metrics driving the CMBS market.

For more information, visit CRED iQ or reach out to our research team.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.

THE DATA, INFORMATION AND/OR RELATED MATERAL (“DELIVERABLES”) IS BEING OFFERED AS-IS/WHERE-AS CONDITION. CRED-IQ MAKES NO REPRESENTATION OR WARRANTY AS TO QUALITY OR ACCURACY OF SUCH DELIVERABLES BEING PURCHASED, WHETHER EXPRESS OR IMPLIED, EITHER IN FACT OR BY OPERATION OF LAW, STATUTE, OR OTHERWISE, AND CRED-IQ SPECIFICALLY DISCLAIMS ANY AND ALL IMPLIED OR STATUTORY WARRANTIES INCLUDING WARRANTIES OF MERCHANTABILITY AND OF FITNESS FOR A PARTICULAR PURPOSE, TECHNICAL PERFORMANCE, AND NON-INFRINGEMENT. WITHOUT LIMITING THE FOREGOING, YOU AS CUSTOMER ACKNOWLEDGE THAT YOU HAVE NOT AND ARE NOT RELYING UPON ANY IMPLIED WARRANTY OF MERCHANTABILITY OR OF FITNESS FOR A PARTICULAR PURPOSE OR OTHERWISE, OR UPON ANY REPRESENTATION OR WARRANTY WHATSOEVER AS TO THE DELIVERABLES IN ANY REGARDS WHATSOEVER, AND ACKNOWLEDGE THAT CRED-IQ MAKES NO, AND HEREBY DISCLAIMS ANY, REPRESENTATION, WARRANTY OR GUARANTEE THAT THE PURCHASE, USE OR COMMERCIALIZATION OF ANY DELIVERABLES WILL BE USEFUL TO YOU OR FREE FROM INTERFERENCE. BY ACCEPTANCE OF THE DELIVERABLES, YOU HEREBY RELEASE CRED-IQ AND ITS AFFILIATES AND AGENTS FROM ALL CLAIMS, DAMAGES AND LIABILITY ARISING HEREUNDER.