CRED iQ analyzed recent loans issued this year and compared them to loans from a decade earlier. Our analysis compared underwriting of the same asset for two different loans during two different commercial real estate cycles. One was in 2011 that was fresh out of the great financial crisis of 2008/2009 and the most recent loan was issued in December 2023.

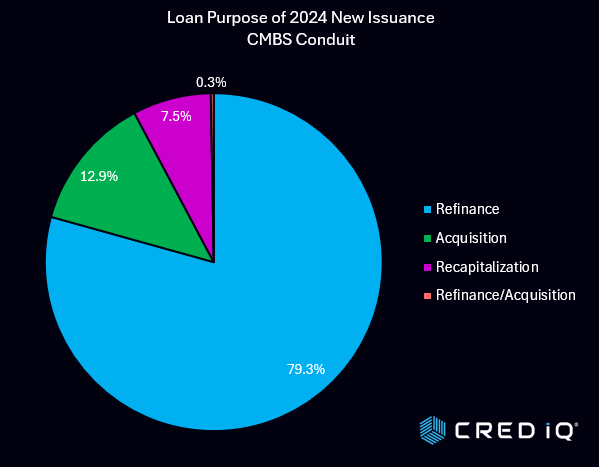

This week’s Tale has special significance when we look closely at today’s CMBS marketplace. The latest new issuances this year feature a a predominance of refinancing transactions. Refinancing accounted for 79% of the loan activity across 2024 new issuances thus far, with recapitalization taking on another 7.5%. Only a relatively modest 12.9% of the underlying loans represented acquisitions. Refinance & Recapitalizations totaled approximately $5.6 billion while acquisition volume was only $827 million.

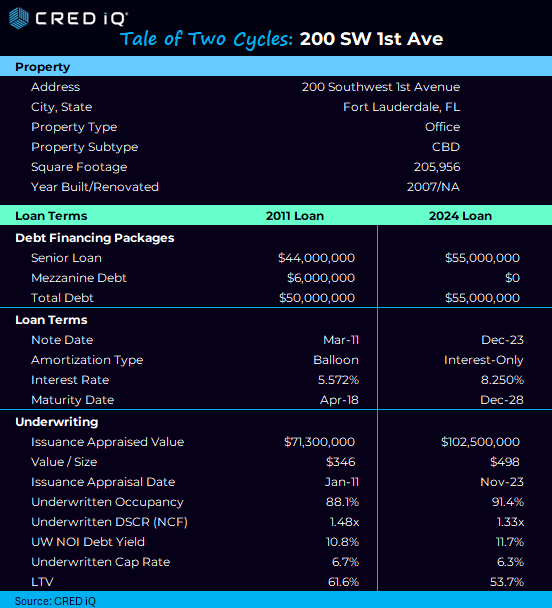

Now let’s compare two loans on the same Fort Lauderdale property – one in 2011 and the second from four months ago in December 2023.

Property

200 Southwest 1st Avenue is a 17-story, Class-A office tower containing 205,956 SF in downtown Fort Lauderdale. The property was built in 2007. The tower which is often referred to as the Auto Nation building originated at high occupancy rates of 88.1% and 91.4% in 2011 and 2024 respectively.

2011 Loan

In January of 2011 the loan was originated with a 5.572% interest rate on an appraised value of $71,300,000 ($346/SF) and an underwritten cap rate of 6.7% and a LTV of 61.6%. The balloon structure carried maturity date of April of 2018 and included mezzanine debt of $6,000,000. Average rents based on the 2011 rent roll were $19.81, which is significantly lower than today’s average rent of $28.03, a 41.5% increase.

2024 Loan

In December of 2023 an interest-only loan was originated at an 8.250% interest rate with a 5-year term. The issuance appraised value was $102,500,000 ($498/SF). The Underwritten Cap Rate was 6.3% with an LTV of 53.7% and a maturity date of December 2028. Underwritten DSCR was 1.33x compared to the 2011 underwriting of 1.48x. The newer loan’s interest rate is 270 basis points higher than the 2011 loan.

Understanding how loans are refinancing are key to forecasting in this new market…for most borrowers and investors, it is indeed a tale of two cycles.