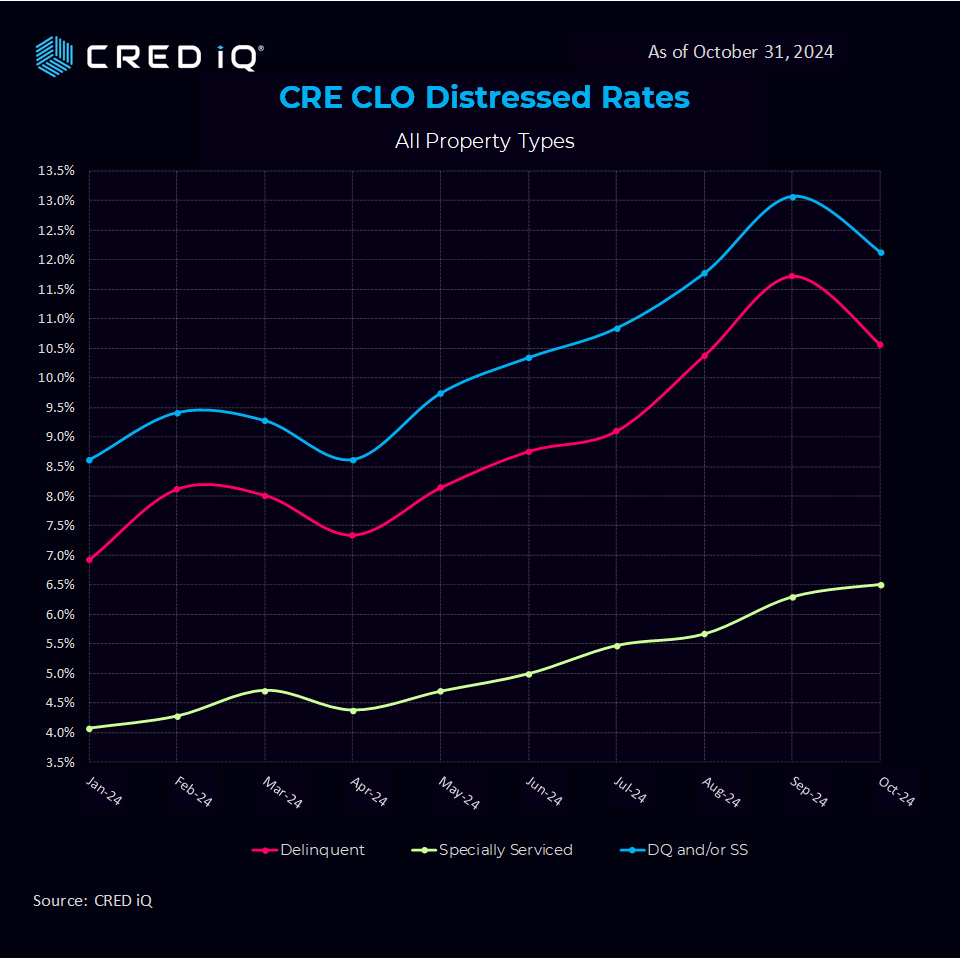

The CRED iQ research team focused upon CRE CLO distress this week. We wanted to explore how this marketplace has evolved since our previous report last month. The CRED iQ Distress rate gave back 97 basis points (falling to 12.1% from 13.07%) during the month, after adding 277 BP in our October print. In comparison to the CMBS Distress Rate of 9.6%, the CRE CLO sector remains by 250 basis points.

The CRED iQ distress rate includes any loan reported 30 days delinquent or worse, past their maturity, specially serviced, or a combination of these. We also examined the most recent property-level net operating income figures and compared them to underwritten expectations.

Given the rapid surge in interest rates, these floating-rate loans have shown significant declines in debt-service-coverage-ratios (DSCR). 47.0% of the properties within the distressed CRE CLO sector have reported a lower DSCR (NCF) compared to their underwritten DSCR. These numbers are based on the underwritten “as is” DSCRs and net operating income (NOI).

CRED iQ’s analysis uncovers that 67.1% of all distressed CRE CLOs are operating below a 1.00 DSCR, up from 62.3% last month. NOI is a key variable in calculating a loan’s DSCR which determines the strength and creditworthiness of a given loan.

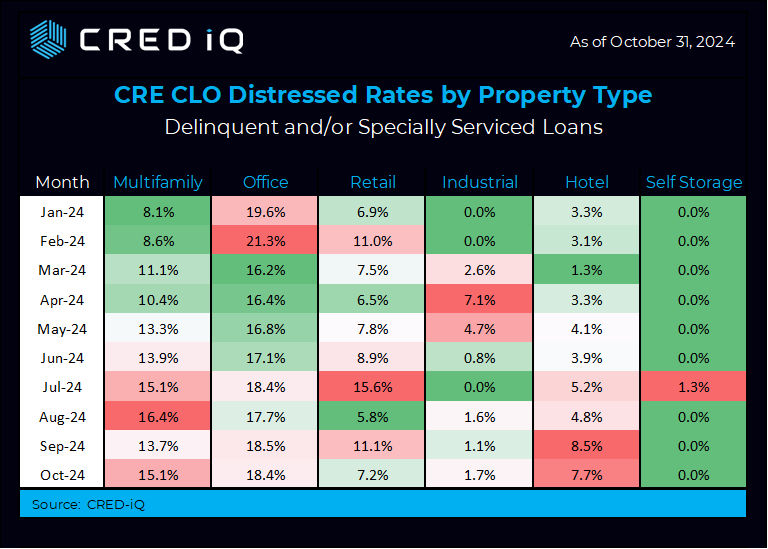

Segment Analysis

Office continues its leadership in distress across all property types logging a distress rate of 18.4%, remaining mostly flat to last month’s print. While high, the office segment is off its 2024 distress peak of 21.3% in February.

