Office Distress Rate Climbs 70 Basis Points to 15.5% in November

The CRED iQ research team evaluated payment statuses reported for each loan (securitized by CMBS financing), along with special servicing status as part of our monthly distress update. The office sector reached a new high this month as it jumped 70 basis points to 15.5%.

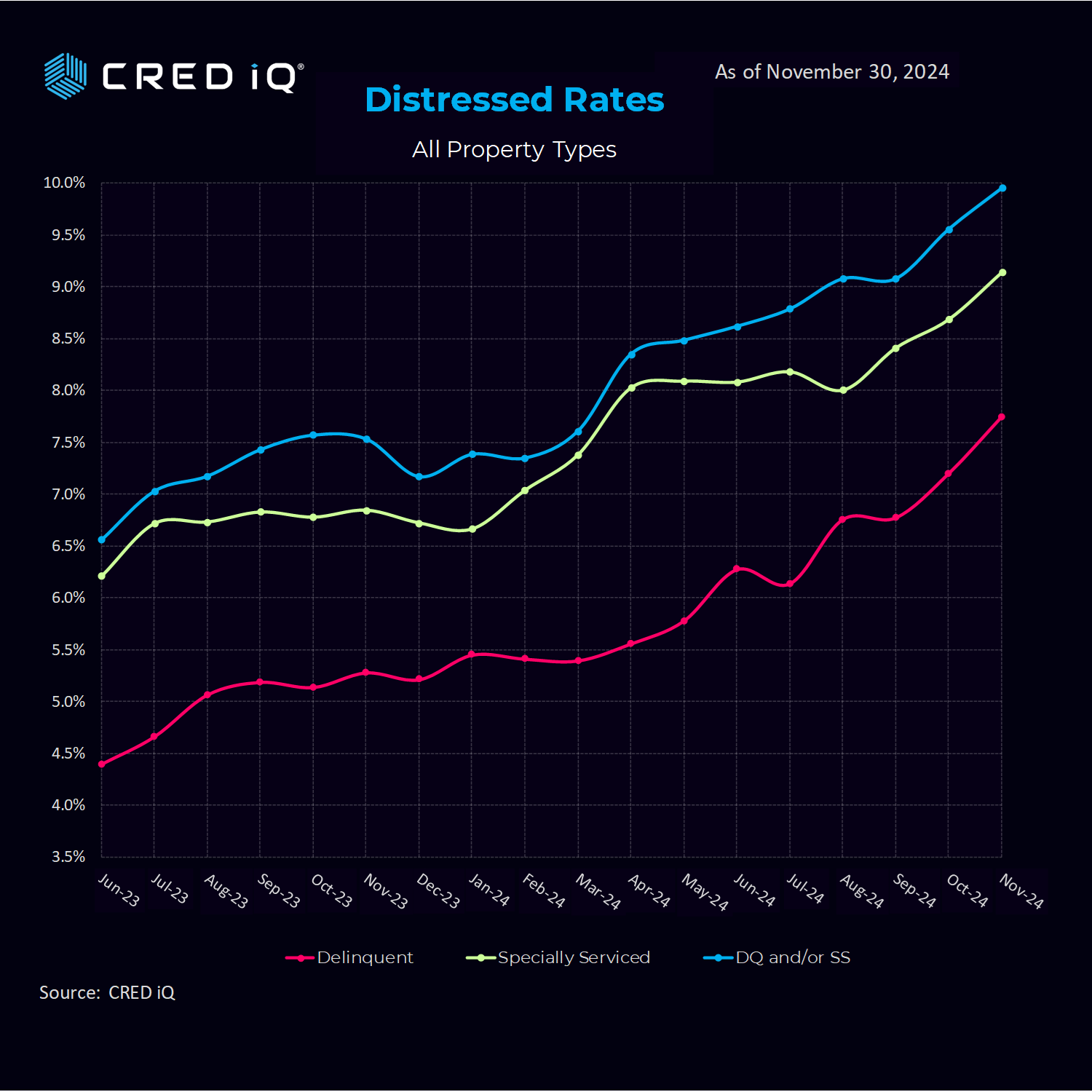

The overall CRED iQ distress rate added 40 basis points and crossed into double digits for the first time this year at 10%. On a positive note, four of the six major property types that CRED iQ tracks saw decreases in November. The November print represents the third consecutive record high for the index. CRED iQ’s specially serviced rate added 40 basis points to 9.1%. The CRED iQ delinquency rate rose from 7.2% to 7.8% in November.

