Arbor is Not Alone…

CRED iQ took a deep dive into the CRE CLO ecosystem to better understand the rapidly growing distress rates in this space. CRED iQ excludes CRE CLO deals from our monthly delinquency reports but decided to zero in on this important sector on a stand-alone analysis. Following the news of Arbor’s distress level recently, we also wanted to understand how other CRE CLO issuers are faring in this marketplace.

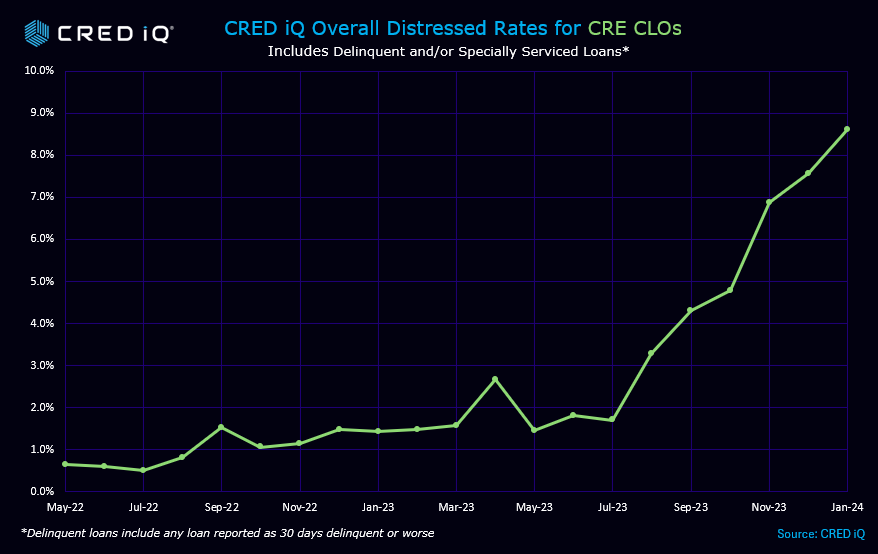

CRED iQ’s Overall Distress Rate for CRE CLO surged in 2023—from 1.4% to 7.4% and jumping even further in January to 8.6%. This metric includes any loan that reported 30 days delinquent or worse as well as any loan that is with the special servicer.

Outstanding CRE CLO loans amount to approximately $80 billion in loans. The vast majority of these CRE CLO loans are structured with floating rate loans with 3-year loan terms equipped with loan extension options if certain financial hurdles are met. Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto, and TPG.

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Many of these loans were originated in 2021 at times where cap rates were low, valuations high, low interest rates, and are starting to run into maturity issues given the spike in rates.

CRED iQ’s analysis uncovers that in the course of 12 months, the amount of CRE CLOs under distress ballooned from $1.3 billion in February 2023 to over $6.8 billion as of the latest January 2024 reporting period. Distress levels grew over 440% over the past 12 months. The sudden spike up started happening in July and August 2023 when distressed rates were around 1.7%, and then each month started increasing by an average of 1.2% each month. The latest distressed levels total 8.6% for all of CRE CLO loans as of January 2024.

CRE CLO Office Loan

700 Louisiana and 600 Prairie Street is a 1,259,314-SF high-rise office property in downtown Houston, TX, is backed by a $232.0M initial loan with a fully funded commitment of $252.0M. The interest-only loan failed to pay off at its September 2023 maturity date and has only paid through September. The 56-story office tower was built in 1983 and renovated in 2011. The asset was appraised as-is at $403.0M at underwriting in June 2023 based on 66.7% occupancy at of April 2019. A 0.77 DSCR (NCF) and 65.8% occupancy was reported in the September 2023 financials. The largest tenant, TransCanada USA Pipeline, represents 23.0% of the net rentable area (NRA) with a lease scheduled to expire in February 2036. The remaining tenants each represent 4.0% or less of the NRA.

Multifamily Loan

An example of upcoming distress despite a “current” loan status is Caden at East Mil. The Caden at East Mill is a 768-unit multifamily property in Orlando, FL, backed by a $98.9M loan that was originated by Arbor. The loan is scheduled to mature in October 2024 with a fully extended maturity date in October 2026. The most recent financials from year-end 2022 reported a 0.65 DSCR (NCF), down from 1.56 at contribution in September 2021. The property was 96.2% occupied and valued at $120.1M in September 2021, at underwriting. Occupancy at the property fell to 85.6% as of November 2023.

About CRED iQ

CRED iQ is a commercial real estate data, analytics, and valuation platform providing actionable intelligence to CRE and capital markets investors. Subscribers use the platform to identify valuable leads for leasing, lending, refinancing, distressed debt, and acquisition opportunities.

The platform also offers a highly efficient valuation engine which can be leveraged across all property types and geographies. Our data platform is powered by over $2.0 trillion in transactions and data covering CRE, CMBS, CRE CLO, Single Asset Single Borrower (SASB), and all of GSE / Agency.