SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

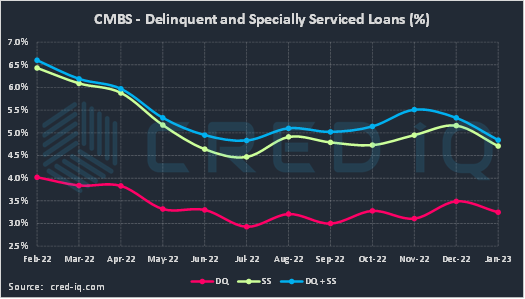

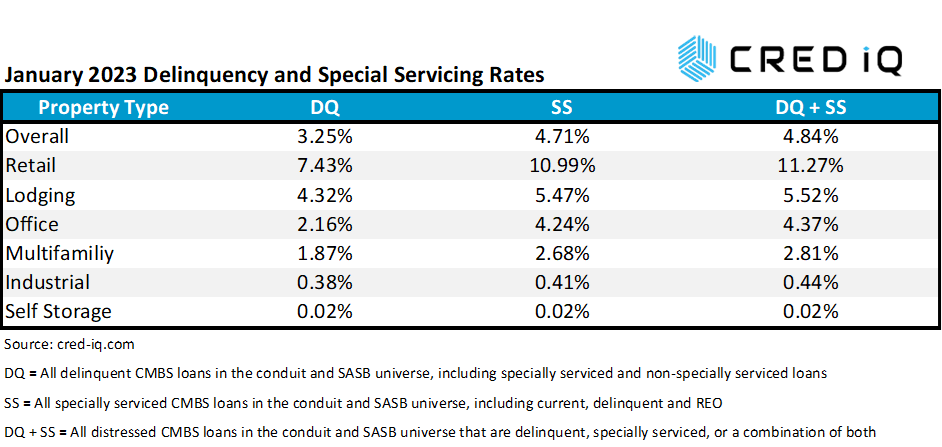

The CRED iQ delinquency rate for CMBS started 2023 with a downswing compared to the previous month. The delinquency rate for the January 2023 reporting period was 3.25%, which was approximately a 7% decline compared to 3.49% as of December 2022. The delinquency rate is equal to the percentage of all delinquent specially serviced loans and delinquent non-specially serviced loans, for CRED iQ’s sample universe of $600+ billion in CMBS conduit and single asset single-borrower (SASB) loans. CRED iQ’s special servicing rate, equal to the percentage of CMBS loans that are with the special servicer (delinquent and non-delinquent), also declined month-over-month to 4.71% from 5.16%. Aggregating the two indicators of distress – delinquency rate and special servicing rate – into an overall distressed rate (DQ + SS%) equals 4.84% of CMBS loans that are specially serviced, delinquent, or a combination of both. In parallel with the delinquency rate and special servicing rate, the overall distressed rate decreased compared to the prior month’s distressed rate of 5.33%. Distressed rates generally track slightly higher than special servicing rates as most delinquent loans are also with the special servicer.

SS = All specially serviced CMBS loans in the conduit and SASB universe, including current, delinquent and REO

DQ + SS = All distressed CMBS loans in the conduit and SASB universe that are delinquent, specially serviced, or a combination of both