Multifamily distress increased 140 basis points to 15.1% in October, compared to 13.7% last month. Multifamily remains firmly entrenched as the second most distressed segment.

Retail saw its distress rate decrease significantly from 11.1% to 7.2% — dropping two slots to the fourth most distressed CRE CLO property type. The hotel segment also saw a decrease in their distress rate to 7.7% and landing just above retail as the third most distressed CRE CLO property type.

Industrial saw a slight uptick to 1.7%, representing a 60-basis point increase from last month. Self-storage continued to operate without distress in October.

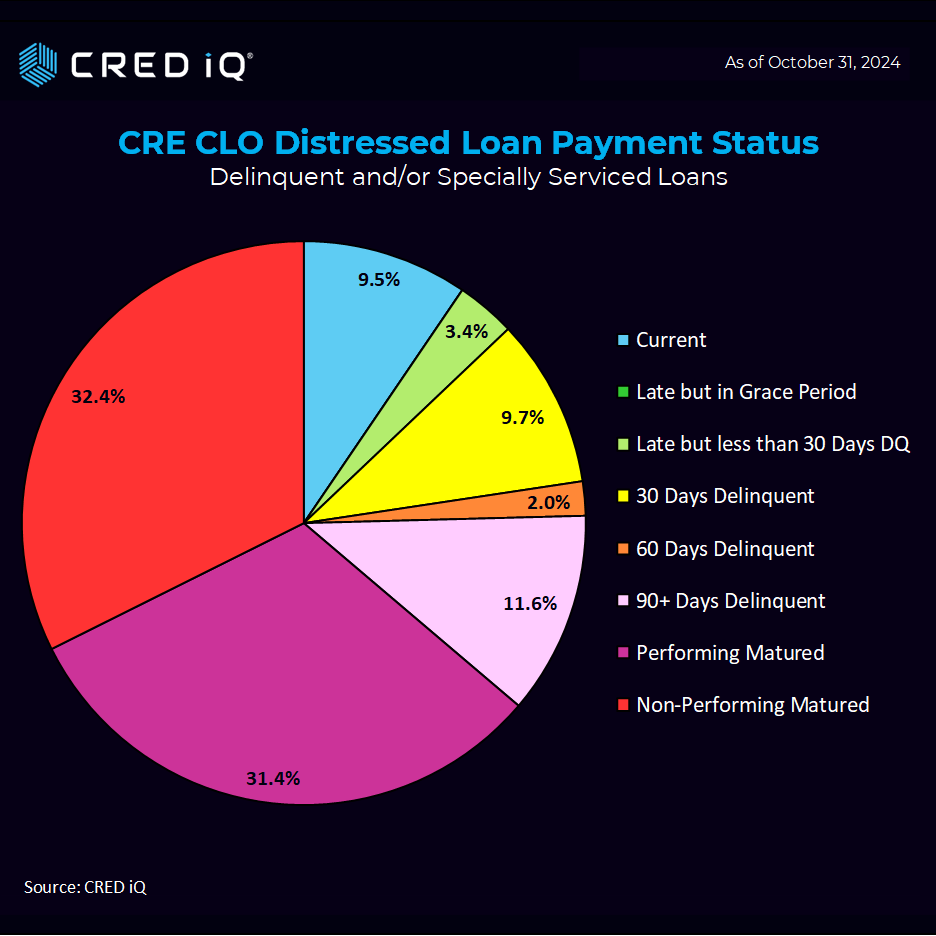

Payment Status

Looking across payment status, 31.4% of loans are performing matured, with another 32.4% non-performing matured, meaning 63.8% of the CRE CLO loans in our study are past their maturity dates –down slightly from 64.3% in last month’s report.

Analysis Scope & Methodology

CRED iQ consolidated all of the loan-level performance data for every outstanding CRE CLO loan to measure the underlying risks associated with these transitional assets. Our team examined $70.8 billion in active CRE CLO loans. Many of these loans were originated in 2021 at times where cap rates were low, valuations high, low interest rates, and are starting to run into maturity issues given the spike in rates.

Some of the largest issuers of CRE CLO debt over the past five years include MF1, Arbor, LoanCore, Benefit Street Partners, Bridge Investment Group, FS Rialto, and TPG. The vast majority of the $79.1 billion in CRE CLO loans are structured with floating rates with 3-year loan terms equipped with loan extension options if certain financial hurdles are met.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.