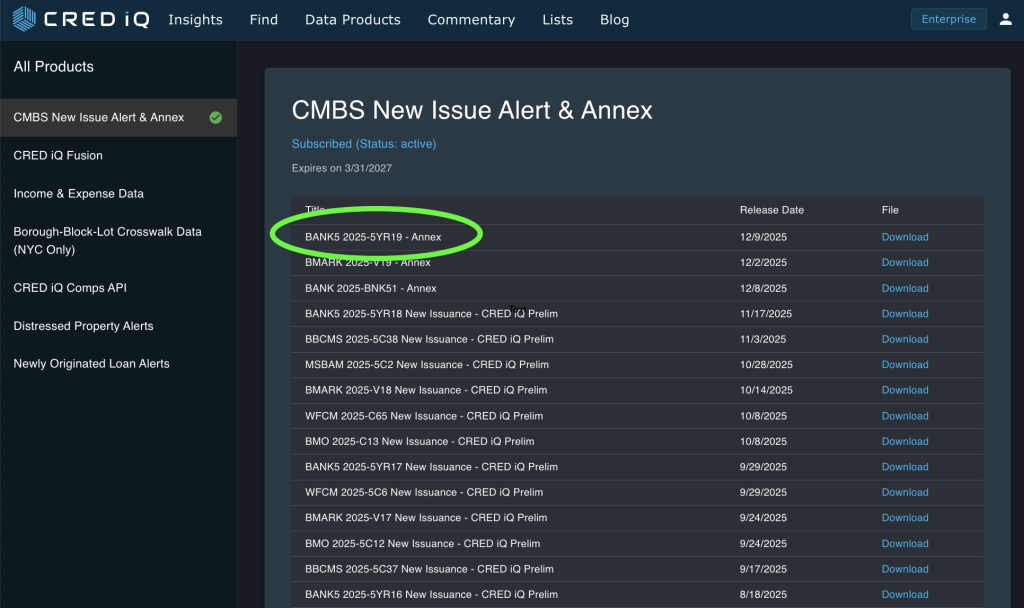

CRED iQ Preliminary Analysis

Deal Overview

Type: Public fixed-rate 5-year conduit CMBS (fully amortizing)

Size: $794.55 MM publicly offered certificates (total pool: $949.07 MM)

Issuance Date: Announced & pricing December 10, 2025 | Expected closing December 23, 2025

Lead Bookrunners: Morgan Stanley, BofA Securities, J.P. Morgan, Wells Fargo Securities

Co-Managers: AmeriVet Securities, Siebert Williams Shank

Key Pool Characteristics

Number of loans/properties: 35 loans / 85 properties

WA Coupon: 6.3181%

WA Cut-off LTV: 60.0%

WA UW NCF DSCR: 1.63×

WA UW NOI Debt Yield: 11.0%

WA Original Term / Amortization: 60 months / 60 months (100% fully amortizing)

Top 10 loans concentration: 54.2%

Loan sellers: Wells Fargo (32.0%), Bank of America (31.7%), Morgan Stanley (24.7%), JPMorgan Chase (11.6%)

Top states: CA (21.4%), NY (20.1%), VA (14.4%), FL (10.0%), TX (8.7%)

Top property types: Multifamily (27.8%), Retail (26.6%), Hotel (17.1%), Manufactured Housing (11.0%), Self-Storage (10.6%)

Risk Retention: Eligible Vertical Interest (EVI)

Servicing & Parties

Master Servicer: Trimont LLC

Special Servicer: Torchlight Loan Servicers, LLC

Data & Analytics Provider: CRED iQ

Notable: One of the very few fully amortizing 5-year fixed-rate conduits to price in 2025 and the final new-issue conduit of the year. Tight credit band (60% LTV, 11% NOI debt yield, 1.63× DSCR) reflects the highly selective lending environment for short-duration paper. Heavy combined retail + hotel exposure (43.7%) in total pool, likely higher in top 10) stands out in an otherwise conservative structure.

Key Analysis

Credit Quality and Metrics: The pool is deliberately underwritten to a tight credit profile typical of 5-year money, with rapid de-levering from full amortization (projected pool LTV 30% at maturity). The 11.0% NOI debt yield is among the strongest seen in recent 5-year deals, though the 1.63× NCF DSCR is thin by 7/10-year standards — a function of elevated 5-year rates (6.32%) rather than aggressive advance rates. Top-10 concentration is moderate at 54.2%, providing reasonable granularity for a 35-loan pool.

Property Type Exposure: Multifamily (27.8%) and retail (26.6%) dominate, followed by a meaningful hotel sleeve (17.1%). The retail exposure is likely anchored/grocery or necessity-based given the low LTV and strong debt yield, while the hotel piece introduces the most cyclical risk in a 5-year bullet-like payoff structure (despite amortization). Manufactured housing (11.0%) and self-storage (10.6%) add stable, cash-flowing collateral with low operating-expense volatility.

Geographic Concentration: Well diversified across top five states (none >21.4%), with exposure skewed toward coastal and Sunbelt growth markets (CA, NY, VA, FL, TX = 74.6% combined). Minimal overlap with recent natural disaster zones.

Structural and Risk Considerations

All loans are non-recourse with standard carve-outs and include TI/LC and capex reserves; partial releases are allowed on select multi-property loans under customary tests. Primary risks stem from the 17.1% hotel and 26.6% retail exposure — cyclical RevPAR sensitivity in hospitality and potential shadow-anchor/tenant-roll issues in retail. These concerns are meaningfully offset by the pool’s tight 60.0% LTV, strong 11.0% NOI debt yield, thick 30% AAA credit enhancement, and 100% five-year full amortization that eliminates maturity risk. A blue-chip originator lineup (WFB, BANA, MS, JPM) and Torchlight’s aligned role as both special servicer and controlling class rep further bolster the structure. Overall, BANK5 2025-5YR19 stands out as one of the most defensive 5-year conduits of 2025.