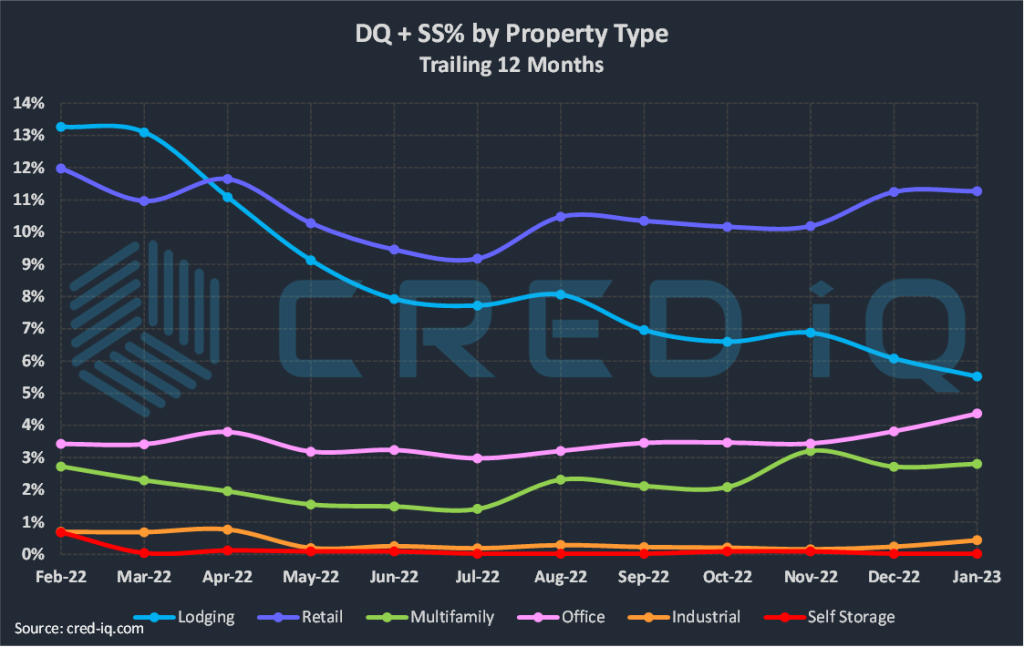

By property type, loans secured by office properties exhibited the sharpest jump in delinquency. The delinquency rate for office increased to 2.16%, compared to 1.76% as of December 2022. The surge was equal to a 23% month-over-month increase. Office delinquency as of January 2023 is at its highest level over the past 12 months. One of the largest loans to become delinquent this month was a $120 million mortgage secured by Charlotte Plaza, a 632,283-SF office tower in Charlotte, NC. The loan defaulted at maturity in January 2023 after multiple years of occupancy struggles.

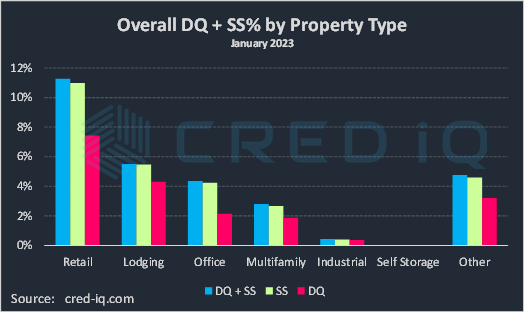

Retail maintained its position as the property type with the highest delinquency rate, equal to 7.43% as of January 2023. The delinquency rate for lodging was second-highest, equal to 4.32%. Both retail and lodging delinquency rates exhibited month-over-month declines. The delinquency rate for multifamily (1.87%) declined compared to December 2022 while the delinquency rate for industrial (0.38%) increased modestly.

Focusing on special servicing rates by property type, loans secured by office (4.24%) exhibited the largest month-over-month increase among all property types. As of January 2023, the special servicing rate for office was at a 12-month high. The sharp increase in the percentage of specially serviced loans was driven by a $277.1 million senior floating-rate mortgage secured by the Wells Fargo Center, a 52-story, 1.2 million-SF office tower located in Denver, CO. The loan had an initial maturity date in December 2021, but the borrower exercised one of its three, one-year extension options at the time, which pushed maturity to December 2022. The extended December 2022 maturity date was synchronous with the expiration of an interest rate cap agreement. The interest rate expiration may have contributed to the borrower’s decision not to move forward with a second maturity extension given the relatively high costs of one in a rising rate environment. The loan went into maturity default in December 2022 and transferred to special servicing. This is the second consecutive month with a high-profile maturity default reported for a loan secured by a Denver office tower. Last month, CRED iQ’s December 2022 Delinquency Report detailed the special servicing transfer of Republic Plaza, which was also caused by maturity default.

The special servicing rates for multifamily (2.68%) and industrial (0.41%) increased compared to last month. Retail (10.99%) and lodging (5.47%) exhibited declines in respective percentages of specially serviced loans.

CRED iQ’s CMBS distressed rate (DQ + SS%) by property type accounts for loans that qualify for either delinquent or special servicing subsets. This month, the overall distressed rate for CMBS declined to 4.71%, which was aided by lower distress in lodging and retail. However, the distressed rate for office increased by 14% to 4.37% this month following the aforementioned maturity defaults of loans secured by Charlotte Plaza and Wells Fargo Center. For additional information about these two loans, click View Details below:

| [View Details] | [View Details] | |

| Loan | Wells Fargo Center | Charlotte Plaza |

| Balance | $243,621,128 | $120,000,000 |

| Special Servicer Transfer Date | 12/21/2022 | – |

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform designed to unlock investment, financing, and leasing opportunities. CRED iQ provides real-time property, loan, tenant, ownership, and valuation data for over $2.0 trillion of commercial real estate.