CRED iQ Preliminary Analysis

Deal Overview

Type: Public fixed-rate conduit CMBS

Size: $894.51 MM publicly offered certificates (total pool: $1.0074 Bn)

Issuance Date: Announced Dec 8, 2025 | Pricing week of Dec 8 | Expected closing Dec 23, 2025

Lead Bookrunners: Wells Fargo Securities, Morgan Stanley, BofA Securities, J.P. Morgan

Co-Managers: Academy Securities, Drexel Hamilton, Siebert Williams Shank

Key Pool Characteristics

Number of loans/properties: 74 loans / 91 properties

WA Coupon: 6.1615%

WA Cut-off LTV: 59.5%

WA UW NCF DSCR: 2.83x

WA UW NOI Debt Yield: 19.4%

WA Original Term: 10 years

Top 10 loans concentration: 59.5%

Loan sellers: Morgan Stanley (32.0%), Wells Fargo (24.6%), Bank of America (15.0%), National Cooperative Bank (14.8%), JPMorgan (13.7%)

Top states: NY 30.4%, FL 12.9%, CO 9.9%, CA 9.1%, VA 8.7%

Top property types: Retail 30.7%, Multifamily 19.9%, Office 17.7%, Life Sciences/Industrial 9.9%, Hotel 8.0%

Risk Retention: L-Shaped (horizontal + vertical)

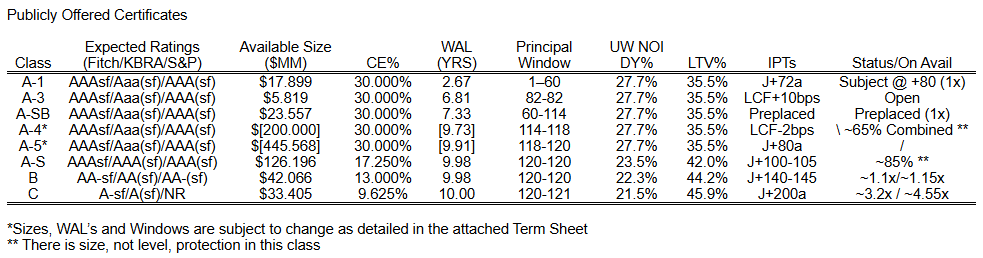

Pricing

Servicing & Parties

Master Servicers: Midland Loan Services (PNC) & National Cooperative Bank

Special Servicers: Rialto Capital Advisors & National Cooperative Bank

Data & Analytics Provider: CRED iQ

Notable: Relatively high retail exposure (30.7%) and meaningful office (17.7%) in a post-COVID environment, but strong credit metrics (59.5% LTV, 2.83× DSCR, 19.4% debt yield) and 30% credit enhancement on the AAA classes.

Key Analysis

Credit Quality and Metrics: The top 10 exhibit solid but varied underwriting, with WA LTV of 58.9% (slightly below pool average) and WA DSCR of 2.02x (below pool’s 2.83x, signaling some stress points). Debt yields are lower at WA 13.0% vs. pool 19.4%, reflecting larger loan sizes and potentially more aggressive structures. Standouts include Brentwood Commons and Market Place Center (both offices with >3.0x DSCR and >17% debt yields), indicating strong cash flow coverage. Conversely, the anchor loan—Sheraton Denver Downtown (9.9% of pool)—raises concerns with a high 76.6% LTV and thin 1.29x DSCR; as a leased-fee hospitality asset, it faces cyclical risks from tourism/occupancy volatility in Denver’s competitive market. Burke Centre (retail, 1.41x DSCR) also warrants monitoring for tenant rollover in a suburban VA strip center.

Property Type Exposure: Retail dominates at ~38% of top 10 balance ($227.6MM across four loans), aligning with the pool’s 30.7% retail tilt but amplifying sector-specific risks like e-commerce disruption and post-pandemic shifts. Premium outlets (Ellenton) and urban retail (4 Union Square South) show resilience with 2.41x and 2.49x DSCRs, but Red Rock Commons’ 1.59x coverage in a smaller Utah market adds vulnerability. Office comprises 32% ($178.5MM), concentrated in high-quality NYC CBD (255 Greenwich, stable 1.98x DSCR) and suburban assets; no major distress noted, but remote work trends could pressure renewals. Hospitality (22%, $134.8MM) is the riskiest slice, with both hotels exposed to RevPAR fluctuations—Sheraton’s elevated LTV amplifies this. Industrial (10%, single portfolio loan) provides diversification with moderate 1.55x DSCR across Midwest logistics properties.

Geographic Concentration: Diversified across 9 states, with no single state exceeding 10% of top 10 (NY at 11.6% via two retail/office loans). East Coast (NY, VA, FL, IL: ~33%) and West/Southwest (CO, CA, UT, TN: ~27%) balance urban/growth markets, while the Midwest industrial portfolio adds logistics stability. This mitigates regional downturns, e.g., no heavy Florida hurricane exposure beyond Ellenton.

Structural and Risk Considerations: All top loans feature non-recourse carve-outs and reserves for TI/LC/RE, with partial releases allowed on multi-property loans like Midwest Industrial. Key risks include hospitality sensitivity (22% exposure) and retail tenant concentration (e.g., Ellenton’s outlet mix). However, strong sponsor lineup (Morgan Stanley and Wells Fargo originate 60% of top 10) and 30% CE on AAA tranches provide buffers. Overall, the top 10 support the deal’s investment-grade ratings but underscore the need for vigilant special servicing on lower-DSCR assets like Sheraton and Burke Centre.