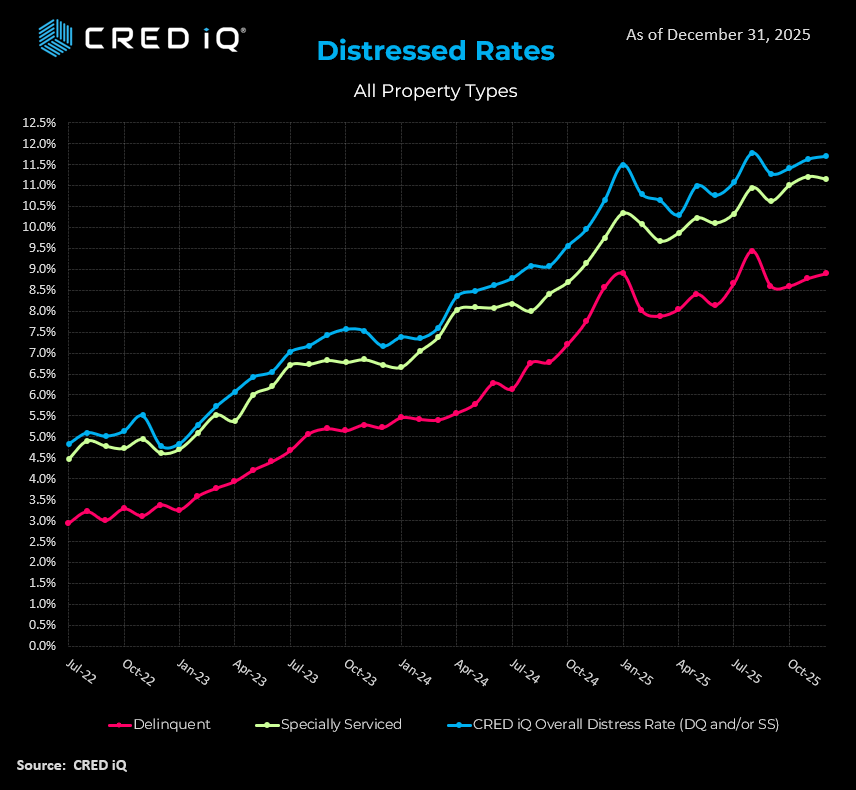

The commercial mortgage-backed securities (CMBS) market continues to grapple with elevated distress levels, as evidenced by CRED iQ’s latest data for December 2025. The overall distress rate—encompassing loans that are either delinquent or specially serviced—rose to 11.70%, representing the third consecutive monthly increase. This uptick follows a delinquency rate of 8.89% (up from 8.78% in November) and a specially serviced rate of 11.15% (slightly down from 11.21% in the prior month).

These metrics highlight a persistent trend where loans are increasingly entering special servicing due to maturity defaults, imminent balloon risks, and operational challenges, even as some assets show signs of stabilization. The narrowing gap between delinquency and special servicing rates suggests proactive transfers for workouts, often before payments formally lapse. Office properties remain the most vulnerable sector, while multifamily and retail assets exhibit mixed performance, with refinancing hurdles exacerbating distress in otherwise viable loans.

Loan-Level Insights: Key Transfers Illustrating Distress Trends

To provide deeper context, CRED iQ examined several recent transfers to special servicing across CMBS, CRE CLO, and agency deals. These examples underscore the multifaceted drivers of distress, including maturity defaults, cash flow erosion from low occupancy, and sector-specific headwinds. Resolutions are progressing through strategies such as asset dispositions, collections, and refinance negotiations.

Alamo Towers Portfolio – FORT 2022-FL3 (CRE CLO | Office | San Antonio, TX)

This $12.5 million office loan, secured by a 182,748 SF portfolio in San Antonio’s North Central submarket, transferred to special servicing in December 2025 due to a balloon payment/maturity default. Classified as non-performing matured, the asset reports occupancy of approximately 46% and a DSCR of 0.46x, indicating severe cash flow impairment. The special servicer, FORT CRE Special Servicing LLC, is advancing a disposition strategy: Plaza Towers is slated for a $2.2 million sale by year-end 2025, Alamo Towers for $11.2 million with a February 2026 closing, and the remaining Onyx asset expected to hit the market in Q1 2026. This case exemplifies the office sector’s ongoing leasing challenges and the shift toward liquidation amid weak demand.

4520 S Drexel Boulevard – BANK 2022-BN43 (Conduit | Multifamily | Chicago, IL)

A $15.4 million multifamily loan backed by a 68-unit property in Chicago’s South Side transferred to special servicing for payment default, currently 30 days delinquent. Constructed in 1922 and renovated in 2021, the asset has seen occupancy drop to 85% from 95% at underwriting, with DSCR falling to 0.98x from 1.23x at year-end 2023. Contributing factors include reduced rental income and elevated expenses for repairs, utilities, and apartment turnovers. Recent inspections flagged deferred maintenance issues, such as microbial growth and exposed wiring. Collections are in process, with the servicer engaging the borrower on remediation. This transfer highlights idiosyncratic multifamily distress tied to operational inefficiencies rather than broader market weakness.

Princeton Court Apartments – FREMF 2016-K53 (Agency | Multifamily | Frederick, MD)

This $11.3 million agency loan, collateralized by a 159-unit multifamily complex built in 1986 and renovated in 2013, entered special servicing following a October 2025 maturity default. Despite the non-performing matured status, fundamentals are robust: occupancy stands at 96%, and DSCR exceeds 2.1x. The special servicer, CWCapital, is reviewing files to determine a workout, with full payoff or refinance as potential paths. Unlike many distressed assets, this loan’s issues stem primarily from refinancing friction in a high-interest environment, illustrating how maturity walls can impact even high-performing properties.

Brier Creek Corporate Center I & II – WFCM 2016-C33 (Conduit | Office | Raleigh, NC)

Secured by two adjacent office buildings totaling 180,955 SF in Raleigh’s RTP/RDU submarket, this $18.9 million loan transferred to special servicing amid imminent maturity default and chronic cash flow shortfalls. Occupancy has plummeted to 37% following the 2021 exit of a major tenant occupying 50% of space, triggering cash sweeps and yielding a negative DSCR of -0.33x. The sponsor remains committed, with recent leasing activity boosting occupancy slightly, but progress is slow. Rialto Capital is overseeing collections as maturity approaches in December 2025. This example underscores the office sector’s vulnerability to tenant churn and the challenges of repositioning assets in competitive markets.

Williamsburg Premium Outlets – Multiple (Conduit | Retail | Williamsburg, VA)

A $185 million retail loan backed by a 522,133 SF outlet center in Williamsburg, VA, moved to special servicing in December 2025 due to imminent balloon risk ahead of its February 2026 maturity. Currently late but less than 30 days delinquent, the property maintains 78% occupancy and a DSCR of 2.17x—solid but below the 2.52x underwriting level. Midland Loan Services is initiating borrower discussions on refinance options. This transfer reflects retail’s bifurcation: strong cash flow from well-positioned assets contrasted with capital markets barriers to payoff.

Broader Implications and Outlook

These cases reveal a market in transition, where office distress dominates due to structural shifts, while multifamily and retail challenges are more tied to refinancing dynamics. Maturity defaults are the leading trigger, even for assets with stable operations, amid elevated interest rates and cautious lending. CRED iQ anticipates continued monitoring as special servicers pursue resolutions, with potential for increased dispositions and modifications in early 2026. Stakeholders should prepare for ongoing volatility, prioritizing assets with resilient cash flows and proactive capital strategies.