Segment Review

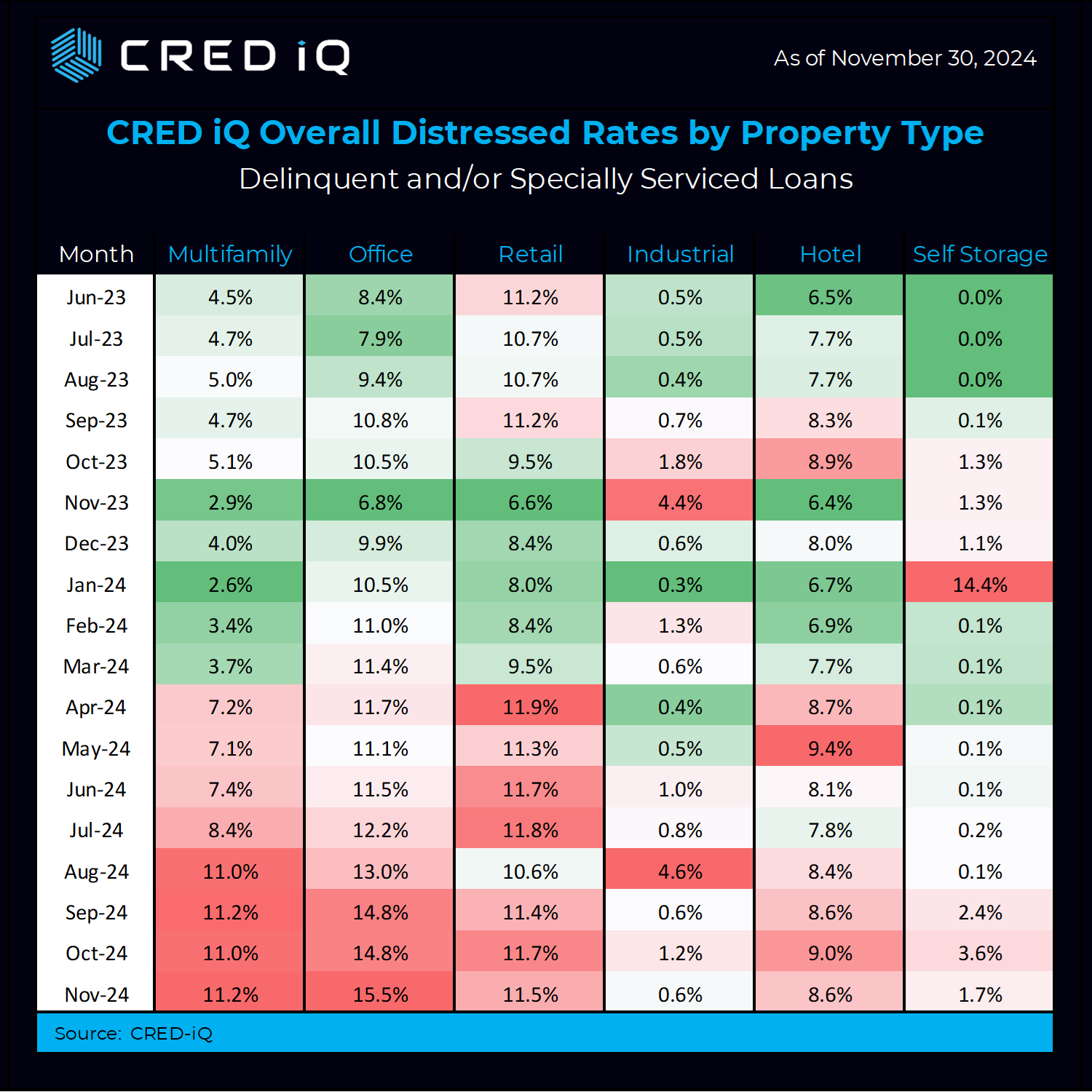

After taking a breather in October the office segment distress rate continued to climb—adding 70 basis points to 15.5%, a new high. Office remains at the top of all segments with respect to distress rate.

Retail continues its reign in the number two slot, with an 11.5% distress rate, shaving 20 basis points in November.

Right behind retail, multifamily has an 11.2% distress rate—adding 20 basis points to October. Multifamily has experienced the sharpest distress increase of all property types in 2024. The January 2024 multifamily distress rate was 2.6%, yielding a stunning 842 basis point increase in the distress rate over the course of 2024.

The hotel segment distress rate decreased by 40 basis points—right back to the September distress rate of 8.6% maintaining a secure, if not a bit distant 4th place on the distress league tables.

Self-storage (1.7% –down from 3.6% last month), and industrial (0.6% –down from 1.2% last month) round out 5th and 6th place respectively.

