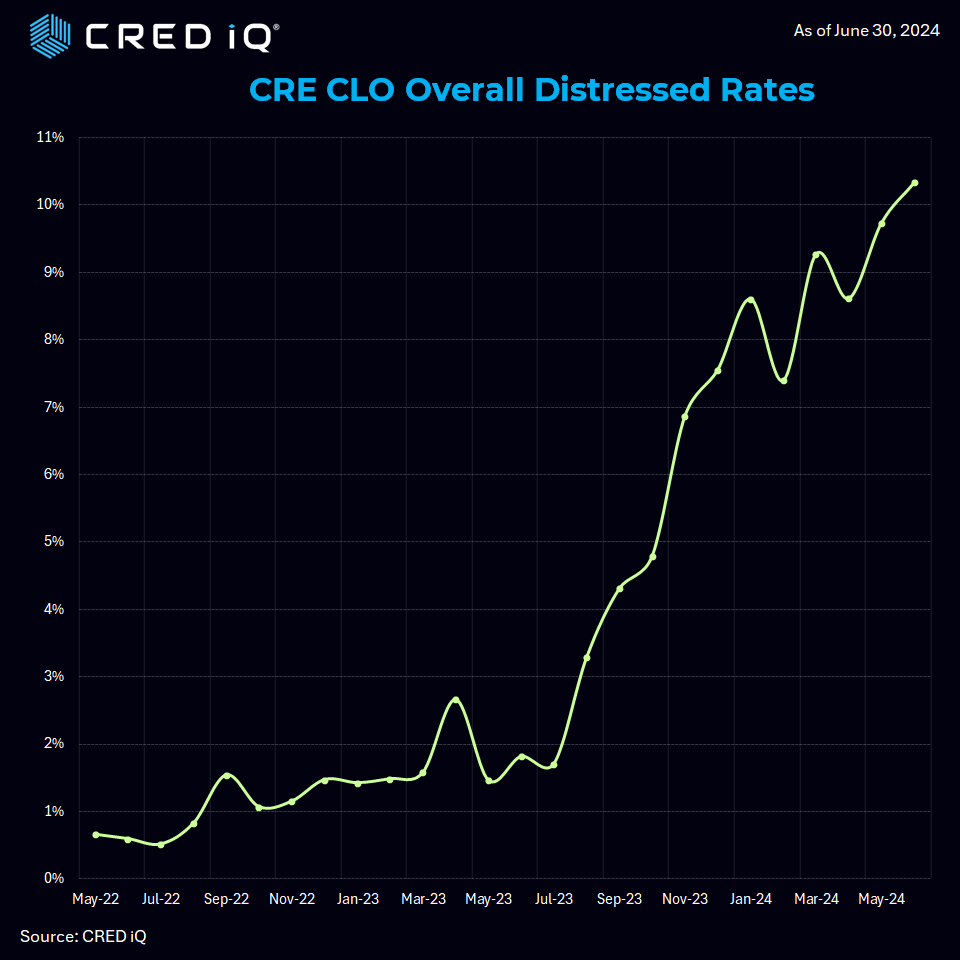

The CRED iQ research team continued its examination of the CRE CLO ecosystem as the CRE CLO distress rate reached 10.3%, an increase of 60 basis points since our June report. This includes any loan reported 30 days delinquent, past their maturity, specially serviced, or a combination of these. We also examined the most recent property-level net operating income figures and compared them to underwritten expectations.

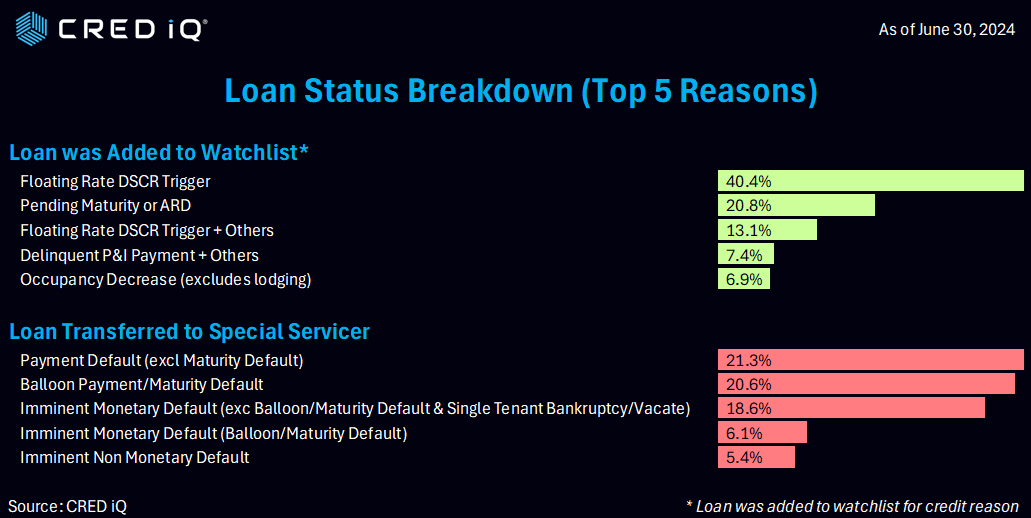

Given the rapid surge in interest rates, these floating-rate loans have shown significant declines in debt-service-coverage-ratios (DSCR). Approximately 78.4% of the properties within the CRE CLO sector have reported a lower DSCR (NOI) compared to their underwritten DSCR. These numbers are based on the underwritten “as is” DSCRs and NOI. CRED iQ’s analysis uncovers that 62.0% of all CRE CLOs are operating below a 1.00 DSCR.

Removing the interest rate variable, CRED iQ data uncovered that 46.4% of all CRE CLO loans perform below their underwritten net operating income levels. Approximately 53.6% of the properties reported NOI figures above the underwritten NOI. Net operating income is a key variable in calculating a loan’s DSCR which determines the strength and creditworthiness of a given loan.

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Many of these loans were originated in 2021 at times where cap rates were low, valuations high, low interest rates, and are starting to run into maturity issues given the spike in rates.

Our research team analyzed $79.1 billion in active CRE CLO loans (an increase of ~$1 billion from the June report) to better understand current distress levels and exposing any potential forecasting bellwether metrics. Along those lines we further explored 1) Loans that have been added to the servicer watchlist 2) The triggers that caused the watchlist designation.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto, and TPG.The vast majority of the $79.1 billion in CRE CLO loans are structured with floating rates with 3-year loan terms equipped with loan extension options if certain financial hurdles are met.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.