For many years, the commercial real estate market has been predicting the decline of traditional malls due to the rapid growth of E-Commerce and the decreasing revenues generated by traditional mall tenants.

The adage “Only the strong survive” aptly characterizes the situation for American malls. However, it’s worth noting that students still favor physical malls for their back-to-school shopping. In terms of monthly statistics, Outlet Malls have experienced a growth of approximately 18% in volume, while renovated Indoor Malls have seen a monthly increase of around 7%, as reported by Placer.AI.

Industry data indicates American Mall year-over-year increase of around 5% in sales per square foot. Fran Horowitz, the CEO of Abercrombie & Fitch, affirms that the brand remains popular among late teens and early 20s demographics. Even though consumers might research Hollister products online, the data reveals that the majority of transactions continue to occur within physical stores. Abercrombie & Fitch has reported for the 2022 fiscal year online sales represented 44%. So, a majority of shoppers are still purchasing products in Abercrombie & Fitch’s brick and mortar locations.

An annual assessment of approximately 1,000 malls, and among them, they have improved 250 American malls by effectively filling anchor spaces and enhancing inline tenancy. According to industry statistics, “B” malls have exhibited notable resilience, demonstrating their capacity to regain stability in the aftermath of the pandemic.

Mall operators Simon Properties and Tanger Factory have reaped notable benefits from substantial enhancements to their individual mall portfolios. The recent bankruptcies of retailers such as Bed Bath & Beyond, The Christmas Tree Shop, and Tuesday Morning primarily affected dark spaces within Strip Center malls.

As the process of filling in vacant anchor spaces progresses, there has been a notable trend of Dick’s Sporting Goods occupying a considerable amount of these empty areas. Additionally, in certain instances, vacant spaces are being considered for occupancy by grocery stores. Another approach involves repurposing these large, unoccupied anchor spaces into smaller units, potentially for purposes like gyms or even satellite locations for colleges.

As vacant anchor spaces begin to get leased out, this development also proves advantageous for in-line tenants. Many of these in-line stores have Co-Tenancy clauses in their leases, which allow them to terminate their leases prematurely in the event of an anchor store’s closure.

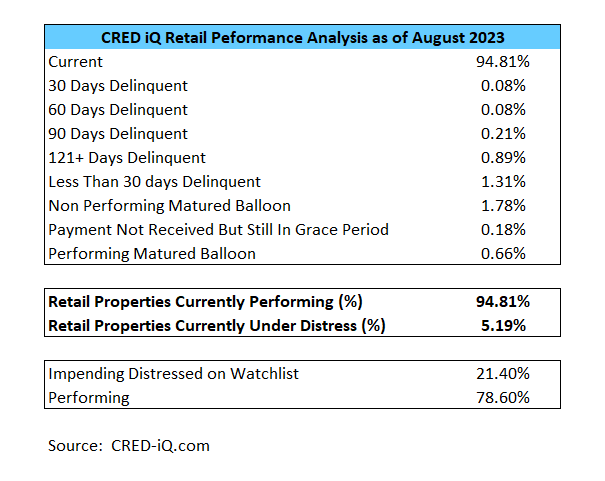

CRED iQ has conducted a comprehensive assessment of our database encompassing retail properties in the U.S. with outstanding loan balances exceeding $1 million. Based on our analysis, the table below indicates that retail properties exhibit a delinquency rate slightly surpassing 5%. Further insights into our retail assets, categorized by loan payment status, can be found in the detailed breakdown provided below.

While the commercial real estate market has often displayed a negative sentiment towards the Retail Sector, particularly American malls, it’s becoming more apparent that these malls are showcasing a remarkable level of resilience.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.