Payment Status

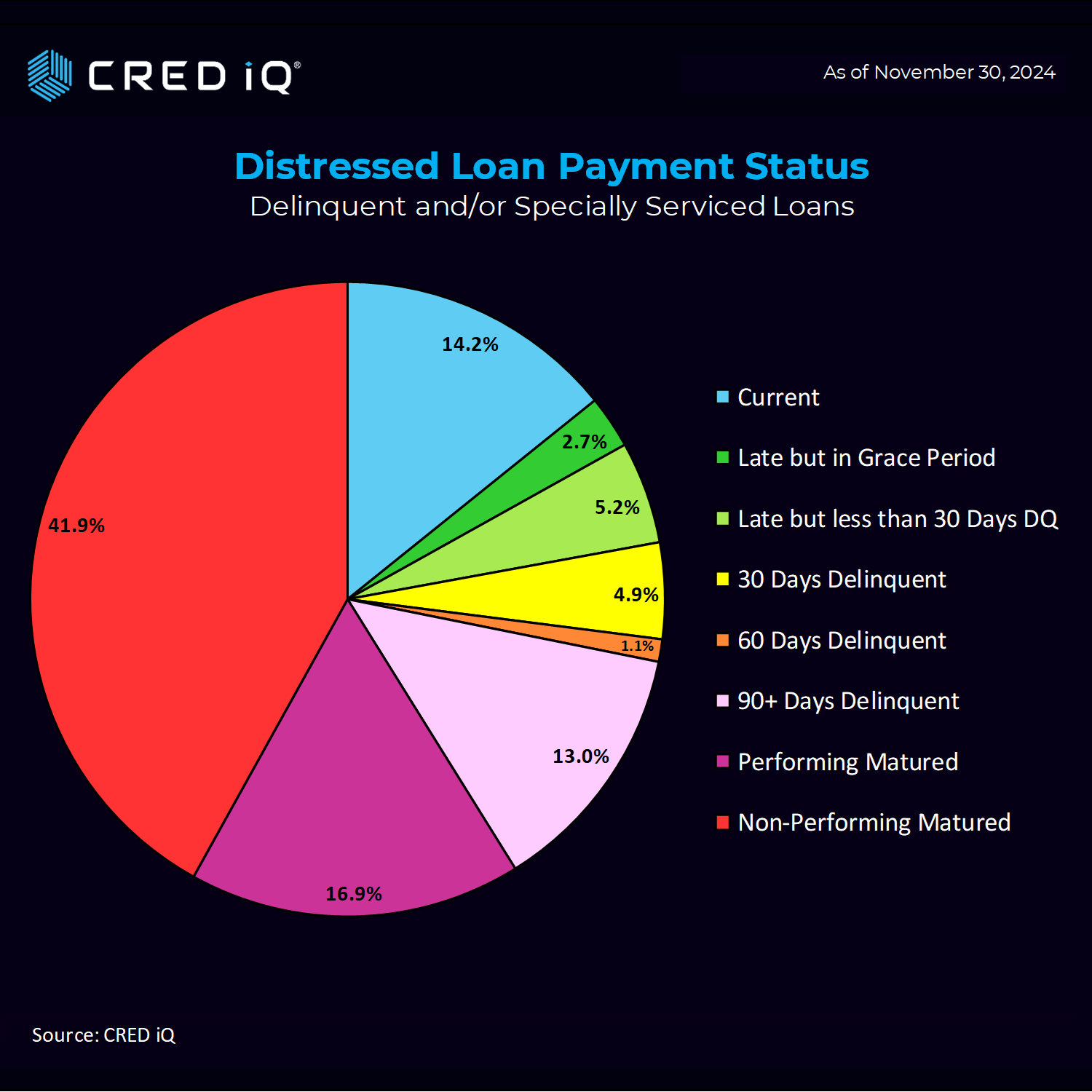

Looking at the distressed loan payment status, 14.2% of the loans are current—a steep 400 point drop. Additionally, 2.7% of loans are attributed to late (but in the grace period) and 5.2% of loans were late (but less than 30 days DQ). When we combine these three metrics 22.1% of all loans were current / late within the grace period / less than 30 days delinquent –a reduction of 250 basis points from last month (adding to the 100BP reduction in our previous print)

Non-Performing Matured increased from 39.9% to 41.9%. Meanwhile, Performing Matured inched up from 16.7% in our October report to 16.9%. 90+ Days Delinquent shaved 30 basis points in November to 12.7%.

Analysis Methodology

It’s important to note that CRED iQ’s distress rate factors in all CMBS properties that are securitized in conduits and single-borrower large loan deal types. CRED iQ tracks Freddie Mac, Fannie Mae, Ginnie Mae, and CRE CLO loan metrics in separate analyses.

CRED iQ’s distress rate aggregates the two indicators of distress – delinquency rate and specially serviced rate – yielding the distress rate. The index includes any loan with a payment status of 30+ days delinquent or worse, any loan actively with the special servicer, and includes non-performing and performing loans that have failed to pay off at maturity.

About CRED iQ

CRED iQ is a market data provider that offers a robust suite of data and software solutions tailored for commercial real estate and finance professionals.

With over $2.3 trillion of CRE loans, CRED iQ delivers instant access to a comprehensive range of financial data and analytics for millions of properties in every market. CRED iQ’s data and analytical capabilities are instrumental in helping investors, lenders and brokers make informed and strategic decisions critical to their business.